Norbert, 30 years old, breadwinner, father of a 2-year-old daughter, his wife is a housewife. Norbert is earning well for the 3 of them. His monthly salary is 40,000 per month; and that is enough to pay for all their bills and have a simple and comfortable life with his family.

Norbert, 30 years old, breadwinner, father of a 2-year-old daughter, his wife is a housewife. Norbert is earning well for the 3 of them. His monthly salary is 40,000 per month; and that is enough to pay for all their bills and have a simple and comfortable life with his family.

He went to one of the parental seminars I conducted for my advocacy on Family Financial Health and literacy.

During the seminar, I talked – about the importance of INCOME CONTINUATION. In case the breadwinner of the family dies, who now takes care of the family?

After the talk, Norbert approached me and said, “I already have 3M life insurance, would that be enough to provide for my family until my daughter graduates from college?”

Me: “Ok,” I said, “Let’s compute. From your income, how much do you want to protect?” ( this is the income you want your family to receive even after you are gone)

Norbert: “I want them to receive the same amount I am providing them now, so P40,000/month.

Me: “Up to how many years you want your income to be protected?”

Norbert: “Until my child graduates college.”

Me: “If she is 2 now, then for a 4-year course, that’s 20 years more.”

Norbert: “Yes, I want my income protected for 20 years. So that my wife do not need to work but continue taking care of our child.

Me: “The 15-year average of the inflation rate in the Philippines is around 5%/year. Ok with you?” (Source: Bangko Sentral ng Pilipinas)

Norbert: “Yes.”

Me: “Your existing life insurance is how much?”

Norbert: “3M from my company.”

Me: “If you are to give the 3M to your wife, what investment instrument do you think will she put it? How much interest will it gain annually?”

Norbert: “Let us say, she will put it in a Bond Market, earning 4%/year.”

Me: “Ok, now let’s see.”

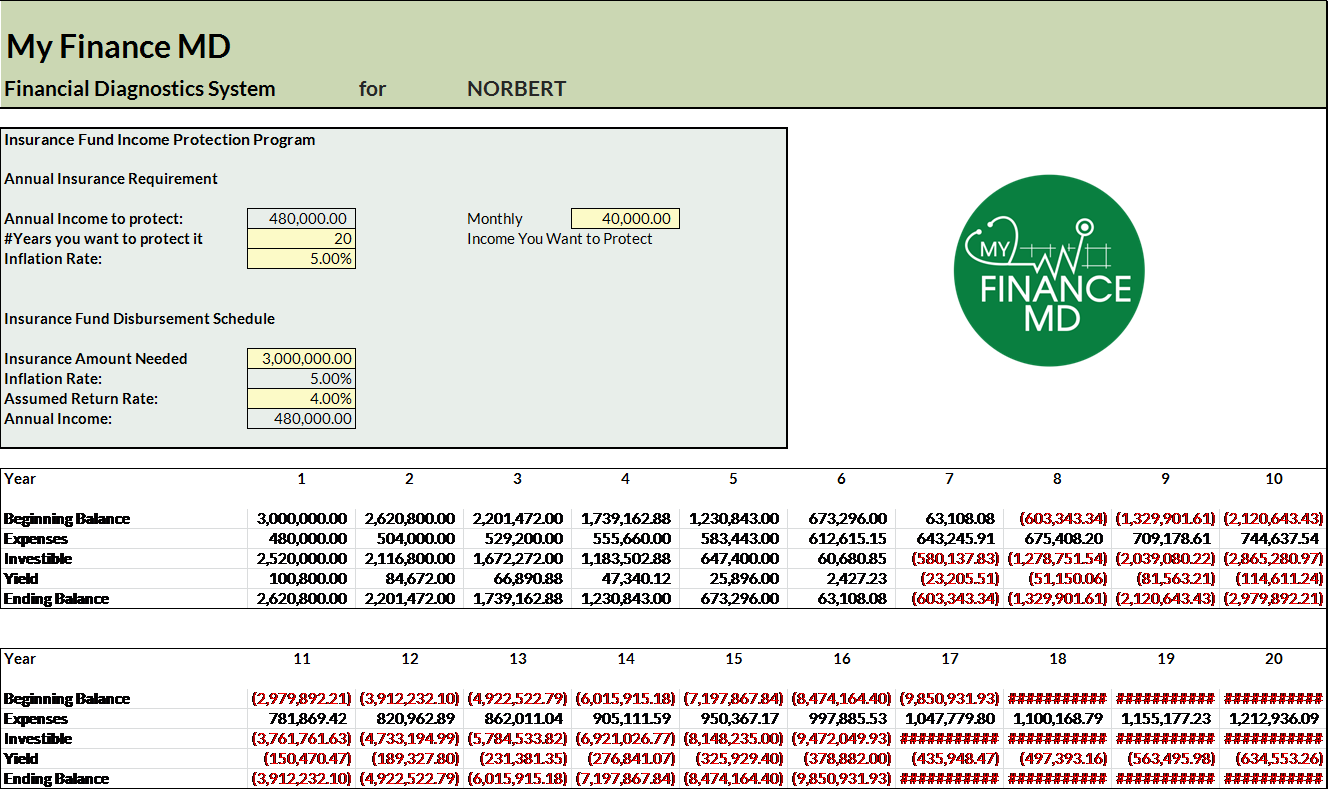

Me: “As you can see in the excel computation – inflation rate of 5%/year are considered and insurance investment of 4%/year applied. As you can see, the 3M that you have, will only last for 6 years. Your child then is only 8 years old and still in elementary.”

Norbert: “Really? I thought I already have a big insurance coverage. If 3M is not enough, then how much do I really need?”

Me: “Let’s, compute again.”

