Do you feel sometimes that no matter how much you earn, it’s always not enough?

Do you feel that even though you budgeted your money so many times, still, you can’t free some cash?

Did you check your expenses?

Did you saw how much you are paying your credit card loans?

Are you paying with almost 1/4 to half of your salary?

Well if that’s the case, it’s time to do something about it.

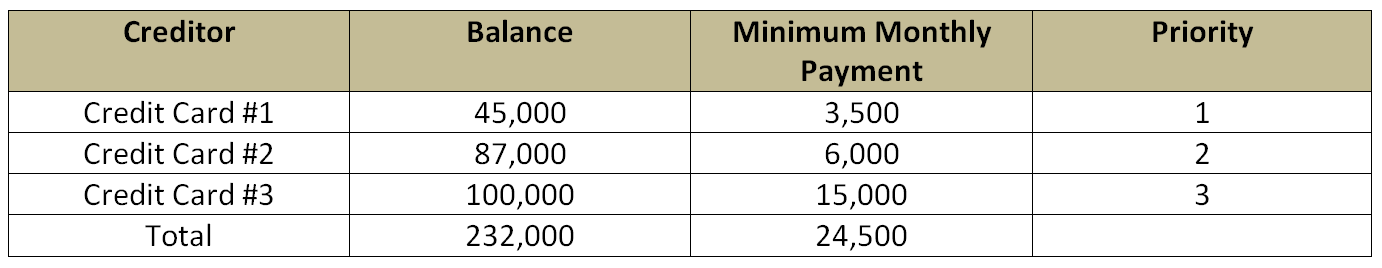

Jessy has 3 credit cards, all with existing debts. She wanted to slowly eliminate her debts so she can breathe easier and have a better life. How can she possibly do this?

Let me suggest 2 ways on how to eliminate your credit card debt the soonest possible time.

You can either do these 2 things:

1. Snowball debt payment

The debt-snowball method is a loan reduction technique, whereby one who owes on more than one debt account and pays off the accounts starting with the smallest balance first, while paying the minimum payment on larger debts. Once the smallest debt is paid off, one then proceeds to the next slightly larger small debt above that, so on and so forth, gradually proceeding to the larger ones later.

From the total minimum monthly payment, how much money can Jessy add as initial snowball? For example, Jessy can add, P5,500 more monthly for her debts.

- Monthly Payment: P30,000 (Minimum payment + Extra payment you can add)

- Initial Snowball: P5,500 will be added to the first debt, until it is paid off.

- After paying off the first debt, the minimum payment of the first debt will be added to the initial snowball, and now will be applied on the next debt.

- Minimum payment for the 1ST debt + initial snow ball = 2ND snowball

- 3,500 + 5,500 = 9,000 (2ND snowball) that will be applied on the next debt

- Once the 2ND debt is paid off. The second minimum payment will be added to the 2ND snowball to be paid to the 3RD debt, until it comes to the last debt to be paid.

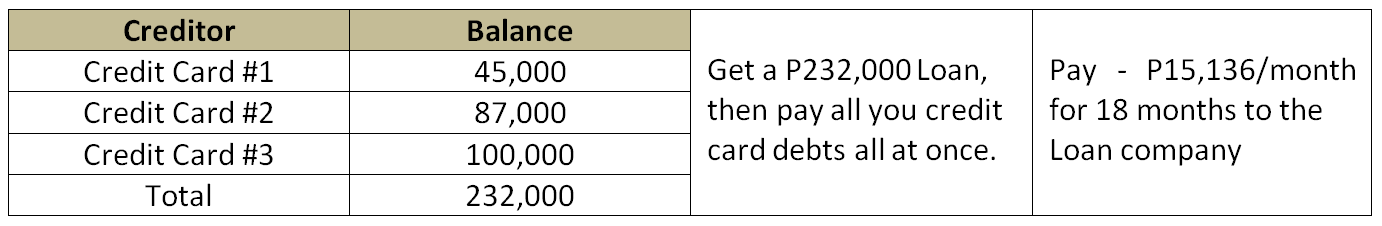

2. Debt Consolidation Strategy

This technique involves adding all your loans and getting help from a loan company so that you can pay all your debts once and for all and just pay in one consolidated loan.

How to do this?

Consolidate all your credit card loans and get a loan with low interest and best payment terms and pay all your credit card debts all at once.

There are numerous loan companies that can help you with that.

Let me give you an example: This loan company can give 1.75% interest per month and you can pay the loan up to 18 months.

Whichever method you use, the important thing would be, for you to pay those loans as soon as possible and don’t try to add more loan until you are paid entirely.

And of course, make sure you learn from the lessons of the experience this has provided for you.

For your Financial Health,

READ MORE:

- Doctors’ Loan: When To Borrow Money?

- Your Scarcity Mindset is Keeping you Poor in Spite of Hardwork

- 5 Common Mistakes Doctors Make when Borrowing Money

- How to Win the War? Filipino vs Debt

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023