After understanding how to become a great manager of your own money from the previous blogs:

Unlock the Secrets of Becoming the Best Manager of your Own Money

Discover the Easiest Money Management Tool that’s Proven to Work

The next important step in your journey to financial freedom is to know these two types of income.

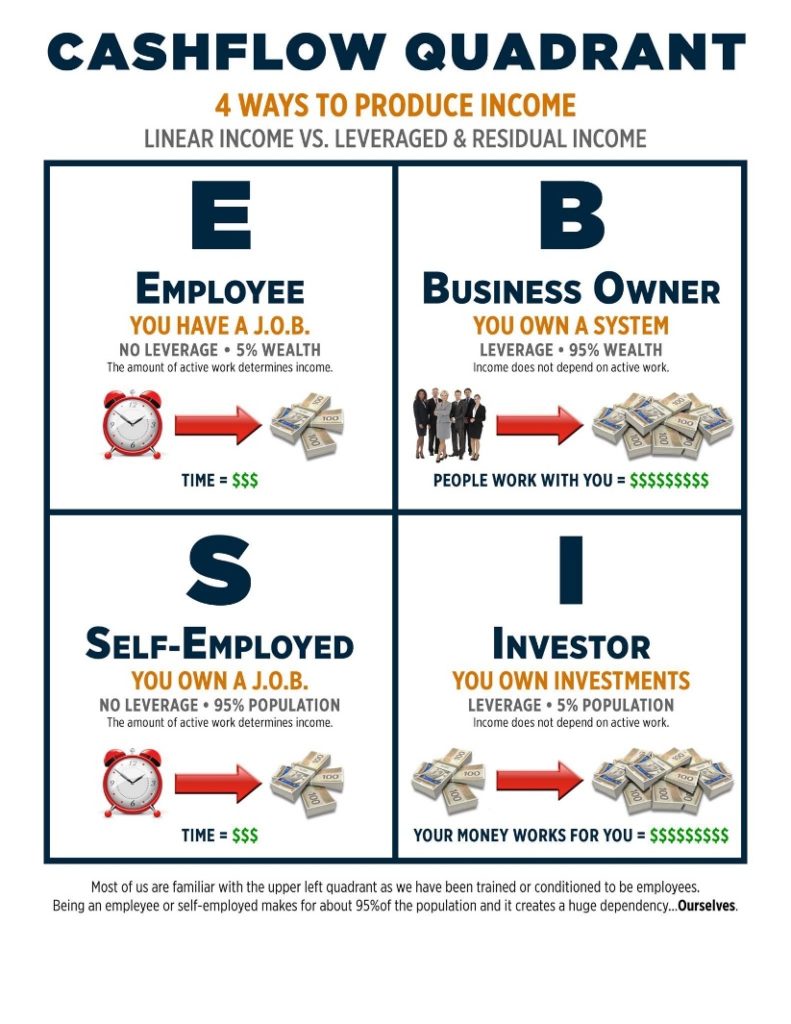

Robert Kiyosaki’s Cashflow quadrant actually divides income into four, but it is further into the left or right side of the quadrant.

These are two types of income:

1. Linear income – Working Hard Income

This is the type of income where your income is directly proportional to your effort. It’s the “No work, no pay” type of income.

This is also called your ACTIVE INCOME.

On the left side of the quadrant (Active Income), you can either be an employee (You have a JOB) or a self-employed (You own a JOB) individual.

Your income comes primarily through hard work and your time. The problem with this type of income is that you don’t get paid if you don’t work. Your time is equivalent to your income. If you want more income, you’ll need to sacrifice more time for your work, which may also mean less time for other things, including your family.

2. Leveraged income – Working Smart Income

This type of income is not dependent on your effort.

Income is multiplied exponentially through the efforts of other people or a system.

This is also called your PASSIVE INCOME.

You can either be a big business owner or an investor on the right side of the quadrant (Passive Income).

Your income comes primarily through a system and is not dependent on your time and effort. For example, if you are a business owner, you hire people who specialize in skills needed for the business and engage those who have more talent and skill than you.

If you are an investor, you look for assets that provide steady income in the form of cash flow. You can earn money while you sleep or are on vacation with this type of income. Your income is not dependent on your time and hard work anymore. This is where financial freedom is.

Ninety-five (95%) of people are only earning active income, and that’s perfectly fine. Almost all of us started that way except for people who were born princes or princesses or sons/daughters of business tycoons.

It’s perfectly normal and acceptable. What is not okay is if you don’t know where you are right now and don’t know that you need to move from where you are to create passive income.

The goal here is to transition from the left to the right side of the quadrant.

While doing your job (active income), you should find ways to earn passive income.

Do your best in your job, but you also need time to focus on growing your passive income, so you don’t have to work for the rest of your life.

If you can’t TRANSITION from LEFT to the RIGHT side of the Quadrant, YOU WILL BE WORKING FOR THE REST OF YOUR LIFE.

Do you like to work for the rest of your life?

Don’t get me wrong, but there is nothing wrong with working for the rest of your life when it’s your choice, but if the reason is, you need to put food on the table or pay the rent? Then, that’s different.

Warren Buffet also said this: If you don’t find a way to make money while you sleep, you will work until you die.

In pursuit of financial freedom, it’s crucial to know the difference between these two incomes. Therefore, in the next blog, I will teach you the formula for becoming financially free at the soonest possible time.

Stay tuned for the next blog.

For Our Financial Freedom,

Read More on this Series:

– My Finance MD is BACK!

– How To Save 50% At the Grocery by Doing This One Simple Step

– Unlock the Secrets of Becoming the Best Manager of your Own Money

– Discover the Easiest Money Management Tool that’s Proven to Work

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023