BIR just recently announced in its website that the much awaited quarter income tax return form 1701Q is now available.

This is the process for manual filing.

What you need to do:

- Download the form. (download here)

- Print 3 copies, then fill-up manually. Affix signature.

- If with payment, file and pay in Accredited Agent Banks.

- If without payment, file in your respective RDOs.

Update : You can now file via ebir forms.

The TRAIN law gave self-employed individuals earning below Php3Million two options in computing the income tax return, the two options are:

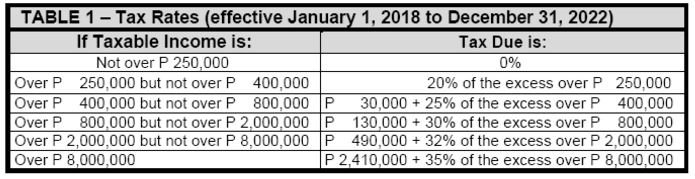

1. Graduated Rates, by using the table below.

- Gross income – 250,000 = Taxable income

- Then get the 8% of the taxable income that will be that tax due. Tax due less the withholding tax paid (2307 forms) will result to Tax Payable.

For those earning Php3 Million and above, you have no choice in computing your income tax return but choose the, graduated rates.

What are Allowable deductions that are included in the computation.

1. Graduated Rates

A. Optional Standard Deduction

- Allowed maximum deduction of 40% of the gross receipts or income.

- The advantage of OSD over itemized deduction is that you don’t need to present receipts or supporting documents to claim the deduction.

B. Itemized Deduction

- These are all the ordinary and necessary expenses paid or incurred during the taxable year which are attributable to the development, operation, conduct of trade, or exercise of the profession, including a reasonable allowance for salaries, travel, rental, and entertainment expense that shall be allowed as the deduction from gross income.

- In short, any expense that relates to your profession could be used as the deduction.

2. Optional 8%

- Allowable deduction is 250,000.

How do we compute for the Quarterly income tax return?

Let’s see how to file your income tax returns. For the purpose of simplification, let us use OSD as our method of deduction and also the optional 8%.

Note: I will be showing the actual BIR Form 1701Q and how to fill it up.

First Quarter Income Tax Return (BIR Form 1701Q)

Case Study: Dr. Bing Go earned the following gross for the first quarter of the year:

Jan 2018: Php250,000

Feb 2018: Php200,000

Mar 2018: Php150,000

Total for 1st Quarter: Php600,000

Using Form 1701Q (FIRST QUARTER) DEADLINE: May 15

How to fill up the new 1701Q Forms?

1. USING GRADUATED RATES

You can get the Creditable Tax Withheld from form 2307 that your withholding agents shall give you. It’s either 5% or 10%.

2. USING OPTIONAL 8%

Gross income – 250,000 = Taxable income

Then get the 8% of the taxable income that will be that tax due. Tax due less the withholding tax paid will result to Tax Payable.

For the first quarter, Dr. Bing Go does not have to pay anything yet, she even gains tax credit since the creditable tax withheld is more than the tax due.

Remember, the deadline for filing will be:

- First Quarter: May 15

- Second Quarter: August 15

- Third Quarter: November 15.

- For the 4th quarter, this will be included in the Annual filing of the ITR, which is due for next year.

I hope this post was able to help you. Don’t forget to like my Facebook Page to keep yourself updated.

Did you like this article? This was discussed intensively in my latest book:

Don’t forget to grab your copy! To order CLICK HERE. Limited copies available.

For your Financial Health,

READ MORE:

- 8% OPTIONAL FLAT RATE vs. GRADUATED TAX RATES, Which is better for Self-Employed Doctors?

- The Essential Guide to Estate tax under TRAIN law

- 8 Facts Doctors Need To Know About the TRAIN and How It Will Impact Your Income Tax

Do you want to know how to file your taxes online without going out?

These courses will teach you how to file and pay your Income Tax returns at the comfort of your home.

