The BEST INVESTMENT Vehicle for Your Child’s Education

In watching movies, I only watch movies that have Happy Endings. I try not to watch those movies that make me sad in the end. Yes, very Filipino trait of mine, I know. But, I want it that way. My husband even teases me that I am so old at watching fairy tales, but I love those movies, because for sure, I know, it will always be a happy ending.

Because of that, let me tell you a happy story of our character today. Jayson and his son, Joseph.

STORY 1:

Jayson is a 25 year-old-Seaman, just started a family. Happily married now, he immediately had a son. Wanting to give the best to his son. He got an education plan for Joseph, now, only 1 month old.

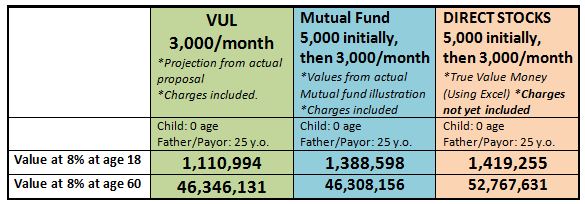

Here are the options, presented to him, with his monthly budget of only 3,000/month.

- VARIABLE UNIVERSAL LIFE (VUL) – Variable Life Insurance with Investment. Life insurance Companies offers this kind of investment. It has an insurance component.

- MUTUAL FUNDS (MF) – Pure investment offered by Mutual Fund companies. They usually require a 5,000 initial investment. The minimum investment thereafter is 1,000 per investment.

- DIRECT INVESTING IN STOCK MARKET – this is Stock investing directly in the Stock Market. You can use online stockbrokers. The initial investment is 5,000.

Now, let’s compare their Projected Returns at 8% Compounding Interest at these 3 mentioned investment vehicles.

*Note that, the interest rates can be a range from 4% to 20%, depending on the stock market. The Illustration below only shows a conservative projection of 8%.

*Note that, the interest rates can be a range from 4% to 20%, depending on the stock market. The Illustration below only shows a conservative projection of 8%.

Of the 3 investment instruments, who do you think gave the highest yield?

Direct investing, of course!

Direct stock investing – the value above is more or less the value, although charges are still not yet included. But relatively it has the lowest charges from the 3 investments from above that’s why it gave the highest yield.

Mutual fund – next highest. A lesser charge than VUL because it did not have the insurance component. But, at age 60, it is lesser than the VUL because it has trail charges which the VUL does not have.

VUL (Variable Universal Life) – Lowest yield at age 18 of the child. The reason for that is, there is insurance component that is being paid. But became bigger than Mutual Fund vis a vis long term because of no trail charges.

That is true, if all in life is good and if life is without risks.

STORY 2:

In real life, it’s not always a happy ending I’m afraid. There are times that people have to deal with real life risks like death, accidents, and sickness.

Let’s say, Jayson, after 10 years of paying, met an accident and became permanently disabled. What will happen to his investments for Joseph since nobody is paying for it after 10 years?

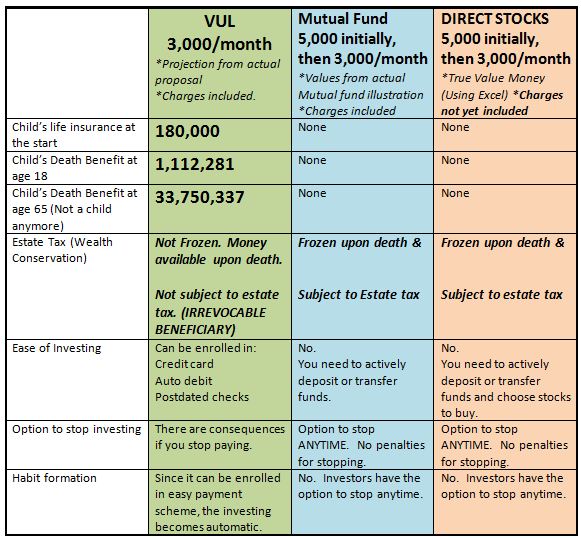

Since VULs are products of life insurance companies, that is pegged on a LIFE’S RISKS AND UNCERTAINTIES. In REAL LIFE with REAL life risks. VUL became a more realistic investment of choice.

