Getting a credit card is easy but being responsible in using it is quite a challenge. Everyone loves that giddy high of a good card splurge but here are things you need to know to steer clear of debt pitfalls.

1. Know your credit limit.

Ranging from a few thousands or more, how you acquire your credit limit is dependent on how the bank evaluates your income and your ability to pay. Remember, just like superheroes who have power limits and weak points, your credit card has limits on it spending powers too.

2. Treat your credit card as cash.

Your credit card is not an “extra money”. Don’t fall into this misconception. Treat it as an alternative to “cash“, a cash that you already have but prefer not to carry around.

3. Don’t be misled by “minimum payment”.

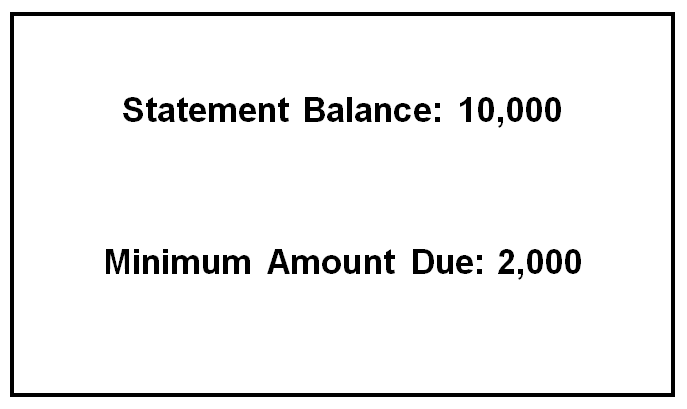

I got my first bill looking like this:

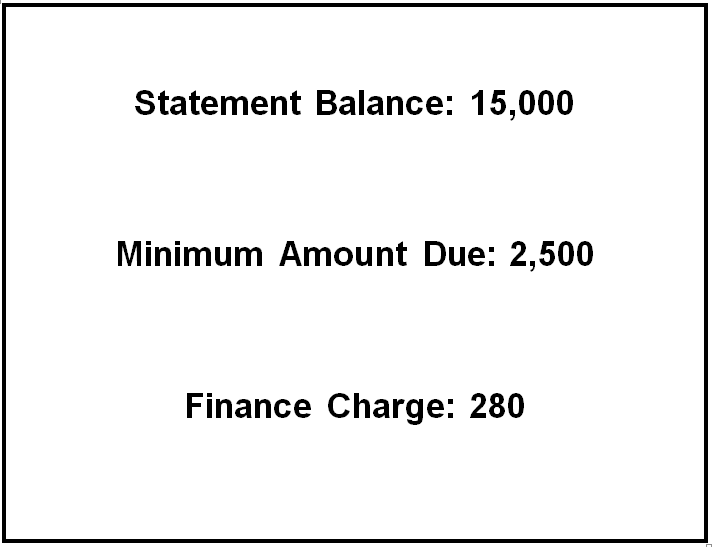

Just when I thought it was a good deal paying for only Php2,000 – reality hit me like a speeding truck when I got my next bill:

Lo and behold! Another type of charge appeared, the finance charge.

What is this finance charge?

A finance charge is a fee charged for the use of credit card. It may be a flat fee or a percentage of borrowings, with percentage-based finance charges being the most common. (Investopedia). This is also called the interest rate you pay for not paying on time and in full.

