Although 2013 is over and we are almost halfway through 2014. The Insurance commission hasn’t yet released the 2013 ranking of the top insurance companies in the Philippines. They said, they will release it on August 2014. So, with that, we have to content ourselves with the 2012 rankings. In the case of the Philippine Stock Exchange (PSE), I will be giving the November 2013 ranking.

Since this is an unbiased review, I will not only highlight one category just to make one insurance company look good. I will be enumerating all the rankings in all categories from the Philippine Stock Exchange (PSE) and Insurance Commission (IC). That’s why this is an UNBIASED review.

New Update:

Top 10 Life Insurance Companies in the Philippines 2015

Top 10 Life Insurance Companies in the Philippines Most Updated and Most Unbiased Review 2014

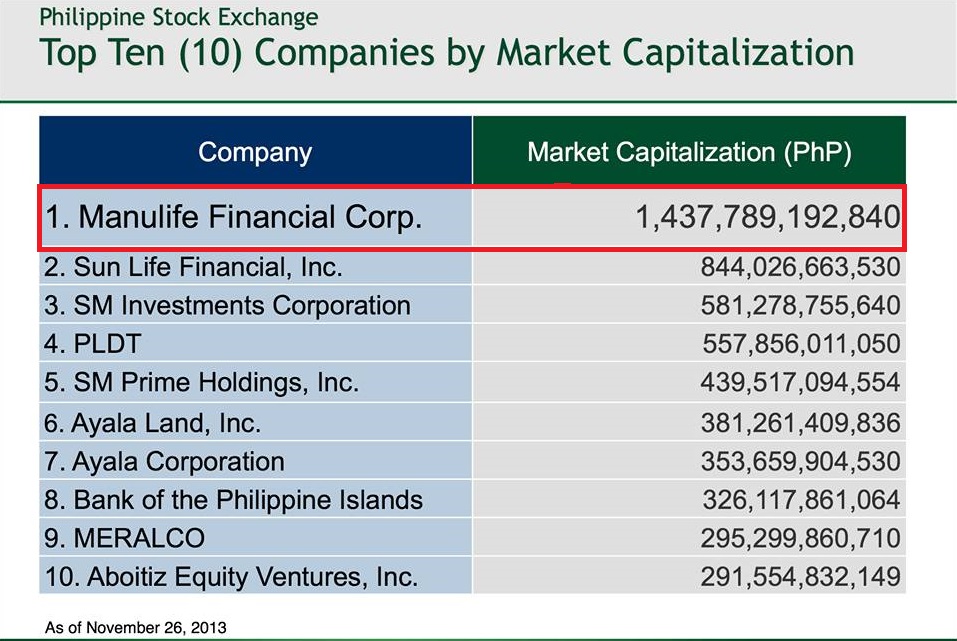

First Category: Top 10 Companies in the Philippines, According to Market Capitalization by the Philippines Stock Exchange (PSE)

Investopedia defined Market Capitalization as – the total dollar (Peso) market value of all of a company’s outstanding shares. Market capitalization is calculated by multiplying a company’s shares outstanding by the current market price of one share. The investment community uses this figure to determine a company’s size, as opposed to sales or total asset figures.

Please note from the 10 companies in the Philippines stated below only 2 companies are from the life insurance industry. Manulife Financial Corporation as the top 1 with over 1.4 Trillion Pesos Market capital and Sun Life Financial Inc. in the top 2 with 844 B Pesos.