Yes, it may not yield higher returns than direct investing, but it has a more protective component to the Investor.

This is where VUL becomes more perfect that than the other two.

OTHER ADVANTAGES OF VUL over other investment vehicles:

“Estate Planning is not only about protecting your wealth when you shall have built one. It is also about protecting your family while building your wealth.” – A.M. Cabrera

As you build your wealth through wealth creation, you should also know how to protect it by preserving the love and harmony of your heirs, your family.

“Personal Finance is 80% BEHAVIOR and only 20% HEAD KNOWLEDGE.” – Dave Ramsey

I have been saying this all the time to my clients:

Investing should be painless and should be made habitual. What a better way to begin a habit of investing is by making it automatic. VUL provides way on how you can do it automatically and provides penalties should you not.

The reasons why I love VUL and why my daughter already has 2 of those are:

- No matter what happens to us, as parents and as the investors, we are assured that the plan we have for her will continue. That her dreams will not die along with us, should we be taken out of the picture, prematurely.

- If I will be granted with long life, then, if my daughter is old enough, it can also be a form of LEGACY I can give to her, that she can continue investing to until she gets old. She may even use it for her retirement.

- I can even use it to buy her graduation gift. Maybe her first car? Let’s see, 19 years from now if she deserves it. (Oh no! I hope she will be able to read this! So, be a good girl Tats. Ha ha!)

The most significant part of INVESTING, is the INVESTOR himself.

The person putting the investments month after month. Protecting the INVESTOR is as important as maximizing RETURN.

In real life, it is not always IDEAL. You may wish to invest up to age 60, but, there are human risks you have to consider:

- Are you sure you are going to reach 60?

- If you get critically ill or disabled, can you still continue investing?

With all that, I am hoping that before you decide on anything else, I know it will be an informed choice. Will you have a happy ending too?

Always Giving you the best option possible,

Do you want to start investing for your child? The earlier you can do it, the better. I started mine for her at Zero age. Contact me here.

Read More:

- How to get more than 50% discount for your child’s College Tuition fee?

- 3 Genius Reasons Behind VUL (Variable Unit Linked) Insurance

- 5 Money Habits To Avoid Telling Your Kids

- What is Estate Tax and How it can hurt you even After Death?

References:

Real Proposal Illustration system from a leading life insurance company and a Mutual fund company I represent.

For Direct Investing, I used TVM (True Value Money) in Excel and Financial Calculator.

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Wow, I didn’t thought about that, that way. Thank you so much. I will contact you so I can start my plan for my newborn. Ty dra.

Thanks Michele. We will create a plan customized to your child.

Been a reader of your blog for quite sometime now, I really like your tips and advises specially when it comes with saving and investing. I’m hoping for more helpful articles to come.. Thank you so much. God bless you more & your beautiful family.

Been a reader of your blog for quite sometime now, I really like your tips and advises specially when it comes with saving and investing. I’m hoping for more helpful articles to come.. Thank you so much. God bless you more & your beautiful family.

Thank you sir.

I have 11 and 4 years old kids and planning to get an ideal investment vehicle for them,thank you for this article it helps a lot

Thanks for reading

Hi maam 🙂 i’ve been a follower of your blog since i got married almost 3yrs now. Thank you for this article. Just want to ask which would be a better option to get since i am already 35yo: a) new policy with my daughter as beneficiary, b) my daughter as the policy holder, or c) top-up to the old policy i got with my daughter as beneficiary? Thank you so much!

Hi po. thank you for reading, It really depends on what you currently have now. Please email me: myfinancemd@gmail.com

Thank you po for this article, very informative. I’m planning to get VUL for my 6 year old kid. Who does offer it best po kaya? Thank you in advance.