SAWT or also known as Summary Alphalist of Withholding Tax at Source serves as a consolidated alphalist of withholding agents from whom income was received and are subjected to withholding agents in the process.

Who needs to file SAWT?

This needs to be submitted by the payee as an attachment when filing tax returns on a specific period and this contains a summary of tax credits from all the 2307 forms issued by the payor.

When do you file SAWT?

SAWTs needs to be submitted along with forms, especially for VAT returns and income tax returns.

How do you make your SAWT and how do you submit it to BIR?

Here is what you need to do: (Follow the step-by-step procedure)

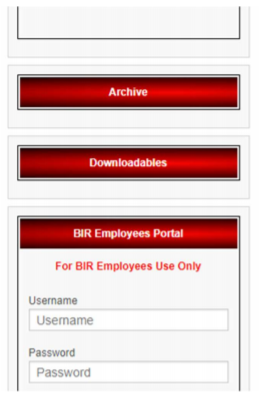

1. Go to BIR website

2. Lower left side of the website look for “Downloadables”

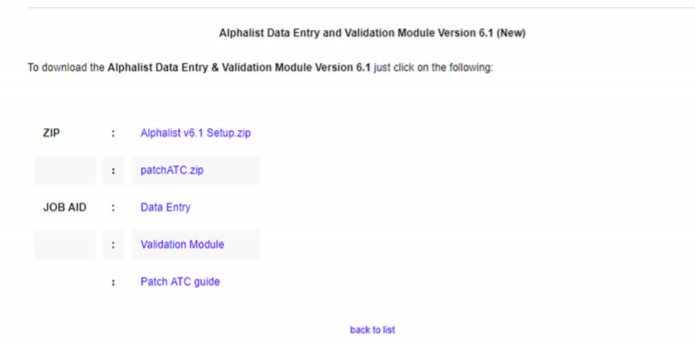

3. In the Index click “Alphalist Data Entry and Validation Module Version 6.1”

4. Download the zipfile “Alhpalist v6.1 Setup.zip”

5. Setup / Install the Application

6. The application will automatically be downloaded in the C drive

7. Go to Local Disk (C:)

8. Open the folder “BIRALPHA61”

9. Click the Application, the icon looks like a fox “bir1604v61”

10. Set a username and password. Note: the username and password that you set up will always be the user name and password for the application”

11. Set the withholding Agent Information. Note: use your COR to fill up the information

12. Click Save

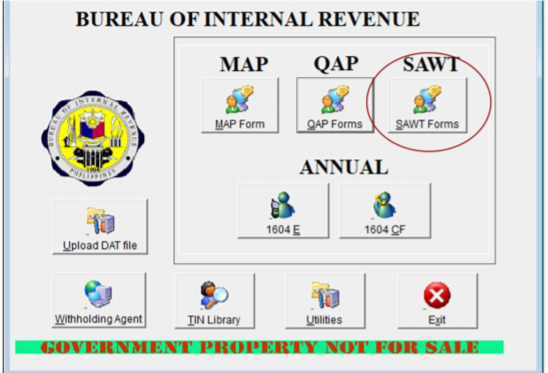

13. Click “SAWT”

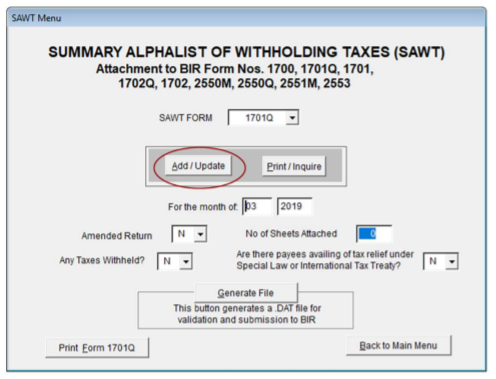

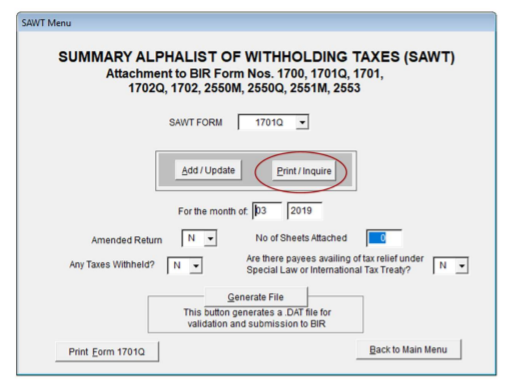

14. In the drop down click 1701Q

15. Set the month of withholding

16. For the “Any taxes withheld?” Click Y”

17. Then click “Add/Update”

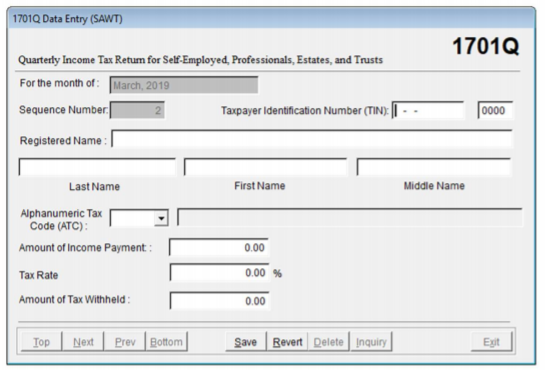

18. Input the Payor Information in the Data Entry. TIN, Registered Name, ATC and amount of Income payment. Use the 2307 you received.

