Estate Tax, according to BIR is a tax on the right of the deceased person to transmit his/her estate to his/her lawful heirs and beneficiaries at the time of death and on certain transfers, which are made by law as equivalent to testamentary disposition.

To make it simpler, the Estate Tax is the tax paid by the heirs, in order for them to transfer the properties owned by the deceased person to themselves.

The previous laws governing Estate Tax is complicated since the tax schedules are computed with different rates and it is also quite pricey because it will start at 200,000 net estates. Now, instead of having a complicated tax schedule, the TRAIN reduces and restructures the Estate Tax to a low flat rate of 6% on the net value of the estate.

Let’s see the major changes in our Estate Tax laws:

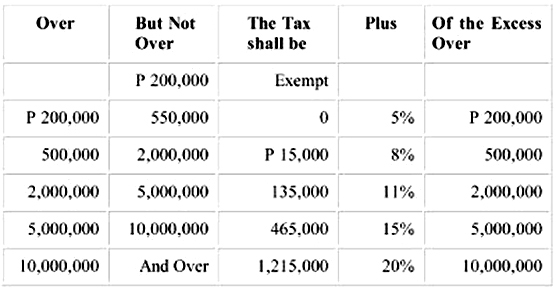

1. Changes in the graduated rates to flat 6%. Previously, the computation of the Estate Tax is on the value of the net estate of the decedent. Computed based on tax schedule from P200,000 onwards.

This was the previous tax rates:

Now it will be subject to a flat rate of 6%.

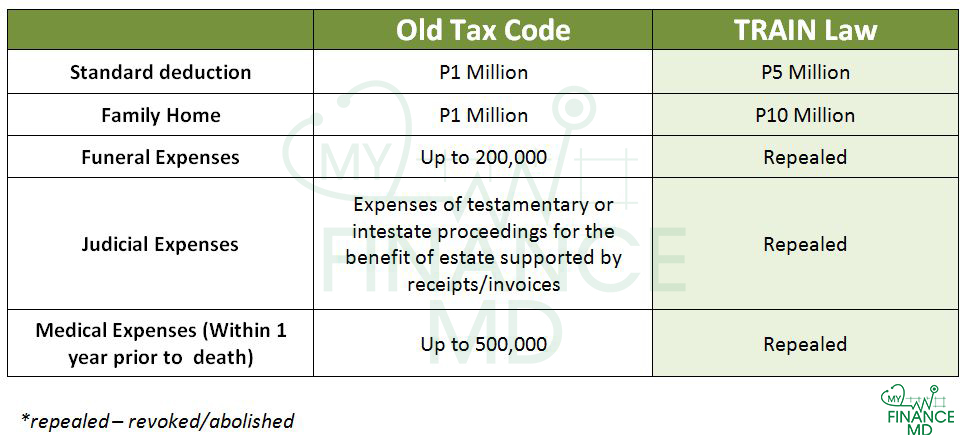

2. Allowable deductions where increase as follows:

Even if the funeral, judicial and medical expenses deductions were repealed, for me its ok since the standard deduction was raised from P1 Million to P5 Million.