Start to end, step by step, no going out. From encoding, filing and payment. (All done online)

Enroll in our online course:

For Physicians/Doctors/Dentists/Vets:

https://pro.myfinancemd.com/taxcination/

For Financial Advisors:

https://pro.myfinancemd.com/taxcination-for-financial-advisors/

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Hi Doc Pinky,

Just want to confirm if you can really put the P250,000 exemption in the quarterly ITR filing.

The way I understand it kasi, it’s similar to the (P50,000 personal exemption before TRAIN LAW) wherein we only put it in the annual ITR filing but not in the quarterly ITR filing.

Thanks very much po.

Yes, you can put it na. Kasi the next form will be accumulated naman. The income and the 250k deductible will still be there.

Hi! If my gross income for the first quarter is less than 250,000 and I use the 8% Flat rate….do I still deduct 250,000 in the computation or just put zero in the #52 Less allowable deductions?

You still deduct 250k, tax due is zero

Hi mam so the 250,000 deduction is just one time deduction we can use it already for the first quarter? My bookeper told me that it should be used at the submission of ITR. You are such a big help 🙂 thanksG

Cumulative po kasi ang form kaya you can start deducting it Sa first quarter until sa annual ITR.

Doc, 8% po ba yung optional tax? confirm ko lang kasi 5% lang ang witholding tax ko. Thank you.

Magkaiba po iyon.

Hi Doc, meaning if less than 250k ang gross income tapos less 250,000 standard deduction, zero ang taxable income yung natira sa 250,000 cummulative po db maadd na po ba yun as tax credit or overpayment? Thank you.

Commutative yun sa next quarterly ITR, pati income and deduction.

Hi po gud morning. sa 2nd quarter and 3rd wala na po less 250k? how po mag file ng 3rd quarter sa 1701q? Thanks in advance…

Once lang yung 250K deduction in a year.

Hi there, During first week of May I filed my 1701Q using the old form. It turned out I had nothing to pay because of my 2307 forms. When I went to my rdo (40) to submit a copy they said they’re not accepting manual filing anymore.

sorry my question is, do I need to file again using the new form? Thanks!

Yes.

I think you need to send your 1701Q in a new form, via online. But ask your RDO about your specific case.

Dra yung 250k na deduction every quarterly po ba yun.. or if naubos na in 2 quarters wala na. Thank you po.

Thank u for being a big help.. i guess we as doctors should really put an effort on learning taxation..

250K lang sya, combine na kasi next filing 1st and 2nd quarter. Until the annual ITR.

Hi Everyone, if you find it hard to do your BIR Returns and all your TAX Obligations and Compliances, please reach me with this no. 09471957761 i’m willing to help you. I’m a CPA specialized in Corporate and Individual TAX. Thank you.

Hello Doc, I read in one of the comments here that for taxpayers who have used the old form in filing their 1701Q has to file a new one. Q2 is already approaching, should I file an amended return for 1st qtr then proceed with my 17101-Q2 in separate file? I’m filing it online eversince. Saw earlier that there is already v7.1 and 1701Q is already updated. Thanks in advance.

Yes file an amended one

Thanks Doc for your prompt response.:)

Just a confirmation Doc since this is my first time to file an amendment return. Is it as if you are filing your 1st QTR for the first time except that

-you need to tick the box amended return,

-put 250k in allowable reduction,

-sales revenue for the 1st qtr and not the “taxable income” in the old form

-prior year’s excess credits

-tax paid in return

Also Doc, for the “prior year’s excess credit” do i need to include that in every filing this yr (Q1-Q4) and just put the excess amount that I paid (over the counter) in “tax payment for the previous qtr”

I am exempted in filing percentage tax since day 1 of my business so I am only filing income tax (1701Q).

