There is no such thing as a free lunch. Moreover, there is no such thing as free medication. Some time or another, all of us will need medical treatment. Whether it would be for simple colds or for serious illnesses, these things would hurt us and burn our pockets.

Especially, during this time of pandemic, you might not want to get sick right now because medical bills skyrocket.

Even if you are not sick of COVID, yet, you are sick of something else, when you get hospitalized, you’ll end up with a hospital bill that is x2 to x3 of that of the normal bill. Because extra precautions are added to your bill to make sure you don’t have COVID or stop COVID from spreading from patients to patients. In short, you are paying for the PPEs of everyone taking care of you there.

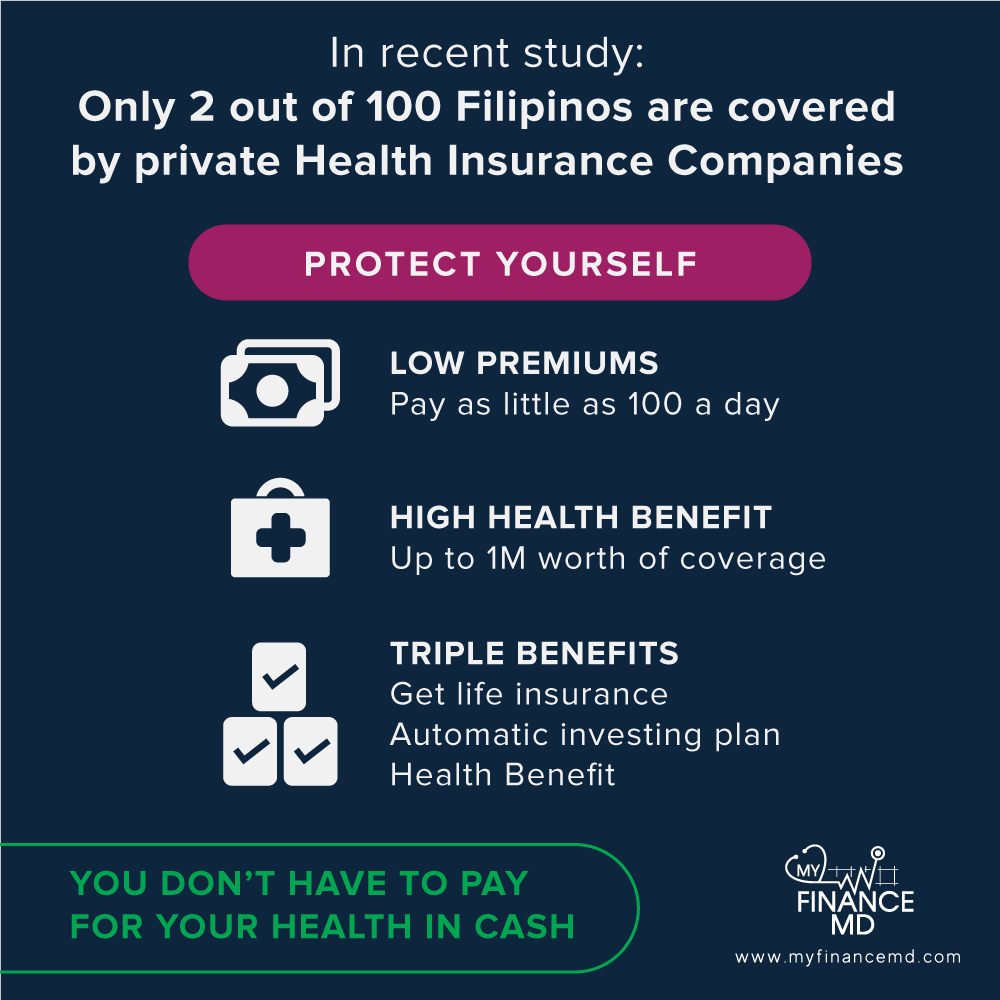

According to a recent study, Filipinos pay 58.6% total out-of-pocket medical expenses in the year 2018. Meaning, Filipinos are left alone to handle our medical expenses unlike other well developed countries, that, as long as they are paying their taxes, their health is also taken cared of, if they get sick.

In the Philippines, sad reality is, If you don’t have any PhilHealth or any other insurance, don’t expect that the government will bail you out, either you ask help from people, you get worst or you die.

Now, we don’t want that, right?

Here are some practical tips on how to cut your medical costs:

1. Exercise

Survey revealed that people who are more active spend less on medical expenses than those who live a sedentary life.

In fact, according to study, lack of exercise increases one’s risk of heart disease, stroke, high blood pressure, cholesterol and body weight. But, is exercise alone can keep you healthy?

