A great deal of people nowadays, shy away from investing their money. Scared of what the next year’s election will bring to them. “Ayoko muna mag-invest, after election na lang.” “Should I Invest Before Election?”

A great deal of people nowadays, shy away from investing their money. Scared of what the next year’s election will bring to them. “Ayoko muna mag-invest, after election na lang.” “Should I Invest Before Election?”

Do you think it is a wise decision?

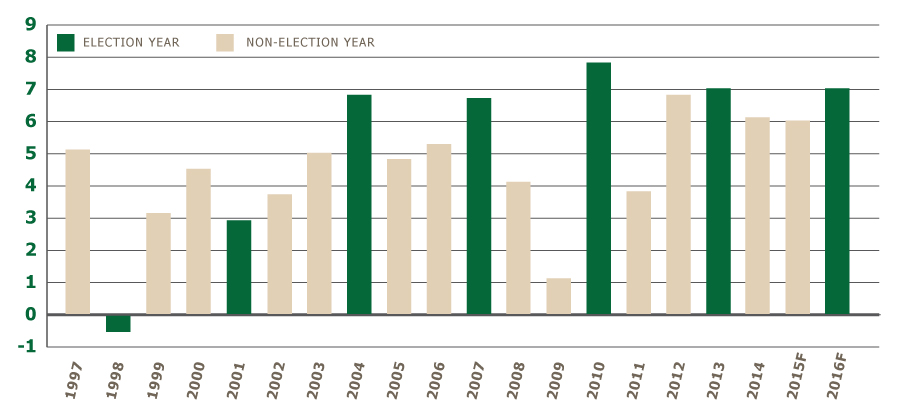

Looking at the chart below, this is a Chart of Philippine economic growth or GDP, from 1997 to 2016 (as forecast). The color green bars, are years where there was an election either mid-year or presidential. Recall that we have an election in the Philippines, which take place every 6 years and in between we have a mid-year election (every 3 years), when we elect half of the senatorial slate, all congressmen, all mayors, all governors, all city officials and all barangay officials.

Sources: Philippine Statistics Authority, Maybank ATRKE estimates

Sources: Philippine Statistics Authority, Maybank ATRKE estimates

With exemption in 1998 which is the Asian Financial crisis and 2001, which is the September 11 bombing attacks, the accounting scandals in the U.S. and EDSA 2 in the Philippines. All the years which are election years, resulted into higher GDP growth. Whether it’s the pump priming that the government does to initiate all the spending ahead of the spending ban or the incremental consumption effect caused by the election money reaching the hands of the voters, all contributed in a higher GDP growth.

That’s what we have experienced in the last 2 decades and that is what we will continue to see well into 2016 as forecasted. That’s why we expect Philippine economic growth to be much higher next year from the predicted 6% this year to a higher 7% next year as forecast by financial analysts.

Especially now, we do not know who will win. As of this writing today, we already have 7 presidential candidates and 5 vice presidential candidates, not yet included are those vying for senatorial position, congressmen and down to barangay officials.

Every candidate will spend and will all trickle down to consumption

Standard Chartered economist for Southeast Asia Jeff Ng said, “Presidential and vice presidential candidates are expected to spend up to P10 billion ($213.27 million) or 0.08% of nominal GDP on their campaigns and senatorial bets and candidates for national and local positions are expected to reach between 0.1% and 0.3% of GDP. Read more

In a nutshell, this tells us:

- The upcoming election promotes more spending coming from the candidates and government. More industries will flourish like: media (election advertisements) be it on TV, radio or prints.

- Government services will spend more (election related).

- Manufacturing businesses and private services can also benefit from production of election materials and ad campaigns.

- Admit it or not, even the illegitimate vote buying. More money to the voters promotes more consumption.

To an Investor, this means:

- If you have money to invest now, do it now to be able to ride the economy today that it is still down before it zoom up again next year.

- If you have money to invest now, there is no better time to invest, but now, if you wait for election next year you might be late.

- You can invest in your VUL (Variable Life Insurance Products) by top-ups, put more money in your Mutual funds and UITF or directly invest in the stock market. Picking up stocks that would be beneficial to the next year’s election.

Of course, investing your money now is a decision, like when deciding who to vote.

Voting wisely can not only help boost our Philippine economy today and next year, but, by voting the proper leader, this can too help our country hold its momentum for the following few years and earn our nation a better and safer place to be in.

Reminding you to Vote Wisely and Invest Now,

If you want to invest your money now at the same time get protected, contact me here.

Read More:

- Aldub and Philippine Tax Reform

- The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review 2014

- The Best Gift for Yourself this Christmas that Could last a Lifetime

- Hurdles of Financial Freedom (Mga Balakid sa Iyong Pag-Yaman!)

- 6 Smart Ways on How to Spend Your 13th Month Pay

- How to get more than 50% discount for your child’s College Tuition fee

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023