19. After you input the details Click Exit

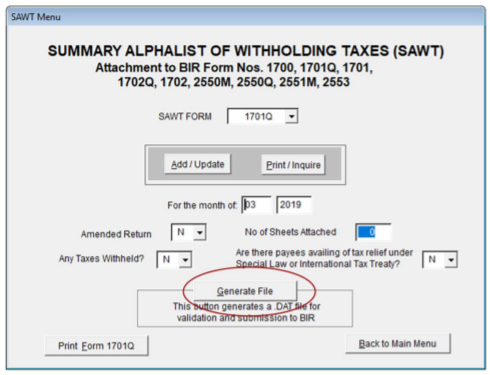

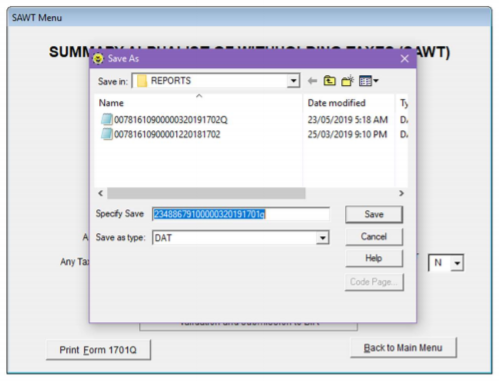

20. Then you will go back to the SAWT Menu, click “Generate File”

21. Save the DAT file. (Remember where you saved the file)

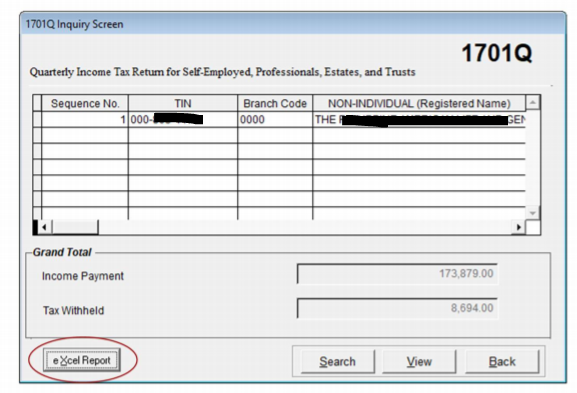

22. If you will pay thru AABs, you have to print the excel file. In the SAWT menu, click “Print / Inquire”

23. Then click the “excel Report”

24. Save the excel file, then print 3 copies

25. Go back to the application, then click “Back”

26. Click Back to Main Menu

27. Then Exit the Application

28. Go to your email that you use for BIR

29. Send to: esubmission@bir.gov.ph

30. Subject: SAWT 1701Q, <YOUR TIN>, <YOUR RDO> , <YOUR NAME> , <PERIOD COVERED>

31. Body: Name

Address:

TIN:

32. Attach the .DAT file

33. Then click Send

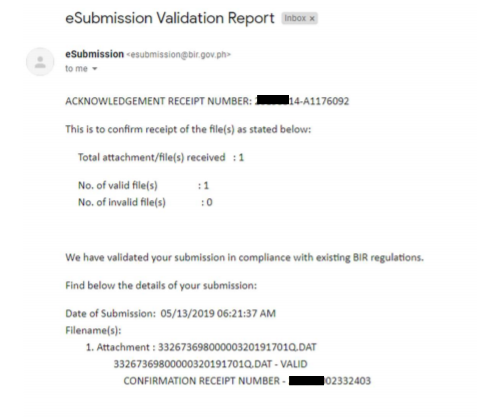

34. Validation Report will be sent to your email.

Here’s how a validation report looks like:

Filing Procedure (for Quarterly ITR):

When you receiver the validation report, you can now pay your income tax returns if you need to pay but first, you need to print triplicate of the following:

When paying thru AABs, print triplicate copy for each of the following:

- Tax Return

- Confirmation email

- SAWT (excel file)

- Validation email

Now, make sure you have those before heading to the bank to pay.

Note: You can also pay thru GCash if you want to skip the line.

Finally, be sure you file on time to avoid the penalties.

For your Financial Health,

Resource person: Ms. Alyssa Kaye Talledo, CPA

Do you want to understand Taxes more? Make sure you grab a copy of this book.

Cheaper than paying penalties, this book will save you a lot of money!

Excellent companion in your financial journey as physicians.

Finally, a book which answers most doctors’ money problems.

When you don’t know what happened to your money, this book is for you!

From a Doctor who specializes in financial health…

This book will teach you what they don’t teach in medical school.

Here’s what other say about Green Book for Doctors… (CLICK HERE)

ORDER Thru Facebook Messenger.

CLICK HERE https://manychat.com/l3/myfinancemd

Do you want to know how to file your taxes online without going out?

These courses will teach you how to file and pay your Income Tax returns at the comfort of your home.

Start to end, step by step, no going out. From encoding, filing and payment. (All done online)

Enroll in our online course:

For Physicians/Doctors/Dentists/Vets:

https://pro.myfinancemd.com/taxcination/

For Financial Advisors:

https://pro.myfinancemd.com/taxcination-for-financial-advisors/

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Thank you so much for your informative posts!

Am getting conflicting info about the attachments — is the 2307 required for the 1701Q also? or will the printed SAWT suffice? Also, if there is no payment do the documents need to be stamped at the RDO or is email confirmation considered submitted?

SAWT is required to be submitted. If you submitted that, no need to attach the 2307.

Hello, if I would be filing for the annual 1701 form and be using 2307 from 1st to 3rd quarter only in the annual, would I be putting the date in SAWT based on 2307 (ex. January) or would I put it all in December since it was all claimed in December? Thank you.

Yes it would be okay to put it in the 4th quarter. BIR would understand that some HMOs and hospitals give the 2307s at the end of the year.

since when was this required? what if this was not done for last year & last quarter… what will happen?

How about 1701? If I was able to submit this online, do i need to submit the documents to my RDO?

No need, if you made the SAWT and summited ONLINE.