According to a study, only 10% of Filipinos set a monthly budget. And of those who have set a budget, only 33% really sticks to it.

According to a study, only 10% of Filipinos set a monthly budget. And of those who have set a budget, only 33% really sticks to it.

If we are going to be more exact about it, only 2 out of 100 Filipinos have a discipline to follow the monthly budget they set. And the remaining 98%? “Bahala na si Batmat!” (Sounds familiar?) It sounds like many of us.

It’s still New year and I know maybe one of your new year’s resolution is Saving-MORE and Spending-LESS. A great way to do it is to keep your expenses under control by planning ahead and tracking the actual expenses.

It is not yet too late. You can start at anytime. If you are from NCR, take advantage of this very long weekend to get yourself organized.

As part of MYFINANCEMD 1ST Year Anniversary, I am offering you a perfect tool to assist you with that. For FREE! All you need to do is to print it and use it right away. See downloadable planner in this post.

Free Downloadable Monthly Budget Summary

Free Downloadable Expense/Savings Tracker

But first let me show you how to use it.

- Set your monthly target or budget for each category. Ideally: 50% goes to Needs (things you CANNOT do without), 30% goes to Wants (things you can do CAN do without) and 20% goes to savings (including investment earning fund values and life insurance earning cash values/dividends).

- Track your actual expenses that you incurred daily. Check categories if you paid in cash, debit or credit. Also, check if it is part of your (Needs, Wants or Savings). In doing this you will become aware of your expenses, on whether you keep buying your wants over what you really need.

- After a month of tracking your expenses, add everything on each category. Add all Expenses and separate all that are included in Savings.

- Are you getting near your target? Or too far out? Practice this consistently over the succeeding 3 months. After 3 months, re-evaluate the past 3 months based on your actual expenses. Then, you might need to re-adjust your budget to each category depending on the actual expenses you tracked in the last 3 months.

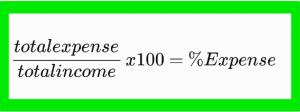

- Summarize each month’s actual expenses over income using this formula. “Don’t include the SAVINGS part yet. Just the expenses.”

The result should be 80% or below.

80% and less = You are right on tract. You are Wisely handling your money!

> 80% = You are spending more than you are saving

>100% = You are living BEYOND your means. Time to re-assess your spending habits.

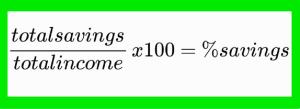

6. For your savings, do this:

The result should be 20% or more.

<20% = you are not saving enough

=20% = you are just right on track

>20% = better than the standard savings

ADVANTAGES OF BUDGETING :

- By going over your actual budget, you can be able to determine at a glance which items you can cut back or eliminate all together (if you are spending more than you are aiming).

- Budgeting helps you control which area your money goes first up to the last. Preferably, SAVINGS first, then NEED and lastly, WANTS.

- It can help you pay your current debts and prevent more debts in the future. Since it keeps you aware every time you use your credit cards.

- Budgeting helps you curtail purchases you don’t really need. Let you see where your money is being wasted. You might be surprised that a Latte a day is 4,500/month or 54,000/year.

It is very important today that you prepare and stick to your budget. A budget helps your personal and/or family’s finances in order, organized and written-down. It will be a big eye opener if you do this religiously each month. That I promise you!

So now, what are you waiting for? Take advantage of the very long weekend, download, print and start budgeting.

Happy Budgeting,

On behalf of MyfinanceMD, I would like to welcome our Pope! Welcome to the Philippines, Pope Francis! We Love You!

More Good Reads This Very Long Weekend:

- 20 Bad Financial Habits to Avoid in 2015

- How to Prioritize Finances? Learn the Hierarchy of Financial Needs: The Financial Pyramid

- How to Compute your Emergency Fund? How much Exactly do you Need?

Is this Post Useful to you? Don’t forget to, SHARE!

Do you want to receive weekly NEWSLETTER? Please put your email here for free!

Want to ask me personally? Contact me here!

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023