VUL (Variable Unit Linked) are life insurance plans that also has an investment component in it. Since it allows you to allocate portion of the premium to be invested in the stock market.

VUL (Variable Unit Linked) are life insurance plans that also has an investment component in it. Since it allows you to allocate portion of the premium to be invested in the stock market.

Many ‘financial experts’ as they call themselves disagree with VULs, since, they say “life insurance policies are best taken separate from investments.

In an ideal situation and ideal setting, I agree with that a hundred percent. To maximize the investment and lower down the life insurance cost. But when it comes to a Filipino living in the Philippines, who always have the less than the ideal setting and situation, it is an entirely different story. Throughout my six years in the financial and insurance industry, I noticed something else that made me think that VUL products are more appropriate to Filipinos.

These are the reasons why you should consider VUL as your first insurance/investment:

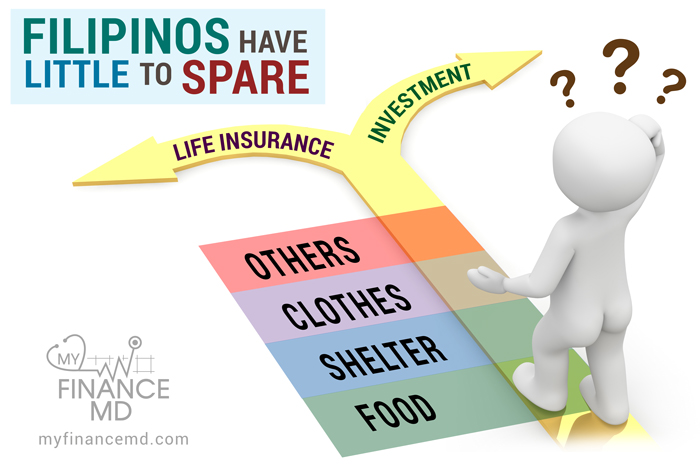

1. Filipinos have little to spare

Life insurance penetration is only 4% in the Philippines, meaning there are only 4 Filipinos insured out of 100 or 4M out of 100M population. Investors in the stock market are even fewer in number, with only few hundred thousand out of a 100 million population. Why? Because, Filipinos have little to spare.

Let’s face it, 90% of the population belongs to the lower income class and middle class family and before a Filipino could even protect himself (and gets a life insurance) and before he can even think of investing. There is a hierarchy of needs to satisfy first before he even gets there. Food, house, education, taxes and other basic necessity.

The average minimum income needed to feed a family of 5 (parents and 3 children) is about 30,000 pesos/month. The minimum wage salary of a worker is only 10-15,000/month.

In many cases of families I have talked to, they just have a little over a few thousands to spare. If I am going to split that further in life insurance and investment, how can I move forward and give the best possible advice?

VUL can provide them the protection of life insurance (more important than investing in the hierarchy of needs) but can also give those people a chance with little to spare to invest indirectly in the stock market and give them a brighter retirement more than what they could possibly get from the government.

2. It’s a FORCED SAVING Mechanism forcing Filipino to SAVE

Some financial “experts” also advises to invest in UITF and mutual fund instead of VULs. Yes I agree that they can invest in these products, but why not also in VUL?

UITF and Mutual fund are investment products that indirectly invest in stock markets where the initial deposit is usually 10,000 in UITF and 5,000 in Mutual fund. The next investments would be whenever you feel like investing. “Kung kelan mo gusto mag-invest.”

Like UITF and Mutual fund, VUL is also investing in a stock market indirectly, but with the condition that you need to save regularly or else your life insurance will lapse. It now becomes an investment mechanism that forces a Filipino to form a HABIT of saving.

With mutual funds, UITF and even in direct investing, you are not forced to invest because there are no consequences if you don’t invest regularly.

According to my experience, of those people who gets a VUL and Mutual fund at the same time. They get to pay the VUL more regularly than fund their Mutual fund, even if they know they can earn more if they put money in Mutual funds regularly. Why? Because, they are given a choice: to invest or not to invest today. Believe me, from my experience with a Filipino investor, when given a choice, there are more times in a life of a Filipino that he chooses not to invest than the times he can for a variety of reasons.

3. Estate Planning Purposes

When you die, all your properties and money in the bank is subject to estate tax. Hence, the money that you have in the banks and other investment vehicles are frozen. Meaning, you can’t touch it until you pay the dues. Money in VUL are somewhat protected since it is attached to a life insurance vehicle. Read more on this in this series.

Rx

- Many Filipinos need to be forced to save and invest since we lack the discipline to do so for ourselves. VUL is a great product where you are forced to invest at the same time insure yourself, that whatever happens to you, your family will not suffer if you die early, or you will not suffer on your retirement if you live a long time.

- If you can have the discipline to invest monthly, no matter what happens. Investing in Mutual funds, UITF and directly to stock market may be the thing for you. But don’t forget to protect yourself by getting a term insurance.

- Financial Experts (as they call themselves) should stop advising people that they should not get VUL products because it can do more harm than good. What is really happening is different from your intended results.

- VUL may not be for everyone at the same time BTID (Buy Term Invest the difference) is not for everyone either.

- You can get both if that suits you.

Ultimately, the products that are suited to you will always depend on your financial goals in life. Insurance and investment products are just there to suit your goals. It’s the job of financial advisers/consultants to tell you what is more appropriate for you.

Get help on choosing the best product suited for you. Ask me here.

For your financial health,

Best Reads:

- Buy Term Invest the Difference (BTID), is that for me?

- Buti pa ang Kotse Insured, Eh Ikaw?

- What is the Difference between PRE-NEED and a LIFE Insurance?

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Wow thank you for sharing

Wow thank you for sharing

Please loop me in for new post, I’m a rookie Life Insurance Agent and I want to learn more.

Thanks,

You can subscribe in the post. Download the book.

Where can i apply for this VUL?

Hi ms Mary Grace, I sent you an email. 🙂

Where can apply VUL? And need help where to invest my daughter’s savings for her education. Need your advise. Thank u

Sent you an email. Kindly check your email. Thanks.

Hi doc Pinky,

Where can i apply for this VUL?

thanks

sent you an email. PM

How can I avail?

I sent private email to you po.

Try Troo!