We work extra hard to safeguard our future. We give out every single effort we can to make sure that we can be able to provide a comfortable life to ourselves and mostly to our loved ones. Part of your hard earned cash of course goes to different contributions in different government agencies. If you’re an employee, your employers would automatically (for most) pay for your SSS (for private employees), GSIS (for public employees), (Social, PhilHealth, Pag-Ibig and Tax contributions.

We work extra hard to safeguard our future. We give out every single effort we can to make sure that we can be able to provide a comfortable life to ourselves and mostly to our loved ones. Part of your hard earned cash of course goes to different contributions in different government agencies. If you’re an employee, your employers would automatically (for most) pay for your SSS (for private employees), GSIS (for public employees), (Social, PhilHealth, Pag-Ibig and Tax contributions.

The contribution would of course be based upon your monthly income. A lot of people know that part of their salary goes to these institutions, however, not most of the working population have any idea on what they may get out these accumulated funds.

They say you can dictate how high the building is going to be depending upon how deep the foundation is.

Are you ready to know how ready are you when there is a sudden financial earthquake? Are the agencies that you contribute to can provide you the financial aid in times of trouble?

Try to answer the table below.

I would like to give you a glimpse on how I usually do one of my financial literacy sessions for my clients. Firstly, I educate them on the importance of building a solid financial foundation and having an Emergency Fund. Next, I provide them this blank table for them to fill up.

By answering this, I get a glimpse of the how strong the financial foundation of the person is and how much he knows what is available to him. I am surprised that >90% of people I presented this does not know what their existing benefits as of date.

So, now, it is time you answer this yourself. What is available for you now? If you have no idea how to fill this up, let me help you a bit.

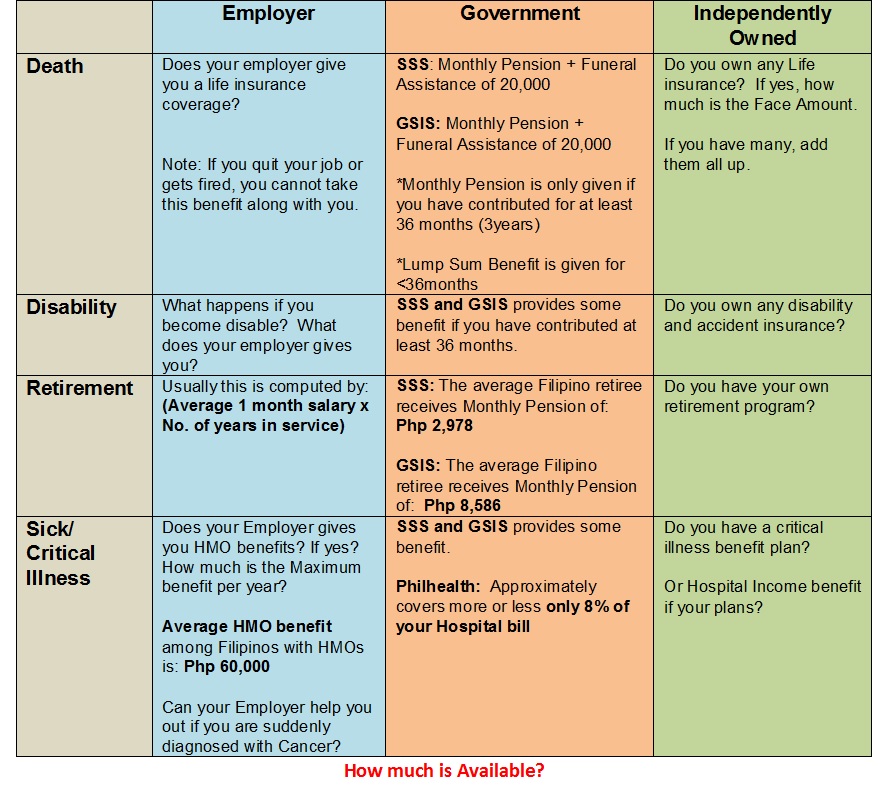

Let me give you the statistics and overview on how to go about answering the blank above.

DEATH

Death is one of the most avoided topic in the world. I totally understand that, but we need to open our mind about it. Know how much we will leave behind if we are suddenly taken out of the picture.

Employer

In case of death? How much will your employer will give your family? Is life insurance part of your benefit in your company? Life insurance benefit from companies is not usually required by the government. So, not all employee has it. If you do have, you are one of the lucky few. If you answer yes, then how much?

If you do not know? Ask them!

Government

If you only rely on government, like SSS and GSIS. They usually give Funeral Assistance worth 20,000 pesos.

And another type of benefit, which is the DEATH BENEFIT dependent on your monthly contributions.

There are two types of death benefit:

- Monthly pension – granted only to the primary beneficiaries of a deceased member who had paid 36 monthly contributions before the semester of death.

- Lump Sum amount – amount granted to the primary beneficiaries of a deceased member who had paid less than 36 monthly contributions before the semester of death. The secondary beneficiaries shall be entitled to a lump sum benefit.

See this SSS site for computation.