I have seen people who pushed themselves in extreme exercises to get fit, but during their breaks or when they get home, they eat chips and all other unhealthy foods. Those people have this in their mind: “I exercise, so I can eat anything I want.” Do you think that is good excuse?

2. Eat Healthy

For some people on the other side of the fence have this: “I eat healthy, so I don’t need to exercise?” Do you belong to these type of people?

What we put into our bodies makes a difference and the benefits of eating a healthy diet are as numerous as the benefits of exercise: It decreases your risk for chronic disease, helps with weight control, assists in stress management, decreases the effects of aging and improves your skin and brain health. Sound familiar?

The benefits of good nutrition are the same as exercise, making the two together a powerful recipe for good health!

3. Break that Bad Habit

For smokers and drinkers, reducing cigarette and alcohol consumption is an option which you may find feasible. You will not only reduce future medical costs but also reduce direct costs from purchasing these products.

4. Go Generic

Taking generic drugs is the way to go. Patents are used by manufacturers to be able to set a price so as to recover their costs in developing their products. But these patents don’t last forever and sooner or later, generic versions of these drugs will be available. Generic drugs are basically the same as the branded ones in terms of ingredients and quality.

Going generic can save you a lot of money. According to the Association of Chain Drug Stores, in 2004, the generic drugs are priced at 4x less than the branded ones.

5. Deal with your Doctor

Take time out to discuss things with your doctor, for this can also save you a lot of cash. Don’t be shy to ask him about the possible alternatives that you can take. Ask him if there is a generic drug that you can take if he prescribes you a branded drug. If you are going to have surgery, try to schedule wisely, so as to prevent overstaying in the hospital. And most importantly, do as you are told. If he asks you to quit your vice, quit it. If he tells you to be active, then you’d better be!

Medical expenses can really dig a hole in your pocket. Try to be wise in your medical transactions and more importantly, take care of your health.

6. Be Ready when it Happens

But, what if, even if you did take care of yourself, you still get sick?

Then, you have to be ready. Get insurance. In the Philippines, there are 3 different of Health Insurance you can get:

- A Health insurance from an Insurance Company

- HMO from HMO (Health maintenance Organization) Companies

- PhilHealth from the Government

I have discussed these 3 intensively in my previous article:

What are the Differences Between Health Insurance, HMO and PhilHealth?

You might want to take a look at that.

Get one or all of the three if your budget permits. Those 3 can help you cut your medical expenses cost because you are just paying a certain small amount for a big benefit.

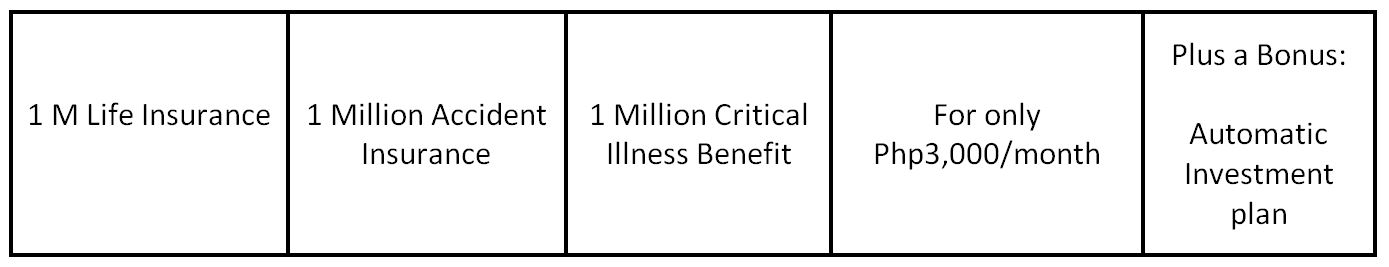

Like for example, a 38 year old male, you can get a 1Million life insurance, with 1Million – accident insurance and 1Million – Critical illness benefit of 1Million pesos, for only more or less Php 3,000/month.

How do you think you can be able to save from that?

If you get sick, especially when it gets critical, you can get a benefit of 1Million from the life insurance company. You are only paying the premium of Php 3,000/month.

That’s one way of saving by planning ahead of time.

If you want to know more about this, approach your trusted financial advisor or you if you don’t know anyone right now, I will very much glad to help you out. I will be your personal financial/health coach.

Remember, always stay safe and be healthy.

Praying for our health as a nation,

Read more:

- What are the Differences Between Health Insurance, HMO and PhilHealth?

- PhilHealth on COVID Cases: How Much are you Really Covered?

- How much do you get from PhilHealth if you become Critically ill? Part 3

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023