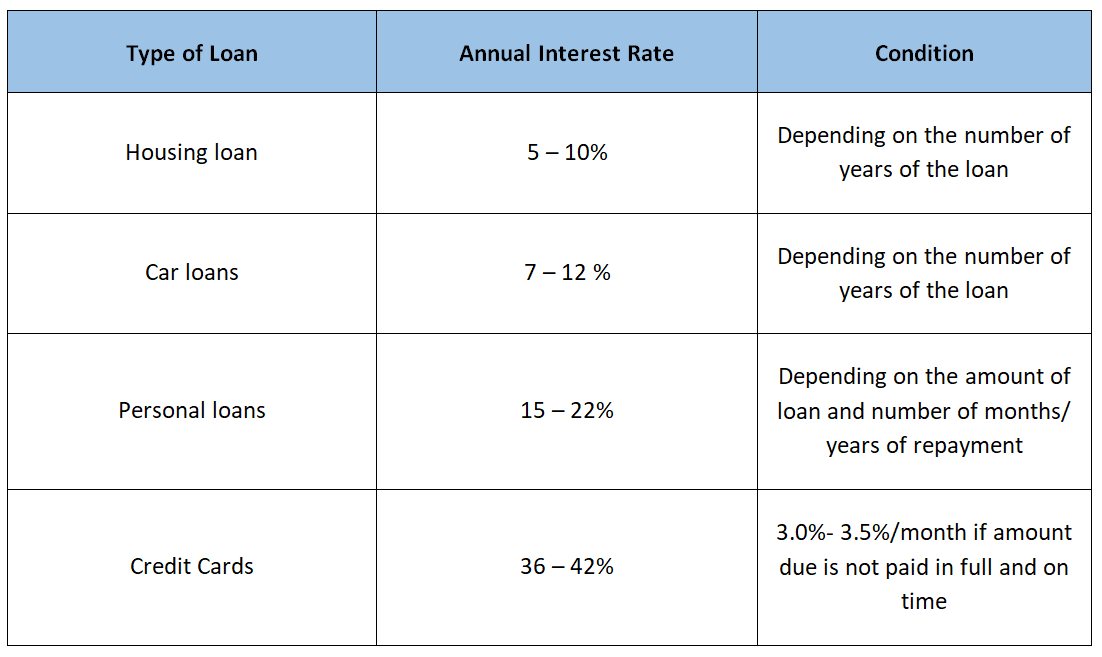

4. Know the interest rates in case you can’t pay on time and in full.

Credit card charges have the highest interest in the loan industry. Compare it with other types of loans on the table below:

You may can compare different credit cards being offered in the market today by considering these factors:

- Interest Rates

- Annual Fee Charges (some are waived for life while others are only waived for 1-3 years)

- Rebates and rewards.

5. Get the right credit card that suit your spending habit.

There is no bad credit card, only credit cards that do not match your spending habit and lifestyle. Most credit cards reward you with points, air miles and/or cashback for different categories of spending. So, it makes sense to pick a card that rewards you the most for your highest category of expenses.

For example, if you consistently spend the most on grocery, then look for a card that rewards you for grocery spending. There is a card for everyone, you just need to find it.

iMoney Philippines has a very good platform in comparing the top credit cards available in the market today. iMoney is the Philippines’ go-to online marketplace for financial products that exists for the sole purpose of empowering Filipinos to make intelligent decisions on money matters. The tools and services are available for free for consumers! See their post here: https://www.imoney.ph/credit-card/top-10-credit-cards

If you are ready to be a responsible credit card holder, you can get started by comparing different credit cards on iMoney. July is a great month to start, as they are giving away exciting prizes to celebrate their SuperSeven anniversary.

Like their Facebook: https://www.facebook.com/iMoneyPH/

And follow their Instagram: https://www.instagram.com/imoney_philippines

6. Know your “cut-off-date” and “due date” to buy you some TIME.

If there’s a necessity you need to purchase immediately and salary is only 5 days away, you can use your credit card to buy you some TIME.

Otherwise, go back to tip #2, to not fall into a trap.

Always be aware of your “cut-off-date” and “due date.”

Cut-off-date – it is a day in a month where your bills are generated.

Due date – the day you need to pay up without generating interest.

7. The dangers of “zero % interest”.

The most enticing feature of all: the “Zero % Interest Promos”. This makes your credit card even more powerful.

From my actual experience: A few years back when our house was new and needed a lot of appliances, I just use the card and swipe “12 months zero interest”. It was a happy and exciting feeling when you can get what you need and want and pay for it later. But after some time, I am not happy and excited anymore, it’s actually draining. It’s like a never-ending load you carry on your shoulder, and for how many months? 12 months or even 24 months? Oh, the feeling sucks! Believe me.

If you are going to use this feature, at least, know the dangers. As much as possible, do it one-at-a-time and pay for it as quickly as you can. The quickest installment you can avail, the better.

Now, that you know how to be responsible Credit Card holder, I hope you keep in mind that, a credit card is not an extra cash. If you can’t be responsible enough, then, think again before acquiring one.

For your Financial Health,

READ MORE:

- Buying your First Home: Pag-IBIG vs Commercial Banks Housing Loan Rates

- Where do UITF, Mutual Fund, and VUL Invest your Money?

- Doctors’ Loan: When To Borrow Money?

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023