Mandatory Life Insurance for all Filipinos

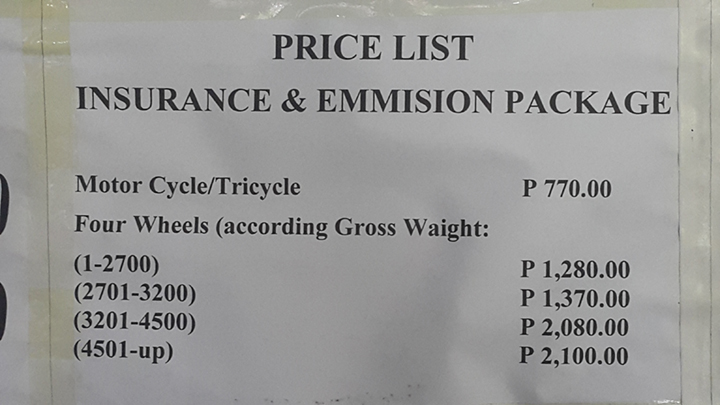

Last week, I had an unusual date with my husband. I went with him to have our car registered. It’s the first renewal registration since we last bought it 3 years ago. So, there I was, bored while waiting. When I suddenly noticed the sign board below, saying:

As I was told, part of the requirements in renewing car registration is: Insurance Certificate of Cover (COC) – a compulsory insurance coverage for cars as mandated by RA 4136. The amount of the insurance package is as seen below:

Since I love thinking, I ponder with the question: What if Life Insurance is also mandatory to each Filipino? Or at least to the breadwinners in the family, namely, the Parents. What could happen?

As I marvelled at this thought, I remember my travels from different countries across the globe. One thing I noticed, that is lacking in our country – is a mandatory life insurance.

I ask a mentor/friend about this: “How come in other countries, almost all people are insured and most of my OFW friends are required to purchase life insurance as a requirement while working abroad?”

He answered back to me, and his answer is very simple, straight and yet very true. He said, “In other countries, a citizen cannot be liable to his own state.” Meaning, if a citizen dies, there is money that could be used in his final expenses and even provide support to his loved ones he left behind.

In our country, it’s an entirely different story, according to statistics, only 4% of the population are insured or have some form of life insurance, including company given. Furthermore, this also means, of all the 100 M populations that we have right now, only 4M have a certain amount of life insurance that their beneficiaries can claim should they die ahead of them.

In Private life insurance companies, for a life of a healthy 30-45-year-olds, the term insurance for a 1M Death Benefit with critical illness benefit, premium ranges at about 5,000 – 10,000 per year.

I know, not all of the citizen in the Philippines are capable of getting life insurance, but that should not deter our government to provide. My point is, since the government is already giving subsidy to all those who can’t afford like in PhilHealth (that is about 2,600/year), why not make another program or government body who can subsidize the life insurance of the poor, let’s say 2,500-4,000/year for a 500K life insurance with critical illness benefit and also require those who can afford to have one (purchased on their own).

These may be the benefits to our country:

- Decrease the number of people who goes in lines in Mayor’s office or any government offices, to ask help for funeral or critical illness of a relative. This maybe can reduce corruption in the government. Some government official reasons out that they need money to give to the people who ask for help. They cannot use this reason any longer.

- Replace the income of the breadwinner in case of death, and help the family to rebuild their lives again. The family left behind will be provided options and they may not to resort to criminal activities to get by.

- The dependents kids will not need to stop their education because their parents died. They can continue to study and finish their school and to be a contributor of the country’s economy instead of further becoming a liability.

- The widow does not need to go far to work if the husband dies. She can continue on caring for their children so that they will continue to be good citizens.

- If enough money may be left, the family can even use it to start a business and become a success story.

Those are the things I can think of, maybe some of you can share more benefits it can give. Do share your thoughts in the comments below.

But even if there are so many benefits,

“Only 4% are insured, although there is a 100% possibility of dying.”

After registering our car, we paid approximately 4,000 pesos, with nothing but a receipt saying, “No sticker available.” I had another realization, with all the cars driving around our country and they are mandated to be registered yearly, and pay from 4,000 – 15,000/year (depending on the type of car). Why do they and how can they pay that? Because it is mandatory, or required. The government would not even subsidize those who can’t afford, yet millions of cars get registered. I think it’s all about changing the entire system. Changing the mindset of most Filipinos that there is always a dole out.

The life insurance industry evolved from a simple story. “The Passing of the Hat.” It is when, if someone dies, the community, relative, and friends passes a hat, where they put in monetary gifts to give to the family that were left behind. It’s from that simple concept.

For now, that there is no law or mandate to get life insurance, let’s mandate ourselves. If you don’t want to be responsible citizen, at least be a responsible person to your loved ones.

I invite each Filipino, to get your own life insurance. Having your own life insurance is in itself being patriotic. You are not only making sure your family has food to eat and roof over their heads, you are also making sure you are not liability to your country.

Be a fellow patriot,

Want to be an Asset than a Liability? Contact me here.

Read more:

- 5 Insider Tips on Finding the Right Insurance Agent For You

- How much Life Insurance Do you Exactly Need? How to compute?

- 12 Terms you need to know before buying a LIFE INSURANCE

- TERM INSURANCE, the Cheapest Life Insurance Ever!

- Top 10 Life Insurance Companies in the Philippines: Most Updated and Unbiased Review

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

I agree doc. Why don’t people hope for the best but prepare for the worst?

Very well said Doc Pinky.Now is the right time that our fellow Filipinos will know the beauty and importance of having a Life Insurance. Sad to say,very few Filipinos are open minded.That is why i agree that it would be better if the gov’t. will strictly impose the “Mandatory Life Insurance for all Filipinos”.Filipinos will surely benefit from this as well as our government.

Hoping it will be a reality soon.

So timely a thought dont you think? This could be part of the change we need in this country. I see friends financially displaced because they hardly had the resources to bury their dead. They borrow, they sell personal belongings, adjust expenses, or depkete what little savings they have…after the burial, they work under difficult conditions. Adjustments have to made.

With the mandatory insurance, funeral expenses are raken care of and life after burial can go on with little compromises.

Yes, I’m with you on that. 🙂

I salute you po…same ideology as mine…more power to you

I absolutely agree with you Doc Pinky.