Do you experience a buyer’s remorse? That feeling after buying something and reflecting on it, you immediately feel, “Oh shucks, why did I even buy this thing?”

Do you experience a buyer’s remorse? That feeling after buying something and reflecting on it, you immediately feel, “Oh shucks, why did I even buy this thing?”

Even as a Financial Consultant myself, I still do have times I do impulsive buying, then buyer’s remorse, and I hate that feeling.

A rule in sales says:

“People rarely buy features. People sometimes buy benefits. People always buy emotion.”

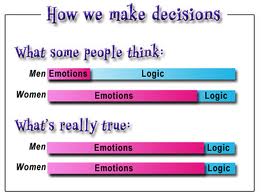

“People make buying decisions based on EMOTIONS and justify their decisions with LOGIC.”

Pic: dental support specialties

Salesperson indeed knows that, so they capitalized on your emotions:

“Ma’am, this looks good on you, it makes you more sosyal.”

“Your kids will love this, ma’am/sir!”

“Sometimes ma’am/sir, you need to reward yourself!”

A month ago, I just had another experience of impulsive buying; so, once and for all, I said to myself, “This has to stop.”. Let me share the steps that prevented me for letting it ever happen again:

1. List down your Priority Needs List

This is the list of the things you really need but you haven’t bought yet. Maybe, you are still waiting for the funds or the best time to buy it. Put it in your phone’s checklist APP, so you can cross out the things you were able to buy.

2. List down all your income and expense every day and set your monthly budget.

To prevent buyer’s remorse feeling, it is also important to give yourself some leeway. Include those cravings and wants in your monthly budget. Set an amount or limit on how much you can buy, if it goes over your budget don’t buy it, if it fits your set budget, then buy it.

I particularly use a useful App for this. See here:

Best Budgeting APP Guaranteed to Make Life Easier

3. Do this: “Three-Step Rule”

Impulse buying can really ruin your budgeting goals. So, whenever you are tempted to buy something, stop looking at the item, breathe in, then do this “Three-Step Rule”.

Step 1: Step out of the store and walk away. It is not helpful deciding if there is a salesperson in front of you, cheering you, tapping your emotions and waiting for your decision.

Step 2: Look at your priority needs list. Ask yourself: Is it more important than the items you have included in your priority needs list?

Step 3: After spending some time away at your temptation, ask yourself the following questions:

- Is the feeling the same? Is the craving still there? Will you die of cravings if you don’t buy it?

- Is it out of your set budget each month for that particular item?

- Is that item more important than your priority needs list?

Hopefully, this article can help you with your impulsiveness in buying, the way it helped me. Hoping you succeed too. Good luck.

Lastly, I leave you with another quote from Zig Ziglar.

“People don’t buy for logical reasons. They buy for emotional reasons.” – Zig Ziglar

Helping you control your emotions on buying,

Read more:

- Top 14 Illnesses of a Financially Sick Filipino

- Best Budgeting APP Guaranteed to Make Your 2016 Easier

- 6 Bad Habits That Will Keep You POOR – Forever #PoorEver

- Millennials and Money: Are they In Sync?

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023