I was intrigued with the 52-week money challenge last year. But, I was not attracted on doing it. Why? Because I do not earn weekly, I get paid twice a month. And when I receive my salary, I already budget it for the entire two weeks. So, I don’t think weekly savings can work for me as well as for other people since most of them are earning twice a month like me.

I was intrigued with the 52-week money challenge last year. But, I was not attracted on doing it. Why? Because I do not earn weekly, I get paid twice a month. And when I receive my salary, I already budget it for the entire two weeks. So, I don’t think weekly savings can work for me as well as for other people since most of them are earning twice a month like me.

Then, last week, I heard from the news about this guy, who completed the 52-week-challenged and already has 130,000 right now. From there, I got inspired and gave a second look at this challenge. I guess I can do it if only I customized it according to my frequency of pay-outs, which is twice a month, as most of Filipinos also do have. So, I will be sharing this to you too.

First things first.

Steps and Some Rules for this 24 Pay-outs Money Challenge:

- Ask yourself, what are you saving for? Cut out a picture of your dream/goal.

- Compute how much you need for that goal.

- Now that you know your goal and how much it cost. it’s time to choose how much you can save until the 24th pay-out that will not be too much on you, but also not too little also. Just right for your goal and you are comfortable on saving till the end.

- Print the PDF file of the saving budget you have chosen then put it your TO DO lists. Glue the picture of your goal along with this.

- Get a glass piggy bank with no rubber holes (cheat holes) in it or any indestructible container. Put a warning sign outside of it. “Break only in cases of Life and Death.” You should have a separate Emergency fund. See post on emergency fund.

- Highlight the week you have already saved your money. Once highlighted, it means it is done.

- If you have extra more money you want to save in earlier months, you can get ahead of your savings, just highlight the week you have already put your money into. As the months progressed, the saving becomes more difficult. So any advance savings you can do on the first few months can make the latter months much easier.

- A bonus at the end of the year can help most people out during the last few heavy months.

Choose what suits your budget and lifestyle below from this money challenge.

