Winning the War: Filipino vs Debt

Do you feel sometimes that no matter how much you earn, it is always not enough?

Do you feel that even though you budget your money so many times, still, you can’t free some cash?

If you do feel all those, then maybe you have debts? Am I Right?

I know there are good and bad debts, but imagine yourself debt free, now. If you are paying 30,000 – 50,000/month on debts like: car loans, house mortgages or credit cards, how does it feel not paying for those anymore? What can an extra 30,000- 50,000/month can do? How much power do you hold in your hand that can be used for anything you want?

Imagine you have all these money on investments? Maybe you can get to your retirement as early as you can and wanted to? You can travel more, eat more, or do pretty much whatever you like. If you like the idea of a zero debt, then, you are one with me in making it a personal fight to win over all debts, good or bad.

“You know what you can do when you don’t have any payments? ANYTHING you WANT.” Dave Ramsey

But getting out of debt is easier said than done, this can require a drastic lifestyle change. Are you ready for that? If you are not mentally prepared and confident in your decision on getting out of debt, you will only feel frustrated. Let us do this scientifically.

There are a lot of techniques, but let me show you my favorite method. The snowball method.

Peter is an Engineer. He just started a family, bought a new house and car under a loan, and appliances to go with it. Now, he had a lot of monthly payments. He wanted to get rid of all his loans, but he does not know how.

Steps of Snowball Method:

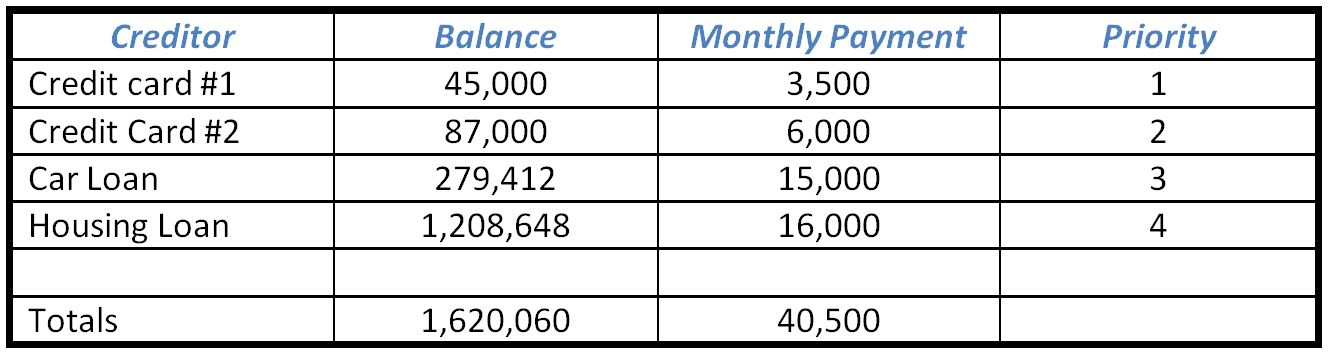

- List all your debts in ascending order, smallest balance to largest.

- Commit to pay the minimum payment on every debt.

- Determine, how much “EXTRA” money you can apply to your SMALLEST DEBT – the SNOWBALL.

- Pay the minimum payment plus the extra amount to the smallest debt, until it is paid off.

- Once a debt is paid in full, add the old minimum payment (plus extra amount available) from the first debt to the minimum payment on the SECOND smallest debt.

Let me show you:

- The total monthly payment he has to pay is: 40,500. Peter decided he can still pay a little more. So he decided on paying 50,000 every month.

- Monthly Payment: 50,000 (Minimum payment + Extra payment you can add)

- Initial Snowball: 9,500 will be added to the first debt, until it is paid off.

- After paying off the first debt, the minimum payment of the first debt will be added to the initial snowball, and now will be applied on the next debt.

- Minimum payment for the 1st debt + initial snow ball = 2nd snowball

- 3,500 + 9,500 = 13,000 (2nd snowball) that will be applied on the next debt

- Once the 2nd debt is paid off. The second minimum payment will be added to the 2nd snowball to be paid to the 3rd debt, until it comes to the last debt to be paid.

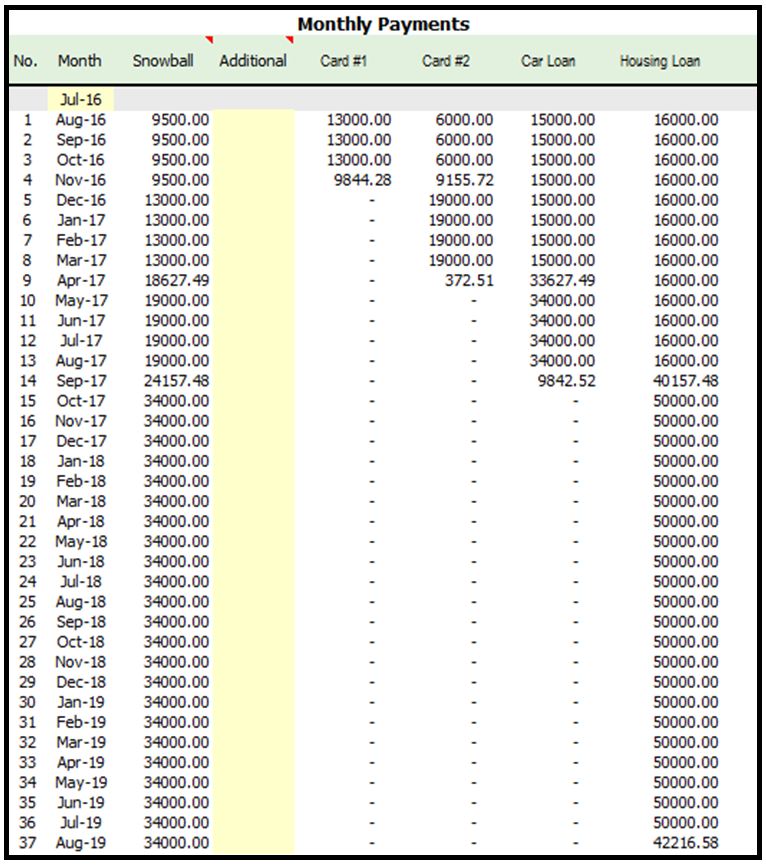

Look at the Payment Schedule:

Comparison of No-System-Approach to Snowball method:

Rx

- With this strategy, it is important to not to incur any more debt as much as possible.

- Interest paid will be lower and paying off much faster, if you add more snowball.

- This method also still works for those with no extra money for the initial snowball. Once the 1st debt it paid off, the minimum payment for the 1st debt becomes the initial snowball.

- Set your family budget. You cannot get away with this. The most important part of a financial plan.

“You must gain control over your money or the lack of it will forever control you.” – Dave Ramsey

- It is important to know how much your profit first. Part of which, you can use as your initial snowball. Read this post: Profit: If you don’t have this, You will never be Wealthy!

As an added bonus to all those who want to be zero-debt as soon as you can, use this free Snowball and Avalanche spreadsheet. Download it in your PC and start dreaming of that time you can shout and say, “I’m Debt Free!”

Be sure to return to this post inspire others to also be debt-free.

Debt Reduction Calculator powered by Vertex42

Let’s win the war over debt,

Wanting to start your finances right? Let me help you plan. Contact me here!

Read More:

- How to Prioritize your Finances?

- How to Create a Family Budget?

- 5 Insider Tips on Finding the Financial Advisor For You

- How to Compute your SSS Retirement Pension

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

[…] here to read her […]

[…] here to read her […]