Hello Doc Pinky! Thank you very much for your tips, they have really helped me in understanding my taxes. I know it is easier just to hire a CPA for this aspect of our profession but I think understanding the process makes paying taxes feel less like a burden. I’m really looking forward to your future posts. Will you be including a post on how to file for the second quarterly taxes (1701Q2)? I was purely a self-employed individual until early this year when I became a regular employee of a Government hospital. I am still freelancing or moonlighting occasionally in some private hospitals.. I am anticipating that i will have some problems in computing for my second quarter tax since the government position i am holding does not give a form 2307 but rather a form 2316 (which is only issued once a year)…i am still a little confused with the accumulated deductions. I hope you will include a sample computation for doctors like me with both government and private practices. I’d really like to attend one of your Tax seminars in the future. Thank you very much again for sharing!

Hello, Doc. What you wrote here is really concise and easy to understand. Just one question: if I don’t need to pay tax, is it enough that we just file online and just wait for the email confirmation or we still need to go to the RDO? Thank you.

You can just file online and wait for email confirmation.

how to compute for the 2nd quarter income tax mam? I paid 2,900 for my quarterly percentage tax and using OSD method.

Wait for my blog for the 2nd quarter. Keep yourself posted by liking my fb page.

Yung 250k sa computation ng 8% flat rate every quarter po ba pwede ibawas? Thanks!

Isang 250K lang.

The 250,000 is only applicable to only one quarter po? How about the succeeding quarterz? Thank you

One 250K lang for entire year.

For example, second quarter po, 80,000 ang gross ng taxpayer. Less 250,000 na po agad deduction? Then for third, no deductions anymore? Thank you.

Consolidated kasi yung 250K ng buong taon. Until maubos ang isang 250k across all quarters

Hi doc,

Your blog is very educational especially for first timer (self-employed professional). I am a former employee and now I am educating myself about tax.

I would just like to ask how the 22,000 was computed under the GRADUATED RATES column? I clearly understood the 28000 which resulted from (350,000 x 8%).

Thank you very much and may you be blessed more.

k

Hi, use the table. The adjusted table for train. It’s there.

can you also give us a guide on how to file our quarterly ITR (1701Q) for mixed income earners? or maybe if you have a link to a sample computation, i’d very much appreciate it!

Hi, can you give us a guide how to file the 2nd quarter ITR (1701Q). Very much appreciate it.

Yes soon, wait for it. 🙂 Like my page in fb to be updated. 🙂

Hi DOc Pinky,

Can u also guide us in the filing of the 1701q for the succeding quarters?

Isa pa pong request, may i know how to calculate monthly vat and fill out monthly and quarterly vat returns?

I will try to do the VAT. Like my page in fb para updated po kayo. 🙂

Hi Dr Pinky, can you also come out with a 3M and up gross income example. Thank you

You have a very informative blog. The details are concise and clear. I love it! Thanks so much for your help. 🙂 More power to you.

Thank you Mitch.

hi mam kapag po ba mixed income at nag avail po ng 8% madeduct po ba yung 250k na allowable deduction every quarter o hindi po kailangang ideduct, sana po masagot samalat po.

If you are mixed income, you can’t use the 8% because the 250K is already being deducted in your employed part. Use the graduated rates.

Hi Dra Pinky! Can you show me how to compute for the quarterly income tax for mixed income earners? I was purely self employed professional last year (2018) but for this year (2019), I started working in a company, hence I am a mixed income earner. How will I file for the quarterly income tax? Should I deduct the 250,000 right away? Thank you very much Doc.

For mixed income, you can’t use the 8% optional rate because the 250K is already being deducted in your employed part. You need to use the graduated rate in computing the quarterly ITR.

hi po, i’m a freelancer. ask ko lang po. from my 2551Q (Q1) meron po akong overpayment total payable worth of 3,088. kasi i have a 2307 for that quarter. so to clarify po kailangan pa din po ba e input yong 2307 ko for 1701Q? and saan ko po magamit yong 3k na overpayment? thanks po.

hopefully po maka reply po kayu. thanks

There is no connection between the percentage tax 2551q and quarterly income tax return. You should have amended the 2551q for that or, check if you can claim that on your next filing for 2551q.

hi Jade, may i know if the 2307 you have is intended for Creditable Percentage Tax or Creditable Tax Withheld at Source? kindly check first, because you cannot use the 2307 Creditable Tax Withheld at Source for 2551Q. if this is for Creditable Percentage Ta, you have two options which you can see at the face of 2551Q.