BUDGET: 50 pesos increments

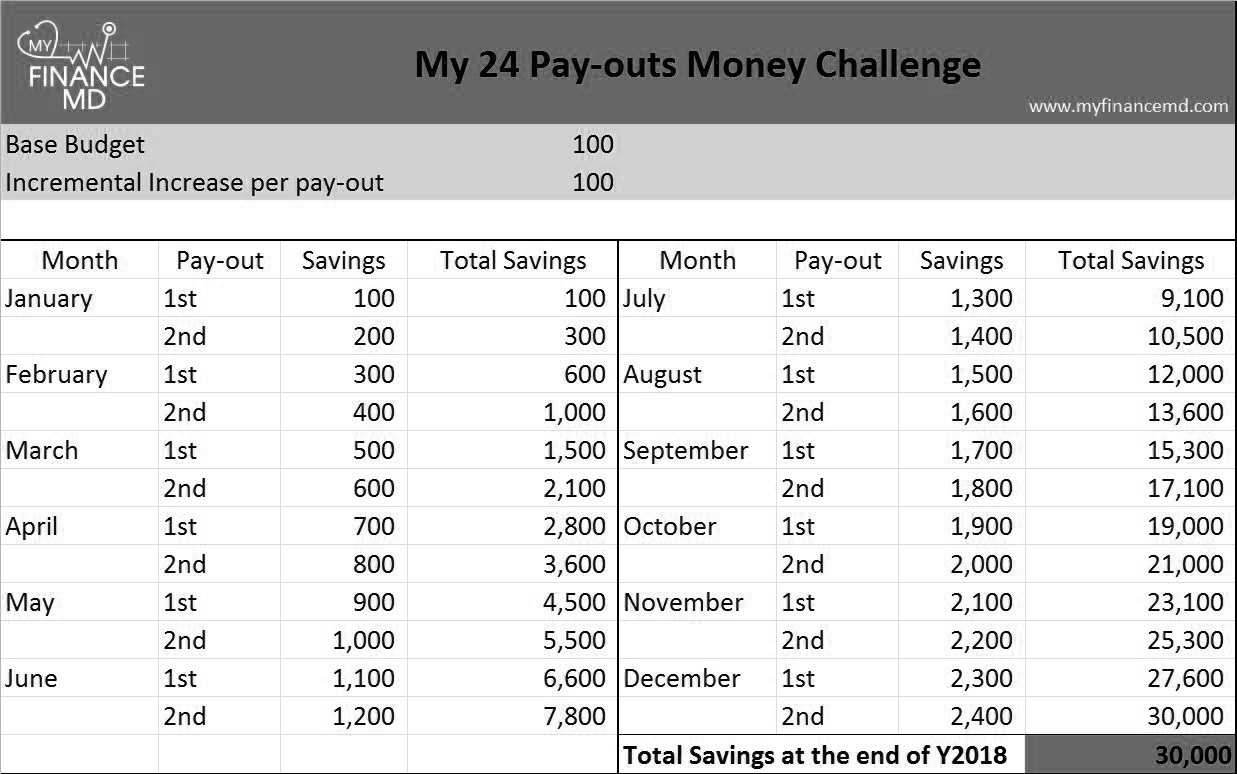

BUDGET: 100 pesos increments

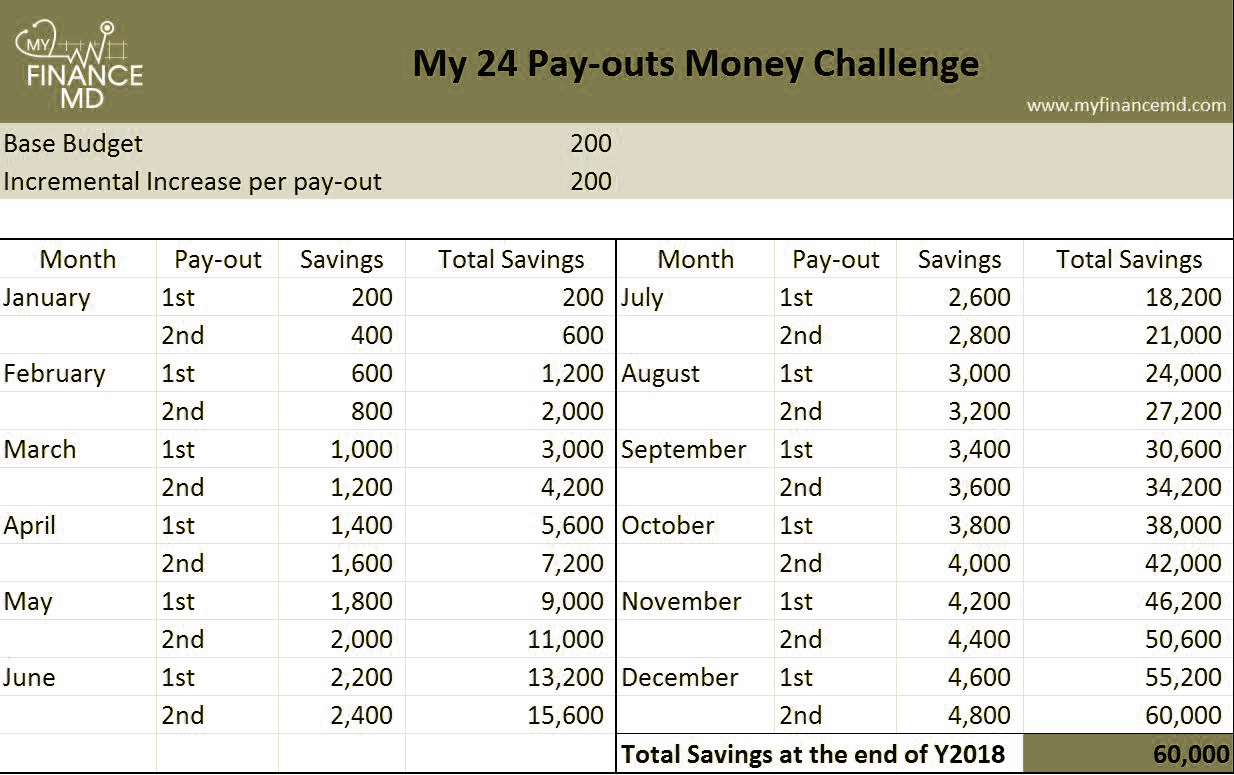

BUDGET: 200 pesos increments

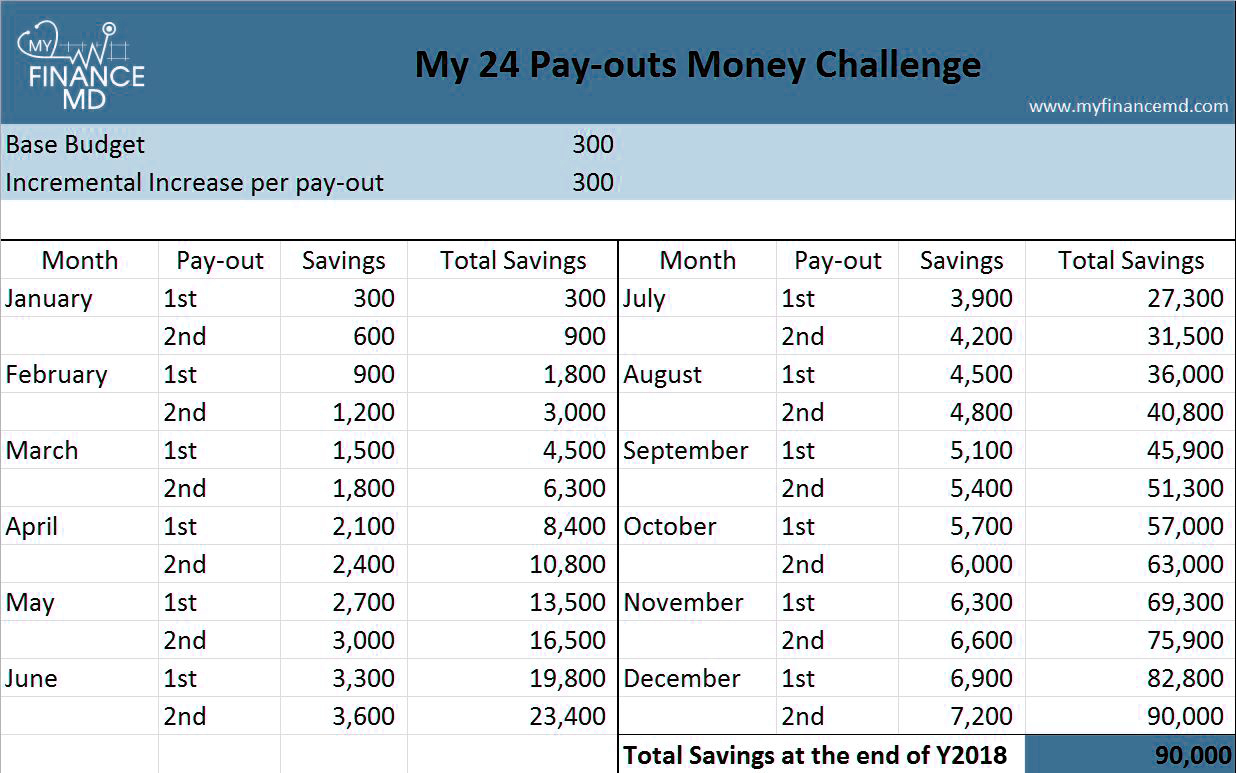

BUDGET: 300 pesos increments

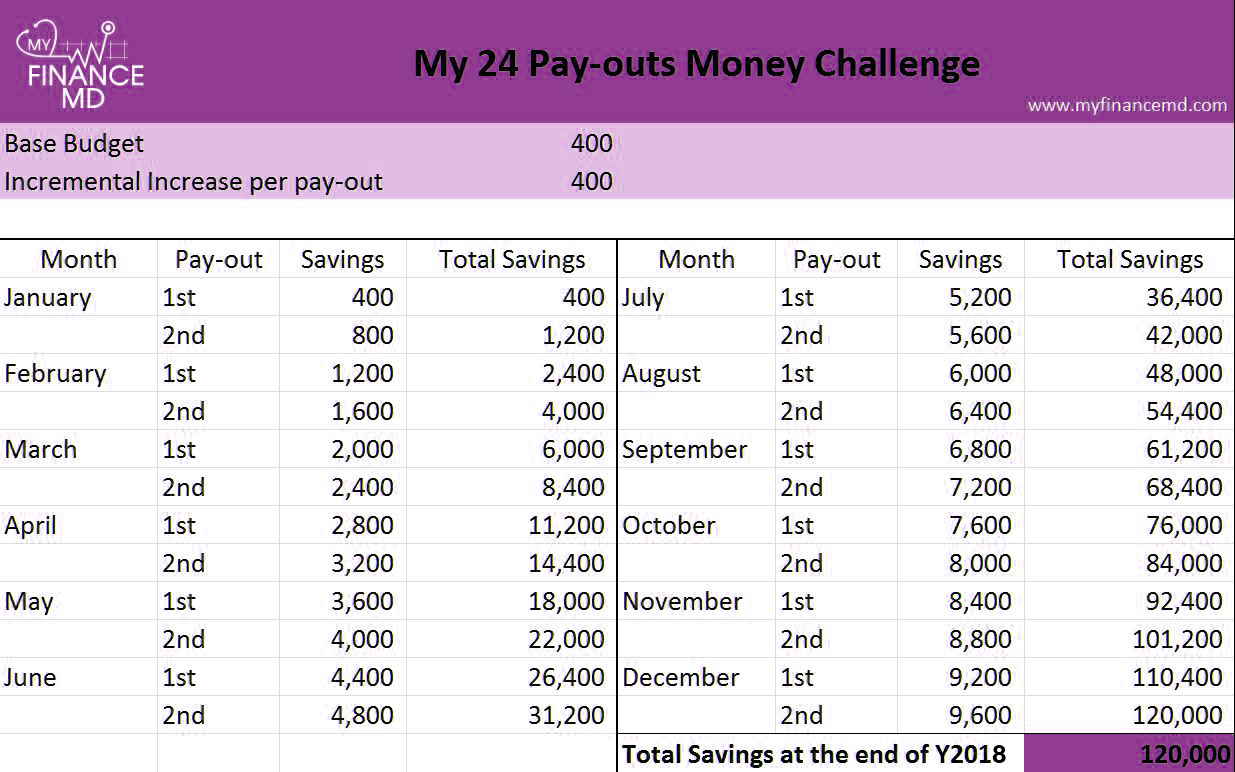

BUDGET: 400 pesos increments

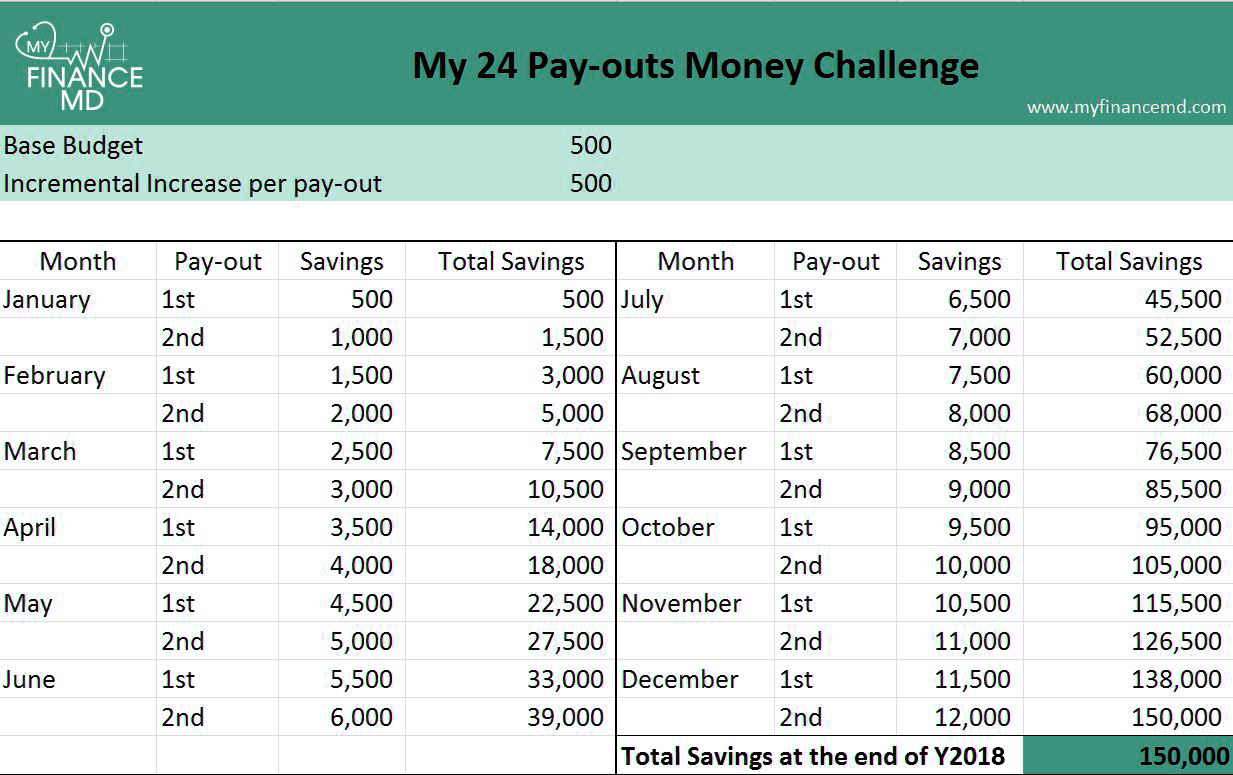

BUDGET: 500 pesos increments

Since this method is fitted with my pay-outs and lifestyle. I will be doing this for 2018. I challenge you all to do the same. Let us do this together and at the end of the year, let us reveal if we were able to accomplish it.

Challenge accepted? I will wait for your answer below.

Download the PDF Printable Version of this blog here.

Challenging you this coming year,

Read more:

- Top 6 Saving Tips this 2018

- How to Know if you are Getting Richer Each Year

- The Best Time of the Year to Buy Things

- The Best Budgeting APP in Android and IOS for me

