SSS P.E.S.O. Fund – is a voluntary provident fund offered exclusively to SSS members, in addition to the regular SSS program.

This is non-voluntary and this is for SSS members who have the capacity to contribute more in order to receive higher benefits in the future.

The major highlights of the program are:

- It is a tax free fund

- The contributions are placed in sovereign guaranteed instruments

- Guaranteed earnings are based on 5-year T-bond and 365-day T-bill rates

Who can join the program:

Employed, self-employed, voluntary and OFW members who have met the following qualifications:

- Below 55 years of age;

- Have paid contributions in the regular SSS program for at least 6 consecutive months for the last 12 months immediately prior to the month of enrollment;

- Note: For Self-employed (SE), Voluntary (VM) and OFW members, should be paying the maximum amount of contributions under the regular SSS program.

- No final claim under the regular SSS program.

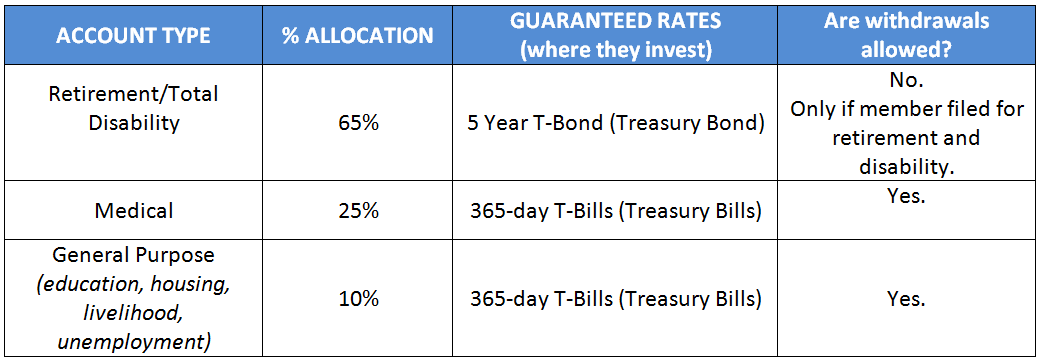

Allocation of contributions, where they do invest and withdrawals:

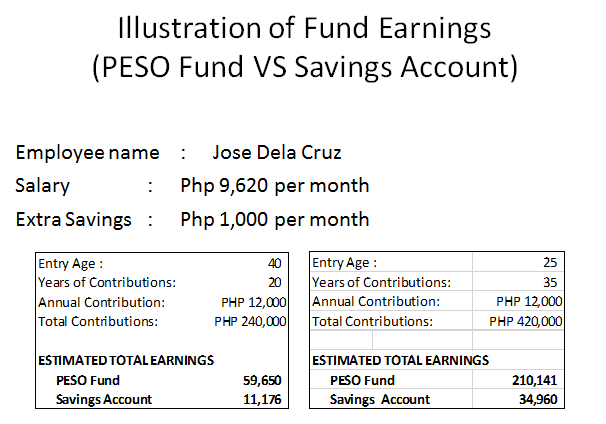

Sample A. 1,000/month (12,000/year) contribution to P.E.S.O. Fund

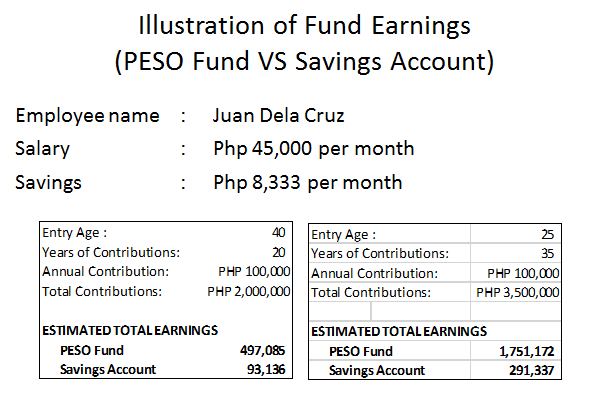

Sample B. 8,333/month (100,000/year) contribution to P.E.S.O. Fund

Retirement or total disability benefits, which consist of the member’s contributions and earnings from the SSS P.E.S.O.Fund, may opt to receive this in monthly pension, lump sum or a combination of both.