*2307 for Creditable Percentage Tax – Withholding Taxes against Sales/Service rendered for Non-VAT registered seller for 2551Q. this is the tax in lieu for the 12% VAT.

*2307 for Creditable Tax Withheld at Source – Withholding Taxes against the income tax payable of the seller for 1701/1701Q.

Hi po doc thank you kasi very helpful guide nyo! Ask ko lang po pano kapag kakastart lang nitong nakaraan, bale 1 month palang po.. Self-employed po ako at 8% pinili ko. Magfafile na po ba ako ng 1701Q kahit isang buwan lang na kinita mailalagay ko? May babayaran na po ba ako dun? Di naman po ata ako lalagpas sa 250k a year.. Saka may guide po ba kayo sa online filing kasi wala po akong idea pano.. Salamat po nang marami!

hi jas, depends if your earning fall sa first Quarter (jan – march) and so on and so forth. if it falls to that, you need to file even if no payment to avoid penalties. you just need to accomplish form and send it to BIR and get Email confirmation.

Hello doc..big big help! Thank you! How to use sawt with multiple clients po?

Will try to make a post on that. thank you.

Good day Dra.

If a doctor is a VAT taxpayer, can he still use OSD for his deductions? Thank you

Yes.

Hi doc..can you help us with sawt? Yung mai multiple withholding agents..

Hi how can i help you?

Hello dra, i am confused on how to compute my 2nd quarter income tax. do i need to combine the taxable income in the previous quarter to the taxable income to date.? my 1st quarter gross sale is 180,744.00 and second quarter is 194,005… OSD deduction

hi, you can’t add your Q1 sales to your Q2 sales. However, to get your Taxable Income to date, you must add your taxable income (Sales minus OSD) from Q1 and Q2. Then, if their is payment made from previous quarter you must deduct it from your current tax due.

Hello po ask ko lng po my every day sale is 500 and it is my first time to file annual income tax. Is it right that i came up with zero tax due….I computed it like this 500 x 30 days x 3 for 3 months= 45 000. Obviously it not exceeded the 250 000 allowablededuction. My hubby went to rdo just this morning but on his form there is a tax payable of 1350. Im wondering how they get that. Could you please help me. Thanks a lot in advance.

Hi, you can ask them why. Supposedly, you don’t need to pay anything. But, the reason could be penalties? Or late payments. Ask them.

Hi po.. just want to ask how to file 1701Q if kakastartl lng at wala pang sales for the 2nd quarter? online filling po kasi ang ginagawa ko. if zero nilalagay ko ksi wala p nman akong sales hnd sya masa save and print. please help. thanks.

Inaaccept ni ebir form po kahit 0. Click Validate muna, then Save and submit.

kailangan po ba isubmit yung hard copy ng 1701Q sa BIR kahit no payment due? May income pero no tax due. Also submitted through BIR forms with email confirmation. Thank you very much!

Hello po Dra, yong first quarter 0 Sales kasi ako, I filled using the old form and naclick yong itemized deduction… For this quarter po nakita ko na po yong new form ng 1701q but I wanted to use the graduated IT rates with 40% OSD instead of the itemized, pwede po kaya yon, salamat

You can’t change unti the next calendar year.

Hi, efps filer ako (professional). If walang tax due, do I need to submit hard copy of my 1701Q sa BIR office? Thanks for your help

Send it thru email and with for confirmation email

Hi po Dra, ask lang Kung pagkakuha ng C.O.R March 5, ay di kagad nakapag sign up thru eBir registration. Then inabutan ng Covid 19 Home Quarantine starts last March 15, 2020. Up to now di papo na register online may penalty po ba? Lahat po kse ng computer shop within the location ay Hindi allowed mag open.

May penalty po ba Kung late na mag register sa eBir online ? Pleasee help. Thanks

Hi, no need to apply in ebir application, you just have to download the app, and encode your details in the app