- Best Investment product for your child’s education

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Ate pinky I actually did this, this 2016 I was able to save $6k with $20 increment biweekly and I spend some on my vacation in the Philipines. Now for 2017 I am trying a different approach instead of incrementing I will do a fixed amount of $250 biweekly that will sum up the same amount I saved on 2016.

Hi Johnray, great to see you here. 🙂 That is great. Since you already have the discipline, yes, i believe you can do the fixed amount na. For those who are still getting the habit of saving, incremental increases might get them to save. 🙂 Thank you for dropping by my blog. I hope to see you soon again. 🙂

this looks much easy. Im gonna try the 200 challenge. Thanks for this.

this is a good read however i feel that i should comment on this. while the payout scheme appears to be light in earlier periods, it becomes burdensome in the latter periods. this somewhat offsets the attractiveness of the early parts (ie. jan to jun have low required payouts but have higher payouts for the remainder of the year)

another thing, creating a smoothed payout may be a good idea but this kinda distorts your time value of money! in fact, this creates a negative cash carry effect. for illustrative purposes, assume that we save (do not confuse it with investing) PHP 1.00 today and we let it grow exponentially by contributing 100% of the previous savings amount for 15 years, then the value of your smoothed savings is only PHP 9.5K assuming 10% cost of money. on the other hand, assuming we mimic the total savings amount (ie. the total value is PHP 32k) and spread it over 15 years (let’s create a fixed stream of even payouts), then the resulting value will be PHP 18k, which is almost double if we compare it with smoothed payout / exponential payout.

note: the working assumption here is that payout = net earnings (ie. net of fixed obligations such as allowances, transportation, taxes)

Lets do it.. ill try the 200.. I hope to give u a good news on december 2017… Goodluck to us! Enjoy…

Lets do it.. ill try the 200.. I hope to give u a good news on december 2017… Goodluck to us! Enjoy…

Hi good day. I like that idea. But i preferred to a monthly money challenge. Because my payout is once a month. Can u give me sample.

You can try adding the 2 pay outs together in a month. 🙂

I will try this… I hope I’ll have the discipline to make it until the end. I tried the 52-week challenge but I finished half-way.lol Thank you! I hope this is the right formula for me! 👍

Go. You can do it!!!

[…] hand with you that you need to segregate accordingly? She customized her own which she called the 24-payouts monthly challenge. For each payout, she has to set aside a fixed amount and when the next payout comes in, she has to […]

Count me in. 🙂

great. let’s do this!