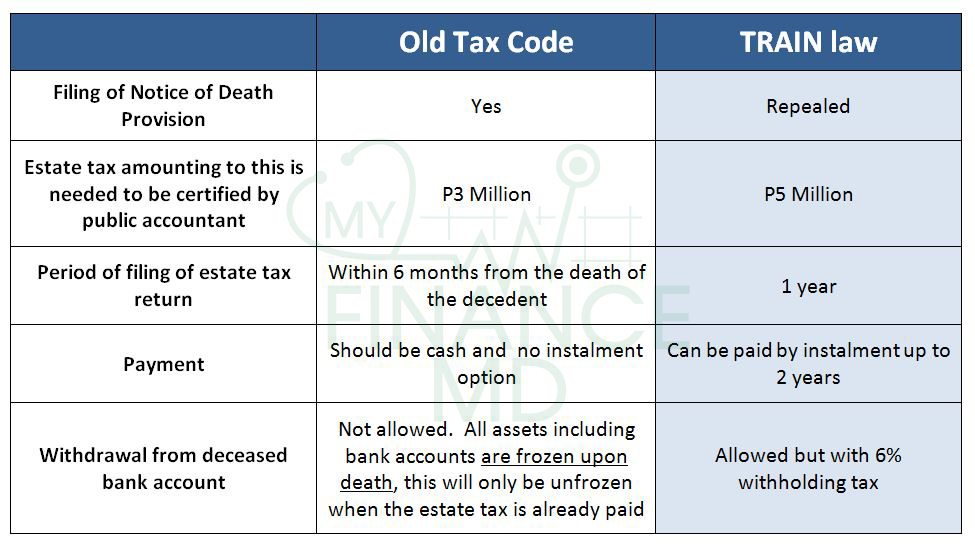

3. Other administrative changes

To make you fully understand how significant the changes are, let me tell you the story of Mr. Mayaman.

Mr. Mayaman, a 70-year-old businessman, single, died of Myocardial Infarction or heart attack. He left a good amount of estate and his siblings will be his heirs. How much would be the Estate Tax to be paid by his heirs comparing the old tax laws and under the new train law?

His gross estate is as follows:

Php13M Family Home

Php3M business properties

Php3M Shares of stocks

Php2M Other Assets

Before dying he incurred Php 1M worth of medical expenses. During burial, the expenses of the heirs are about Php1 Million.

Mr. Mayaman’s Estate Tax Liability under the old Tax code:

Total Gross Estate: Php13M Family Home + Php3M business properties + Php3M Shares of stocks + Php2M Other Assets = Php21 Million

Net Estate: Gross Asset minus Allowable deductions

Php21 Million (less) Php 1M Standard Deduction (less) Php 1M from Family Home (less) 500,000 Medical expenses (less) funeral expenses 200,000 (less) Judicial expenses 300,000

Total Taxable Net Estate = Php 18M

Refer to the old tax table above.

If the value of the net estate is Php18 million, the estate shall pay Php1,215,000. An additional Php1.6 Million shall be imposed, which is the 20% of the excess of P10 million.

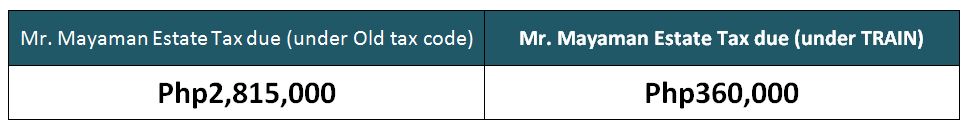

The total amount of Estate Tax to be paid would be Php2,815,000.

Mr. Mayaman’s Estate Tax Liability under the TRAIN law:

Total Gross Estate: Php13M Family Home + Php3M business properties + Php3M Shares of stocks + Php2M Other Assets = Php21 Million

Net Estate: Gross Asset minus Allowable deduction

Php21 Million (less) Php 10M from Family Home (less) Php5 M Standard Deduction

Total Taxable Net Estate = Php6 Million

Under the TRAIN law, from the old estate tax table, it is now computed with 6% flat rate. Thus, 6% of the Php6 million estate is Php360,000.

You see, instead of having a complicated tax schedule, the TRAIN reduces and restructures the estate tax to a low flat rate of 6% on the net value of the estate. It is simpler and definitely – way CHEAPER!

Before, Kim Henares set an ambitious target of Php 50 Billion collected on estate taxes using strong-arm tactics, with little success since the collection average was only P12.5 Billion per year.

Now, Finance Secretary Carlos G. Dominguez’s scheme hopes to encourage compliance by making it cheaper and simpler.

He said, “A lot of people don’t pay (estate taxes) because they don’t like to pay for the transfer of the land, a lot of lands is still in the name of grandfathers, so it’s locked up.”

If people are encouraged to pay cheaper price, it will also encourage the development of idle properties, thus, economic activity and development.

Do you think we have a better Estate Tax under TRAIN? For me, definitely yes. Cheaper and Simpler. But wait, there’s more! If you think this is good enough, it will even get better soon.

For the next TRAIN, the department is looking at an Estate Tax Amnesty for all Estate Tax dues to offer a clean slate to those who have not yet paid their dues and accumulated surcharges, excluding those with filled cases in courts. Let’s see if this will be implemented soon since they are eyeing on this to be implemented this 2018.

Did you like this article? This was discussed intensively in my latest book:

Don’t forget to grab your copy! To order CLICK HERE. Limited copies available.