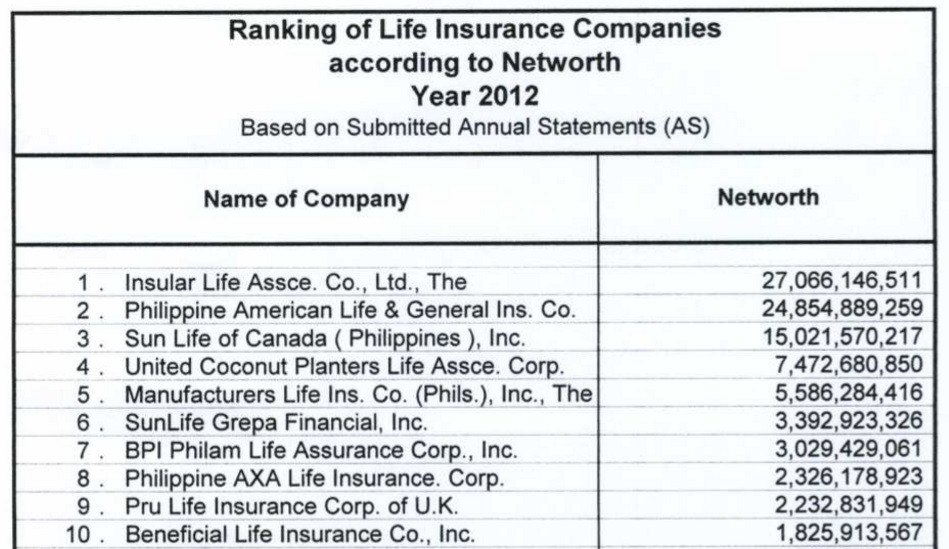

Second Category: Top Insurance Companies, According to Net worth by the Insurance Commission (IC)

Investopedia defined Networth as – The amount by which assets exceed liabilities. The company’s net worth is calculated by subtracting the liabilities from the assets.

The leading insurance company in this category is: Insular Life with 27B Net worth

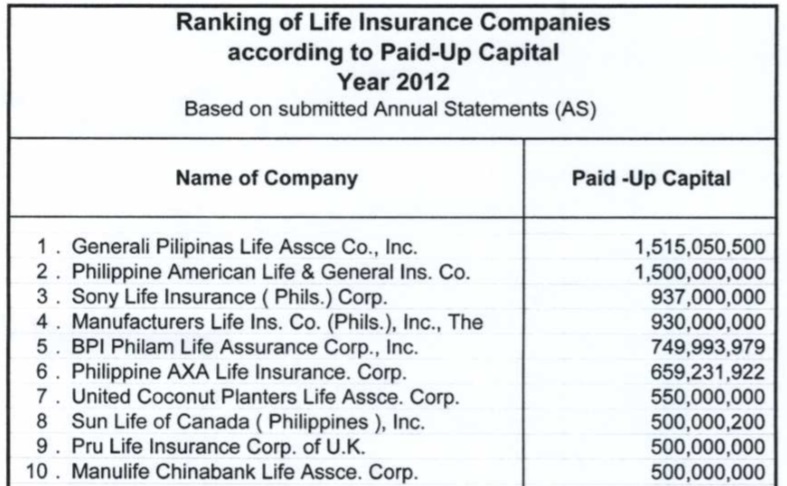

Third Category: Top Insurance Companies According to Paid-Up Capital by the Insurance Commission (IC)

Investopedia defined Paid-Up Capital as – The amount of a company’s capital that has been funded by shareholders. Paid-up capital can be less than a company’s total capital because a company may not issue all of the shares that it has been authorized to sell. Paid-up capital can also reflect how a company depends on equity financing.

The leading insurance company in this category is: Generali Philippines with 1.5 B Paid-up capital

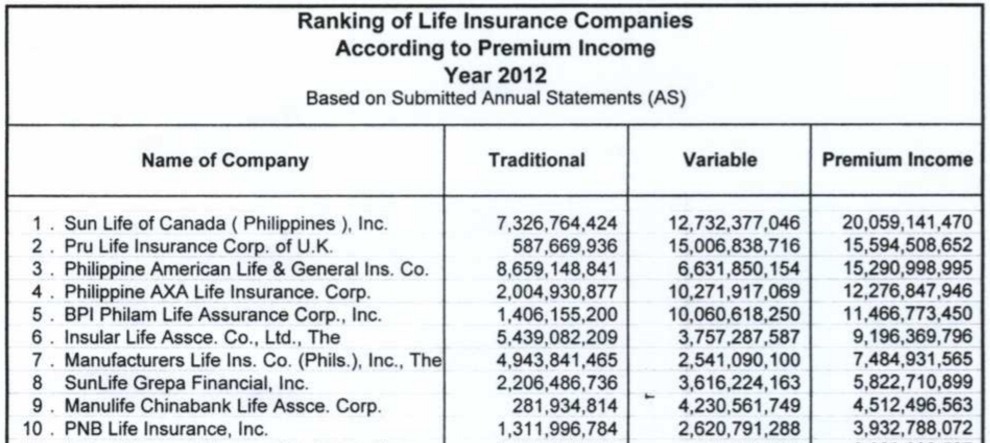

Fourth Category: Top Insurance Companies, According to Premium Income by the Insurance Commission (IC)

Investopedia defined Premium Income as – revenues that an insurer receives as premiums paid by its customers for insurance products. When a customer purchases an insurance product, such as a health insurance policy, the customers cost for a specified term of the policy is called the premium.