Death benefits shall be paid in lump sum to the member’s beneficiaries.

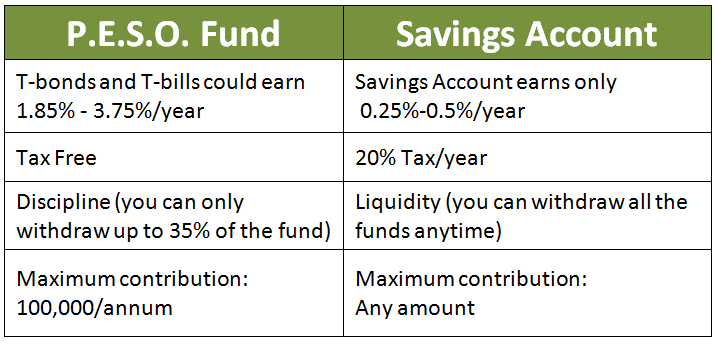

Verdict:

P.E.S.O. fund is one good alternative of saving instead of regularly saving in a savings account for retirement purposes. Here is the summary of comparison:

Are there other means on saving and investing for retirement with greater return?

Yes. Read this (illustrates Compound Interest:

How to Build your Retirement Fund?

Single Pay Investment with Life Insurance (A Super Product for lazy investor)

Do you want to build your own retirement fund with some help? Contact me here.

Knowledge is power,

Read More:

- SSS Retirement Benefits, Is it enough for your Retirement needs?

- How to Compute your SSS Retirement Pension

- How to Compute Company Retirement: What No one tells you about?

- Dissecting SSS. It pays to know your rights and benefits

- The Filipino Retirement Scenario, Find out where will you belong when you retire

Resources:

https://www.sss.gov.ph/sss/DownloadContent?fileName=SSS_PESO_Fund_Brochure.pdf

Briefing on Social Security by Mr. Jhomer C. Gonzales – SSS Communications Analyst

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Do you recommend enrolling on this program?

If you want to diversify your investments, then I don’t see no reasons why not. 🙂 It’s a great tool for retirement.

Whats the difference between SSS Flexi Fund and SSS Peso Fund?

SSS flexi Fund is a Provident Fund program exclusively offered to OFWs (Overseas Filipino Workers) to help them save and earn more money and enjoy SSS benefits at the same tim

I am a seafarer. what is the best fund to join, sss peso fund or sss flexi fund?

Both if you can. The more you save, the better, or try investing in other investment instruments.

Hi Doc Pinky,

I’m 54 y/o dentist and planning to retire at age 60. I just enrolled in SSS PESO Fund. I plan to invest 100k every year until my retirement.

May I ask how important is diversification if there are other means of saving and investing for retirement with greater returns?

I think I just made a wrong move.

Thanks

hi, i sent a private message to your email. please check it out.

Hello!

If you’re enrolled in PESO Fund, are you required to invest at least 1,000 every month? Or is it okay to deposit only on some months as long as it is not below 1,000?

Thank you for the informative article!

YEs.

hi, I am currently employed and I have seen the SSS PESO Fund. May I ask do I really need to include my bank information? Can I pay it separately or can I ask my employer to deduct the amount for the SSS PESO Fund?

I’m a bit lost.

Thanks

try to ask your employer if they can do that for you. It really depends on your company if they will allow it since it is purely voluntary.

I’m employed. What is the minimum contribution required to join SSS PESO fund?

How can I pay it? Directly on my account or should I need to notify my employeer?

good day po

ask ko lang po kung pano po ako pwedeng sumali sa peso fund im interested, sana po matulungan nyo po ako para makapag apply for peso fund.

thank you po..

Hi call nyo po SSS or go to the nearest SSS para maka enroll and makabayad po kayo.

Thanks for the very informative take on SSS P.E.S.O Fund, certainly better than the brochure they provided.

A few questions, I am a Self-employed member and you highlighted that SE members “should be paying the maximum amount of contributions”. I’ve checked the SSS Table of Contributions and it says the highest amount or at least the cap is 1,760 pesos/month. Is this what you meant?

Currently my monthly contribution is 440/month. I pay annually and raise my contributions every now and then. Is there a way to get to the highest contribution as soon as possible? That way I can start paying for P.E.S.O Fund early. I just turned 25.

TIA,

Christopher