Bangko Sentral ng Pilipinas (BSP) Head of Inclusive Finance Advocacy Office, Pia Bernadette Roman-Tayag, said that both BSP and DepEd have integrated financial literacy modules in the K-12 curriculum. BSP is also partnering with other stakeholders such as Visa and Teach for the Philippines to produce materials and guides for teaching.

DepEd will then monitor the link between rising financial capability with initiatives such as this, according to Ms. Tayag.

This is good news and hoping that this will pushed through until implementation, but I see 4 major flaws that could deter this great initiative.

The 4 flaws that may deter this initiative:

1. According to Study by Kobliner, children will start grasping financial concepts like saving and spending at the age of three years old.

This means that money teaching and financial literacy should start at home from the age of 3.

Parents are the most important factor for this.

2. Further Study from University of Cambridge revealed that kid’s money habits are formed by age 7.

Again, parents, as first teachers, play an important roles in here. Flaw #3 reiterate this fact.

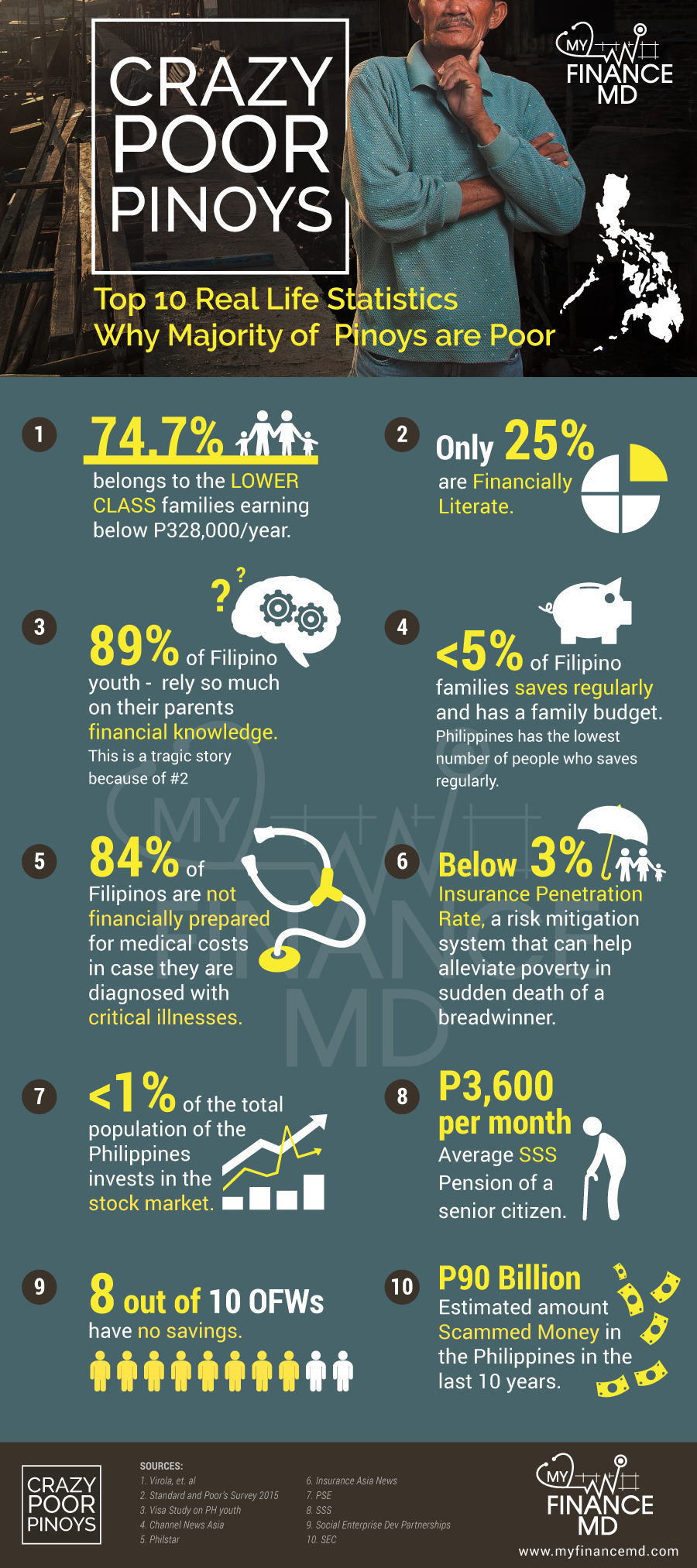

3. 89% of Filipino youth rely so much on their parents financial knowledge, according to a study conducted by Visa PH.

This flaw is unfortunate, because of the next flaw, flaw #4.

4. According to Standard and Poor’s (S&P), only 25% of Filipinos are financially literate when they did the Global Financial Literacy Survey in the Philippines.

This only means that, the adults (especially the parents and teachers that will be teaching these young ones), most of them will not be qualified since 75% of them are not financially literate themselves.

This would mean that the most critical part here, is teaching first the adults that will teach financial literacy to the young ones. Especially the parents and the teachers.

Since Financial Literacy is an important stepping stone to this initiative and eventually to a wealthy Philippines, it’s the part that we need to bring more focus and planning. The Effects of Lack of Financial literacy gives way to these real life statistics which I posted in Facebook, called the:

CRAZY POOR PINOYS

TOP 10 REAL LIFE STATISTICS WHY MAJORITY OF PINOYS ARE POOR

It’s good that the government is taking steps in providing tools to bridge the gaps in the financial literacy. But they cannot do it alone, let us do our part, let us all work together by first, educating ourselves. Read books, attend seminars, read blogs. Be like a sponge; at the same time be discerning and pro-active. Good luck on your journey to financial literacy.

For your Financial Health,

Other Sources:

BusinessWorld, Visa PH, S&P Finlit Survey, Kobliner, University of Cambridge.

Read more on how to teach your kids:

- 5 Money Habits To Avoid Telling Your Kids

- Money Learning Activities for Kids

- Millennials and Money: Are they In Sync?

Read more here if you are a Filipino who wants to know more:

- Top 14 Illnesses of a Financially Sick Filipino

- Mandatory Life Insurance for all Filipinos

- Filipino Worker Benefits, What is Available to You?

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

I think its a good initial step…better than nothing at all…on my part even if my mom ask me to save on my younger years i didnt do it because i thought its just a part of her usual sermon…and i just want to enjoy the fruits of my labor…not until i heard it from others how important is saving did i finally realize how important it is to save and invest for my future…maybe on the part of the students if its being taught in the school and not just in the form of sermon at home maybe they will listen just like what happen to me…

Agree.