The leading insurance company in this category is: Sun Life of Canada with 20B Premium Income

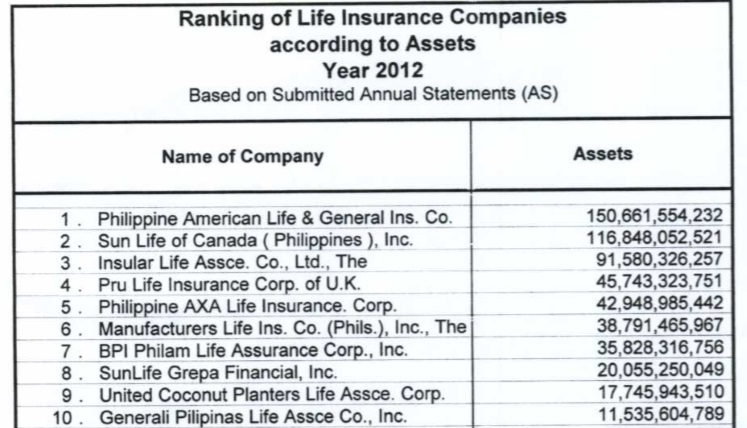

Fifth Category: Top Insurance Companies, According to Assets by the Insurance Commission (IC)

Investopedia defined Assets as – anything of value that can be converted into cash. These could be Cash and cash equivalents, real properties or investments.

The leading insurance company in this category is: Philippines American Life (PhilAm) with 150B Assets

Although I represent a great insurance company, I dare say, all life insurance companies are very much the same. They are all stable, have a solid foundation and all are reliable. For me, the more important thing that you have to consider in selecting the right plan for you is choosing the right and reliable insurance agent/financial advisor that you can depend on. The right insurance agent for you will understand you and will guide you on the best possible plan that will suit your needs, wants and budget. Read “5 Insider tips on finding the right Insurance Agent/Financial Advisor for you.”

The most frequently ask question before buying a life insurance – Pre Need VS LIFE insurance, What is the difference?

In buying a life insurance, don’t let procrastination get in your way. If you don’t know anyone that can guide you in choosing the best policy for you, let me help you with that. You may contact me here.

Update:

Top 10 Life Insurance Companies in the Philippines 2015

Top 10 Life Insurance Companies in the Philippines Most Updated and Most Unbiased Review 2014

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

This is my most read post. Enjoy reading!

Hi Dr. Pinky, thanks so much for this blog. I agree that this is a more objective way of presenting the Insurance companies ranking for 2014. What matters most depends on how an individual would view a stable company, thus the need to show the ranking per category. Let us not be fooled that there is only one way to gauge an insurance company.

Yes that is why I created that article. In order for people to know the truth.

Good day, please update me with the latest information about the Insurance Industry.

God blesd!

The data is most helpful. Thank you for sharing this with us.

very helpful, thanks for sharing Doc 🙂

very helpful information for us

thank you!

how about “Pioneer your Life Insurance”?

[…] The Top 10 Life Insurance Companies in the Philippines The … – The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review… […]

[…] The Top 10 Life Insurance Companies in the Philippines The … – The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review… […]

[…] The Top 10 Life Insurance Companies in the Philippines The … – The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review… […]

[…] The Top 10 Life Insurance Companies in the Philippines … – The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review… […]

nice assets of Philam Life proudly financial Advisor

ma’am pinky,

which is the better insurance company, Sun Life, AXA or Manulife?

hi, i believe all life insurance companies are closely the same and all are reliable. You just need to find that life insurance agent who you can rely on.

Choosing life insurance company nowadays that will serve your future financial needs is a little bit tricky but for sure if you want total reliance, you can visit major banks and ask for the alliance insurance companies such as (in any order):

BDO – Generali Philippines

Chinabank – Manulife Chinabank Life (MCBL)

Metrobank – AXA Phils.