For Your Financial Health,

Read more:

- The Real Benefits of Estate Planning Part 5 of Estate Planning 101

- A Guide to Creating Beneficiaries for your Life Insurance Policy

- The Importance of Having a Funeral Services Plan and Burial Lot

- How I Got 41,600 from SSS Maternity Benefit

Need someone to help you out on planning your Estate? I’m a Professional Estate Planner too. Contact me here.

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Hi, Thanks for breaking this down for everyone in a simpler way. I’d just like to know if there is any other penalty if not paying estate tax? Like govt repossesion??

Charges and penalties.

My father died last Feb 6, 2018. Are we covered by the TRAIN Law?

yes. jan 1, 2018 onwards.

THANK YOU, Doc. Very Informative! It should be reposted at the BIR website!

The NIRC states that CPA statement is required for Assets worth 2 Million and above.

That was a great article! You clearly explained the difference between the old law & the TRAIN law. The example of Mr. Mayaman was a great way to see how much cheaper the Estate tax is now.

I just have a few questions, I hope you don’t mind. Is the Gross estate of the Family home based on the zonal value of the BIR or the fair market value? Is the 10M deduction for the family home a fixed amount irregardless of how old the family home is & probably won’t reach 10M in value?

Thanks 🙂

It will be based on Fair market value. 10M is fixed deduction for family home.

it will be based on the fair market value. and 10M is the standard deduction for family home even if the value is less or more than that.

Thank you 😊

Thank you for the very informative article. Will you also please address the following scenario.

Juan and Maria are spouses with children. They have a house and lot registered/titled in the name of Juan. Juan died in 1995, his wife Maria followed in 2012. Due to financial reasons, their children were not able to report their deaths nor settled the estate tax. How much would be the estate tax if reported/paid today (assume lot’s FMV is 5million and house is 200k pesos). Thank you and more power to you,

Hi Nathan, it would be very difficult to answer you since I don’t know all the facts. Like, exclusivity, conjugality, when are their married. Like that and more. It’s better if you consult an estate tax lawyer. All will be based on individual circumstances.

My grandfather died 2006. Is train law applicable or not?

No, unfortunately.

Hi Doc, what happens if the property included in the estate is still under a mortgage?

May MRI po ba yung property? Or Mortgage redemption insurance?

Hi! My father died last November 4, 2018. is his death covered by train law?

November 2018?

My mom died last October 2017. Is TRAIN law applicable? Thanks

Not yet. Unless they do an amnesty for estate taxes before 2018. Until now, wala pa

Good day, ask ko lang po bale father ko nmatay july 2016, it means po b n sakop p dn xa dun sa old tax code

Yes po old tax code pa.

Hi Doc,

Great article!

I just have some questions po. And ano po ung mga under ng Standard deduction? May chance ban a mag exceed ang standard deduction sa gross asset? Say, ang gross asset lang ni client is 3M?

Thanks!

What do you mean sa mag extend?

Hi doc,

What is the penalty rate for late filing of estate tax?

thanjs

What year did the estate owner died?

Hello po Dra. I hope you can enlighten me

Namatay po kasi ung tita ko October 2017

Tapos sa kanya nakapangalan yung sasakyan which is Hindi pa Tapos bayaran until 2020 yung contract ngaun po binili na namin at kami na po ang masasalo na assume balance sa mortgage

My question is sabi po Nung sa notary dapat daw mag file ng estate tax yung family kasi Baka daw mag suffer ako sa pag release ng sasakyan ko

Paano po kapag Hindi sila mag file ng estate tax paano po kapag Fully paid na Tapos kukunin na Smpre meron pong tax natatakot po ako na Baka malaki ang singilin sakin at sa penalty 😦

Maraming Salamat po sa sagot doctora

Baka di ma transfer sa name mo if di sila naka file ng estate tax. Actually, dapat before you bought it, naayos na yun. Kasi problem nga yun sa pag transfer sa name nyo.

Hi, my Grandfather died in 1975. Estate tax still unpaid. Estate is valued at P2.5 million today. How much would the estate tax be?

Thanks

Estate tax is like a taxi meter, once you are not paying, it keeps on Going up until you paid up. There is a 20% yearly penalty. Unless they enforced the amnesty.