Everybody says that life is priceless, I totally agree. Still, you are wondering how much are you worth or what are you worth in the eye of a potential buyer?

Everybody says that life is priceless, I totally agree. Still, you are wondering how much are you worth or what are you worth in the eye of a potential buyer?

Ever wonder how much money you could get on the open human market?

Let us do this by getting your Net worth.

Everyone has a distorted view of what being RICH means.

Most people, of course, don’t KNOW that rich doesn’t mean having a high income, but rather a high net worth.

Your net worth is a snapshot of your financial life at one instant in time, a single figure representing your financial wellness.

It’s the total of everything you’ve earned and spent until today. It is….

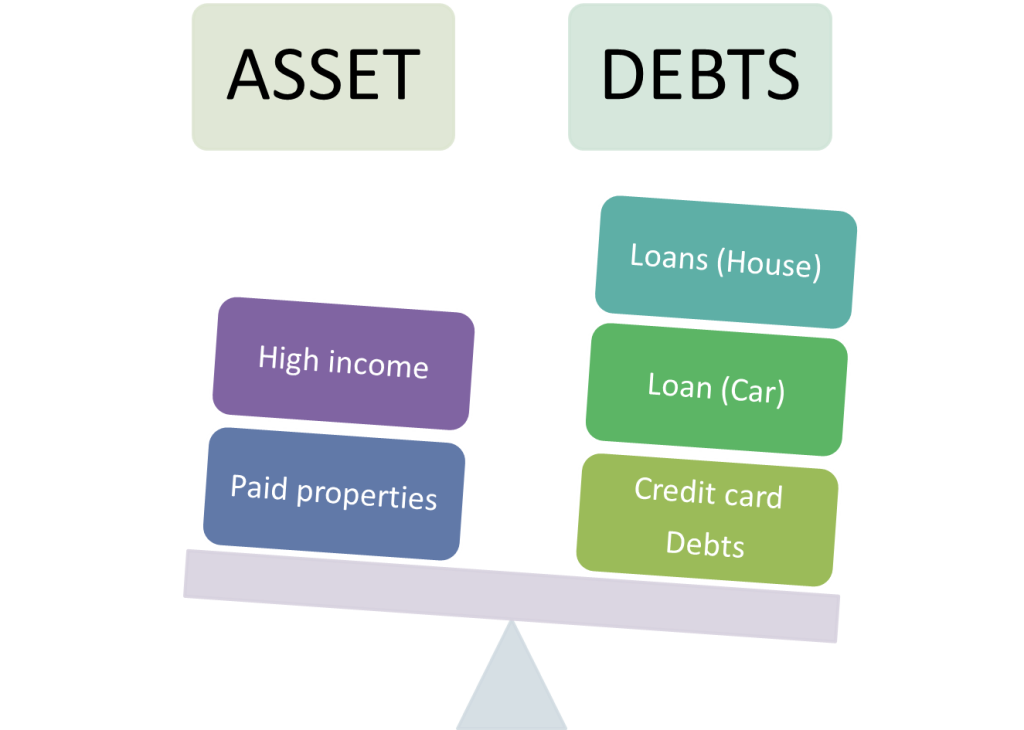

ASSETS will include any completely paid properties, owned real estates, bank account, stocks, mutual funds, cash values of your insurances, owned business.

LESS

LIABILITIES will include all your loans: any mortgaged properties – house or car, personal loans, credit card debts.

The total will be your NET WORTH.

Please take note that you can still have a NEGATIVE NET WORTH even if you have a very high income, if your DEBTS are higher than what you already own.

So, what is the IMPORTANCE OF KNOWING YOUR NET WORTH

- It tells you where you are in the map towards your financial goal. It tells you how far or how near you are to financial freedom, or if you are even getting there.

- You can take a look at your debts and plan strategically which debt/loan you can possibly eliminate first.

- Knowing your assets is also important in wealth building and possibly protecting it as you build it. This will be discussed more on my future posts regarding Estate protection.

Now, I ask you, after doing this exercise, how much are you worth?

You will be astonished that even if you receive a high income, you are not necessarily rich, since most of high income earners tend to have higher debts that those who only receive basic pay.

Don’t be sad if right now, your worth is Negative. The most important thing that I hoped you learned here is, what is your net worth today, and how can you make it increase and make it positive the next time. The lesson here is, to make your net worth increase and not decrease.

This exercise should be done twice a year. So that you can be able to gauge your way towards financial freedom. Make this a habit and everything else will follow, financial literacy and finally financial freedom. It is very important to see where you are now, to be able to see more clearly where you are headed.

For more financial tips, subscribe here.

To know your financial I.Q. click here!

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Thanks for sharing your info. I truly appreciate your efforts and I am waiting for

your next write ups thank you once again.

[…] Know your personal Net Worth. […]