BPI – BPI PhilAm

RCBC – SunLife Grepa

PNB – Ben Life (Owned by the bank itself)

Etc…

very nice..worth to read very interesting..thank you Mam.Pinky..

God bless u more!..

Thank you. 😉

Thank you for this very informative post. I’m glad I stumbled upon this ^_^

So lucky to have read this post..my husband and I are looking for the best insurance company but we want to know the best options first..

thank you for a very informative blog.. 🙂

more power!

ang ganda talaga

Hi dr.pinky,

My sister was diagnosed having hypertension and diabetis. She is 51 with 2 children aged 18 and 20 .

What type of insurance or what insurance company that will cater her or best for her? Thank you

Hi ms Nora, I have a client with hypertension and diabetes. And she is 60+years old. Any insurance company will just do their underwriting and evaluate her present conditions. They will base their decisions to present state of your sister. Don’t worry, she might still get approved.

Hi Doc Pinky!

I’m a 28 year-old also physician who is still having my residency. I got a life insurance just recently, ambushed in a mall (you might have an idea already what insurance company I’m talking about) having to pay my premium using my credit card. I got it without studying about it and so i felt that I might be making a very wrong decision. Though it was explained to me that it is a legitimate insurance company, I just felt I was forced to make a decision right on the spot. And I don’t even know if it I would really benefit from it in the future. Am I on the right track? Should I continue it? Thanks. Your replyis very much appreciated.

Hi dra, parang I have an idea what insurance company that is. Anyway, can you provide me some details what kind of insurance that is? You can email me: docpinky@myfinancemd.com or you can write at the contact page of my site. Will wait for your email. 🙂

Than you for a quick reply doc. I have sen you an email already. 🙂

Your article is very informative. Do you have latest ranking of top insurance companies? Thank you.

Hi munchies, will try to update it soon.

Huhuhuhu Just took the AXA Axelerator last week due to its low “contribution” of 2,500 per month. But became sad upon reading this blog coz I dodn’t see AXA here huhuhu

Hi shonel, don’t worry AXA is also a great life insurance company.

Hi Doc Pinky,

I’m a nurse who’s about to go abroad for a 3 yr contract. I was planning on getting an insurance. i don’t know whats best. Was hoping to get something from my investment after I come back for 3 yrs.

Hi Harvey, you can email me myfinancemd@gmail.com or text me 09258895433.

Dra.Pinky..may i have a copy of your e book.

[…] The Top 10 Life Insurance Companies in the Philippines The … – The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review […]

Thanks for sharing this information. Though it’s not updated anymore, I think the companies listed above are still almost in their same position.

The most wonderful idea u impart to us is that “all life insurance companies are very much the same. They are all stable, have a solid foundation and all are reliable. For me, the more important thing that you have to consider in selecting the right plan for you is choosing the right and reliable insurance agent/financial advisor that you can depend on. The right insurance agent for you will understand you and will guide you on the best possible plan that will suit your needs, wants and budget”

HI Marigold, there is new post on the updated version. http://www.myfinancemd.com/the-top-10-life-insurance-companies-in-the-philippines-the-most-updated-and-most-unbiased-review-2014-2/

Hi! ano po pagkakaiba ng BPI-Philam life at Philam life and GEN? hindi ba iisa lang yan?

BPI Philam i believe is the bancassurance of Philam Life. Relatively the same naman

hi doc im a teacher and I want to get or invest In life insurance ,im single and planning to be married in a few years what should I consider before I get life insurance…thanks doc.

Hi Gerard, Sure I want to help you personally. Send me a text message here 09175035839 or 09258895433. Or email me in myfinancemd@gmail.com – doc pinky

Hi doc,isa po akong ofw. Ask q po sna ang opinion nyo about sa PNB LIFE INSURANCE at ung product na in oofer nla na “VELOCITY”? I’m hoping for your reply soon Doc so i know if i will take it or not b4 my flight…, i am having a second thought right now so pls. Help me po tnx a lot mam

I’m sorry Ms Percy, I don’t know that product because I am not affiliated with PNB life insurance. I only know the products that the Life insurance company offers. I might make a mistake if I just research on your question. Kindly email me if you have further questions.