Independently owned

This is always something you can control. These are life insurance policies you get on your own. Advantages of having your own life insurance policies are:

- you can take it with you anywhere you go,

- it is not subject to employment termination,

- It earns cash values for permanent insurance or fund values from investment-linked insurances.

What you need to know here is the Face Amount or Death Benefit. If you have numerous policies, just add the Face Amounts/Death Benefits. Then you have your answer in the box.

DISABILITY

One of the worst thing that can happen to any person is to become suddenly disable and unable to work. It may be a result of a sickness or accident. It is certainly one of the things we don’t want to happen to us but undeniably, can happen to us. What will be available to you?

Employer

Does your employer provides you with a disability benefit? Normally, employers do not pay this especially if disability did not happen while you are at work. But with some, it is attached as a rider in the life insurance they give. But, not all employers that gives life insurance coverage to their employees has this rider in the benefit they provide. If you do not know, again, ASK.

Government

SSS or GSIS has a monthly pension benefit for those who are disabled (and has paid for at least 36 monthly contribution), which will be based on the payees average monthly contribution. Don’t be so sure that this would be enough because I tell you now, it is not.

Independently-owned

If you owe a life insurance policy, this is one of the riders you can attached to it with a very minimal premium. It is a very important feature because when you become disable, you do not have money to pay for your premium. If you have TDW (total disability waiver) as a rider, premium or payment are waived. The insurance company pays for your premium as long as you can prove you are disable. The premium the insurance company pays your policy could also be used as disability income.

RETIREMENT

Ever wonder how much you will get from your company? Or the government when you retire?

Employer

According to RA 7641 the Philippines has an existing law that requires the payment of a minimum retirement benefit, which is equivalent to a little more than 70% of monthly salary at retirement date for every year of service. Take note that 70% is the minimum required by law, other companies give full one month salary for computation.

But two things must be satisfied in order to be eligible for this entitlement under RA 7641. Employees who retire – not resign with at least (1) minimum age of 60 years old and (2) a minimum service years (5 years).

Example: Juan started working 35 years old, salary is 40,000 pesos as the time of retirement at 60. The company is generous enough to give one month salary as basis of computation. How to compute?

Years of Service: 25 years (40,000 x 25 years) = 1,000,000

Government

According SSS CEO Emilio De Quiros Jr. last April 2011, the AVERAGE monthly pension of Filipinos that they received from SSS is 2,978 pesos. For your personal SSS computation, please see this post.

GSIS on the other hand has a more specific retirement benefits based upon different laws regarding retirement, such as the RA 8291, RA 660, RA 1616, PD 1146 and the RA 7699. But according to survey, the average monthly pension received from GSIS is 8,586 pesos.

Independently-Owned

Again, this is something you can plan ahead of time. If you are like Juan in the example earning 40,000 pesos and working for 25 years, do you think 1,000,000 pesos is enough by that time? Considering inflation? For more detailed discussion how to compute for your retirement, look here.

- How much should you be saving for Retirement? Do you have what it takes to retire comfortably?

- The Filipino Retirement Scenario, Find Out Where will you Belong in the Future

- Help! I’m in my 50’s, Nearing Retirement How long until I can retire?

SICK OR CRITICALLY ILL

9 out of 10 causes of mortality in the Philippines are caused by a critical illness. Only one is due to an accidental cause. If you are to ask yourself, if suddenly you are diagnosed with Cancer, do you have money enough to survive?

Employer

Some employers provide HMO benefits to their employees and dependents. But sadly according to research, the average maximum benefit of HMOs given to Filipino employee across the country is 60,000 pesos for the entire year. Sadly, when you are diagnosed with a critical illness, the average amount money needed just for diagnosis is 90,000 pesos.

Government

SSS provides a Sick Benefit (which is a daily allowance based on the Daily salary credit if the company uses up the sick leave benefit for an employee) for those people who have paid at least 3 month contribution and was absent for 4 days.

GSIS on the other hand provides hospitalization discounts like 50% off on equipment lent by GSIS to a hospital, 30% on room rates, 10% on professional fees of physicians and 35% off for common procedures if you are confined in a Government hospital otherwise they provide no benefit.

PhilHealth of course would provide a lot of benefits to its payees with regards to hospitalization cost discounts. But according to recent research, it only covers more or less 8% of your hospital bill.

Independently owned

Do you have plan that gives you money in case you’re diagnosed? Look here for more detailed discussion. You can get Critical Illness Benefit from your life insurances. You can even just take it as rider. More on this.

In summary: What will be available for you now? I provided below list of questions on what to ask yourself to be able to answer accurately.

After answering the above, the next step and probably the more important one is knowing “How much you really need?”

Follow the links below to know how much you really need?

DEATH

Life Insurance, How much is Enough?

DISABILITY

7 Life Insurance Riders You Need to Know that could Save Your Life

RETIREMENT

How much should you be saving for Retirement? Do you have what it takes to retire comfortably?

CRITICAL ILLNESS

Getting loaded with too much needed to know and to be done? Get some help from your friendly financial adviser.

Helping you avoid financial collapse,

Don’t forget to subscribe here.

Any questions? You can ask me personally! Click here.

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Thank you…

tnx