Just the other day, I was in a certain bank. I was actually inquiring something from them, when curiosity got to me, I suddenly asked the lady assisting me.

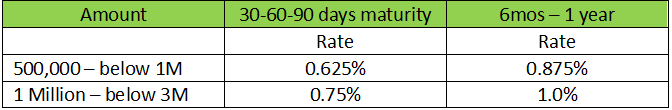

“How much will I get if I save 1 Million pesos in your time deposit?” These were the rates she gave me:

Investopedia, defines Time Deposit as, “A savings account or certificate of deposit (CD) held for a fixed-term, with the understanding that the depositor can make a withdrawal only by giving notice.”

A time deposit is an interest-bearing bank deposit that has a specified date of maturity. Certificates of deposit are issued for a specified term, such as 30 days (the minimum), 60 days, 90 days, or 360 days (1 year) up to five years. Although funds can be withdrawn from banks without notice (on demand), there are penalties for early withdrawal.

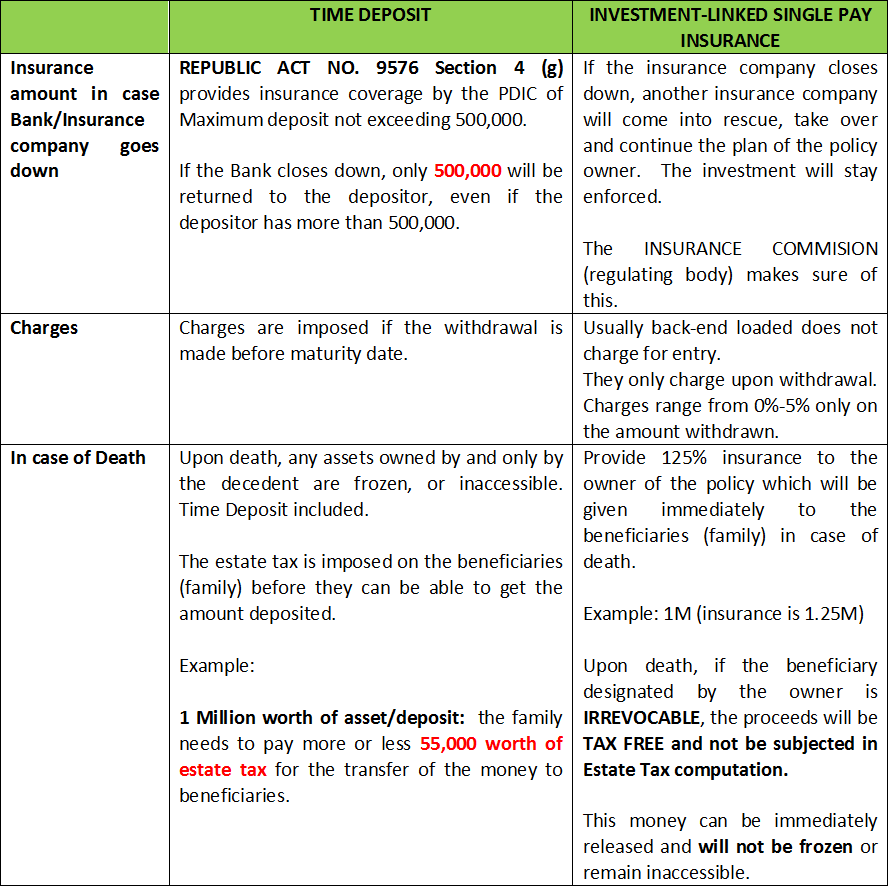

On the other hand, I knew another investment vehicle which is called Investment-linked Single Pay Insurance. I spotted, 3 major differences between the two, these are:

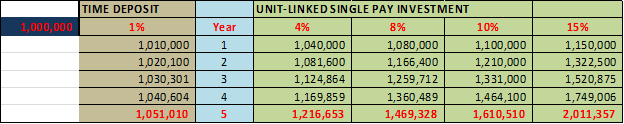

Knowing the major differences between the 2, let us now take a look how a 1 million fund will look like in 5 years.

The above scenario indicated how will the 1M look like in Time Deposit VS Single-pay Investment. In the single pay investment, since money will be placed on the stock market, the ups and down of the market should be taken into account.

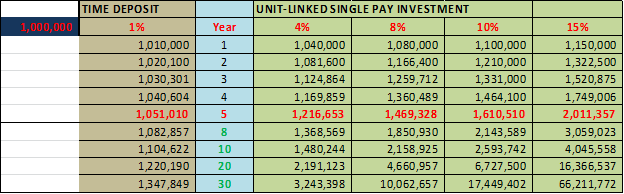

What if this person did not stop at 5 years? But for 30 years? Look how 1 M will look like:

The above table is called Compound Interest. Albert Einstein once quoted, “Compound Interest is the 8th wonder of the world, he who does not know it pays for it, he who knows it, earns from it.”

To further explain compounding interest, here is a video from Peso and Sense

Our old society and even our parents tell us, to keep your money in banks. They said, it is safer there, now, I do wonder if it is really safer there, knowing all about INFLATION, the money’s greatest enemy.

Mario Miranda, SVP and Wealth Management Division Head of BPI Asset Management, when ask in ANC On the Money, Where is the safest place to invest?, he said, “There is no safe investment as far as money is concerned, people think that bank accounts are safe investments. Generally, if you put in money, in time deposit, at best, that will give you 1 or 2% return, inflation is at 3-4%, so, that’s a 100% guarantee you’re gonna lose your money!, so is that risky or safe? For me the way to answer safe investment is, look at inflation, what it is? Then put your money in a portfolio that will yield higher than inflation, that’s the safest one.”

If you have millions? Think more that twice where to put it. Be wise in your decisions. Know your goal, try not to be overly conservative. Keep an open mind on new investment vehicles.

Is your money sleeping in the banks? Let me show you have to passively invest it., contact me here.

Be smart,

Read more:

- Single Pay Life Insurance with Investment (A Super Product for Lazy Investors)

- How to Build Doctor’s Retirement Fund?

- 3 Genius Reasons Behind VUL (Variable Unit Linked) Insurance

- How to Compute Company Retirement: What No one tells you About

- BTID: Buy Term, Invest the Difference, Is that for me? Myth vs Reality

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Please free to comment! 🙂

Wonderfully written. Thank you, Pinky.

if i have 5Million for example i guess i will split it into 5 investments to insurance company the last 3 investments will place 10-20yrs and the first 2 investment anything goes or earn lets say 8% take the income and re-invest it again….it depends on your investment planning style but make sure you are financially free..

how about love your enemy….any blacksheep in the family have him insured but ofcourse beneficary will be you if that is your idea 😀 well thats crazy 😀

lastly how about avoiding this B.I.R i say never put a HUGE amount in the bank unless the title of an account is OR ex. client 1 OR client 2 not client 1 and client 2.

may i repost this? its very helpful

Surely.

thank you Pinky, wonderful suggestion:-)

Always very insightful and easy to understand.