Doc Pinky, how about po yung sa AXA AXELERATOR? Napakuha po kc ng di oras ang asawa ko dahil kumpare niya yung agent. 2,500 po per month yun. May blog po ba kayo tungkol dito or alam na site na pwedeng mabasa para sa amung mga beginners? Nahihiya po kc asawa kong magtatanong na about dito sa kumpare niya. Kala daw po kc niya Mutual Fund napasok niya. Thank you po.

Hi Shinel, I do not have an information on a particular product because i am not affiliated with axa. But, the thing is, you need to be able to ask anything to your financial advisor. This is your future we are talking about. Do not be shy to ask since you will be paying for this 2,500 per month. Do not be afraid or shy to ask. ok?

Hi Doc. Pinky,

I have a 13 yr. son. He is very energetic, and involves himself a lot in extra curricular activities. But I get worried when he got sick recently. Maybe of too much strain and stress. I was thinking to provide him a medical insurance, as in temporarily on a yearly basis. What insurance company should you recommend for my boy to ensure smooth medical checkup.

benjamin

That would be an HMO not a life insurance company. These companies example: maxicare, bluecross, intelicare, etc…

I love this blog! Glad I bumped into this. You seem nice and very objective. Makes me wonder if you are an agent yourself, which company/companies are you affiliated in. (if that’s possible to serve more than one insurance company)

I have been looking at getting an insurance for myself but couldn’t decide which company to trust until I experienced the ambush and felt robbed by the insurance provider in the mall. I didn’t continue at all but was hoping and wondering if I could ever sue them. *sigh*

Right now, I am still looking forward to find the right one. I even thought of joining of becoming an agent as well.

Hi Iris, thank you for reading my blog. We can talk privately on what you want. Email me: docpinky@myfinancemd.com

Hi po Ms Pinky. Kaka join ko lang po ngyon sa isang life insurance company (forced) nasa mall po kase ako then bigla nalang ako na corner so i dont have a choice.. Can you help me po. I just have question lang. I hope u can help me.. Thank you

Sure, what’s your question? you can personally email it to me: docpinky@myfinancemd.com

Hi po Ms. Pinky isa po aking OFW, may nakuha po akong life insurance for me and my daugther. Sa Generali po, 5 years po ang term ng contract ko.Bale mag 4 years na po akong nag huhulog by April.

May naka pag sabi terminated na daw po yung contract nila sa BDO.ANo po ba dapat kong gawin?

Hi mam, well technically di naman mawawala ang generali. Maghihiwalay lang sila ng bdo. Bdo having its own insurance company. The bdo life will handle your account na, with all the promises and all. Don’t worry about that. Bdo life will update you on that once they took over na.

Good day Ms. Pinky, thanks po sa info kahit paano mapapanatag na ako ang dami po kasing mga insurance company na nag sasara po kasi. Sayang naman po yung naiihuhulog po namin kung hindi reliable yung makukuha naming insurance company. maraming salamat po ulit. God bless you always po.

hi ms dina, those that are folding before are Preneed companies. Please read this post regarding that:

http://www.myfinancemd.com/what-is-the-difference-between-a-pre-need-and-a-life-insurance-the-most-frequently-asked-question-before-buying-a-life-insurance/

Maraming salamat po Ms. Pinky, Malaking tulong po etong article na eto

God bless you always

Hi! I would like to know if COCOLIFE is also a good insurance company?

hi, you can look at the IC (Insurance Commission) and see if they are registered insurance company.

Isa po akong OFW, Nag invest po ako ng $5,000.00 sa BPIphilam Dollarmax ,ano po ba ang masasabi nyo sa naging desisyon ko, ok lang po ba ang mag invest sa ganito?salamat po…

Hi Alain,

As long as alam mo ang goal mo bakit k nag invest and timeline of your investment, that would be fine. But maganda rin na mamonitor mo ang investment mo once in a while para nakikita mo sa sarili if tama ba naging desisyon mo. 🙂

hi po.. interesado po kong kumuha ng life insurance para s akin 28 years old at sa aking asawa 29 years old , much better po b n magkaiba ang insurance compny namen ? pinag iisipan ko din po kase ung term o me investment /savings ang kukunin ko . Ano po kaya? Salmat po

hi Michelle, I sent you an email. PM. Thanks.

Hi po. Tanong ko lang po ung sa philippine prudential. Hnd po ba un scam?

Hi Kenneth. Try to see for yourself. Here is the website of Insurance Commission : http://www.insurance.gov.ph/

Hi po..ask ko lng po ma’am..nag-housing loan po aq sa BDO and yearly po ay me binabayaran ako na insurance worth 10k pesos.Fifteen years to pay yung housing loan ko,which means 15 years din aq need n mgbyad ng 10k for insurance.I’m planning to get an insurance from BDO din..yung Pilipinas-Generali..then don ko po ipasok yong insurance n binabayaran ko..para hindi po masayang yung 10k na binabayad ko yearly.Tama po ba yong naiisip kong gawin?

Well, there is such thing as TERM insurance, very cheap for MRI (mortgage redemption insurance), and you only have to renew the balance of your loan every year. Meaning, you started at 2M, after few years, 1.5M na lang loan mo, you only renew for 1.5M, then same thing as years progressed.

For permanent insurance, you can use that too naman, but I suggest you get permanent insurance and make your family your beneficiaries, in that way, if something happens to you, your loan is paid thru your Term insurance, and your family still gets something from your permanent insurance.

Hi Ms. Pinky,

I would like to know kung alin ang pinaka magandang insurance na kasama ang health, invest/savings, accident, etc,.? thank you so much.

Hi ms Nhel, I think that would be Variable life insurance, if you like everything all in. In one plan. You can PM me if you like me to guide you. docpinky@myfinancemd.com

Hi Ms. Pinky,

Good day po!

Ask ko lang po kasi po nung lasy vacay ko ng Feb.po, may inalok po stock sa akin ang BDO.

Yung agent ko din sa Insurance ko sa Generali po ang nag alok, since matatapos na po ako next sa life insurance namin ng anak ko.Nag decide po ako a kumuha, kahit hindi ko masyadong naintindihan yung paliwanag nya po. Okey po ba yung naging desisyon ko po. Bale 30k po annual payment po nun at 5 years to pay po.

Thanks 🙂

Dina

Naku, it depends on the plan you got. Iba iba kasi, kahit sa isang company, iba iba ang Klase ng plan. Better po if pa explain po kayo ulit sa agent nyo. Thanks.

Magtatanong lang po kung alin ang The best Insurance Company to do business with.. Please email me .Thanks so much.

Hello po Mam Pinky…2 yrs.ago po nag join ako sa generali..at nag advance payment na din for 2 yrs.kc po ofw ako…then last Feb. Po nagbayad ulit ako ng 53k annually kc ang term for 8 yrs.

Then Sabi po ng agent sa akin ng generali eh me payout cheque daw ako marereciv after 2 yrs.and supposed to be last Feb. Pa dapat po….but until now no notification ako narereceiv and ung agent po eh di ko na makontak. …ano po dapat Kong gawin…

Thank you po in advance sa reply nyo..

Check your policy contract if there really is such terms there. If you can’t contact the agent, then you can contact there customer service.

Hi Pinky,

I’m searching for a great Health & Life Insurance company. Kindly email me your suggestions. Thank you. Michael

sent you an email

HI MS.PINKY, i am currently an insurance holder in manulife now, for 2 years, i just want to ask if that company is a reliable company, because im reading some reviews and the reviews are not so good when it comes to claiming money, the money im paying is a little high so i want to assure if im in good track because if not can i still withdraw my contract with them even its just two years

Yes, Manulife is a good company. Claims only become an issue if there are undeclared issues when policy holders are still applying for the plan.

[…] The Top 10 Life Insurance Companies in the Philippines The … […]

[…] The Top 10 Life Insurance Companies in the Philippines The … […]

[…] The Top 10 Life Insurance Companies in the Philippines The … […]

[…] The Top 10 Life Insurance Companies in the Philippines The … […]

[…] The Top 10 Life Insurance Companies in the Philippines The … […]

[…] The Top 10 Life Insurance Companies in the Philippines The … […]

[…] The Top 10 Life Insurance Companies in the Philippines The … […]

[…] The Top 10 Life Insurance Companies in the Philippines The … […]

[…] The Top 10 Life Insurance Companies in the Philippines The … […]

[…] The Top 10 Life Insurance Companies in the Philippines The … […]

[…] The Top 10 Life Insurance Companies in the Philippines The … […]

[…] The Top 10 Life Insurance Companies in the Philippines The … […]

[…] The Top 10 Life Insurance Companies in the Philippines The … […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review […]