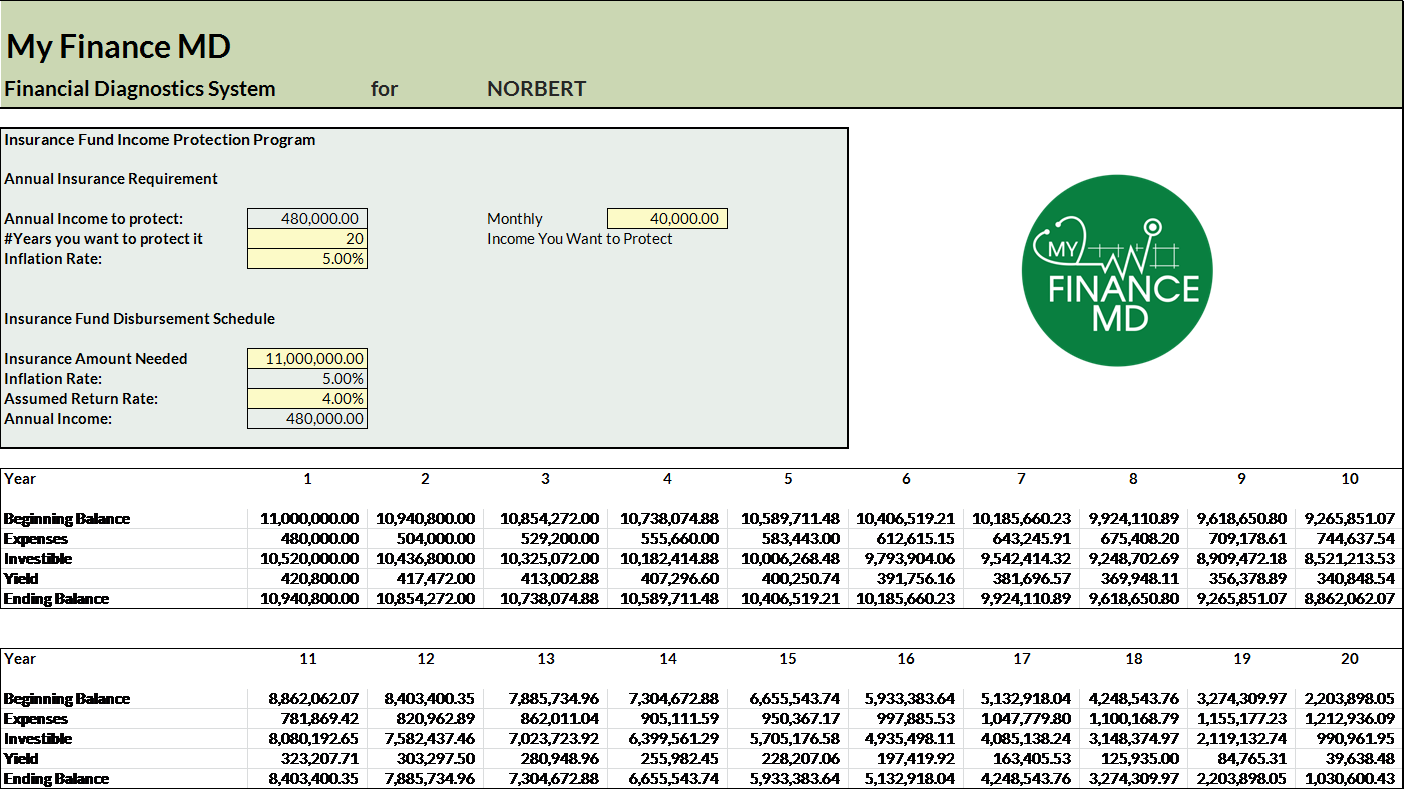

Me: “In order to have adequate life insurance coverage enough to continue your income for 20 years in case you die, you need 11M pesos life insurance coverage.”

Norbert: “11M life coverage? Wow, I didn’t think I needed that much. Thank you for making me realize the value of adequately insuring myself. If I go, I don’t want my wife to leave my child to the hands of caretakers just to work for them to survive. And I know she can’t really provide the way I am providing for them now.

I will be getting adequate life insurance for myself because I don’t want the dreams of my child of becoming whatever she wants die along with me, just in case. Thank you Dra. Intal.”

Norbert’ story reminds me of the story of the goose that lays golden eggs.

If you are to choose between the two, what is more important? The goose that lays the golden egg? Or the golden eggs?

If you are a bread winner of the family, you are your family’s greatest asset, not your home, your car nor your bank accounts. For the simple reason that you are the goose that lays the golden egg. Your assets are just your golden eggs.

It is much more important for the family to have the goose than the golden eggs alone because we never know until how long the golden eggs will last without the goose.

Be an adequately insured goose,

Do you have any questions on how to get an Income Replacement/Continuation insurance for you? Contact me here.

Read More:

- Is Employer Sponsored Life Insurance Enough?

- When a Life Insurance Company Closes, Should you Worry?

- 3 Reasons Why Your Housewife Needs Life Insurance Too

- Life Insurance, How much is Enough?

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Dear Dra. Intal: Presently, I am 55 y.o. and taking care of my 95 y.o. dad. I plan to have a private practice as before, an online work, earn a lot for retirement, and buy a house for me and my dad. I am renting presently. I don’t have savings right now because my savings were spent supporting a nephew through nursing school. He had long since graduated. Is it still possible to earn a lot to achieve these four goals. do you have financial seminars to address my goals? Please advise. thank you.

Hi doc, I sent you an email. 🙂

Hi Maam, Greetings Doc I’m avid reader of your website.Lots of learning for me especially as new Financial Wealth Planner looking forward to learn more from teachings and sharings to better myself. Regarding this Financial Diagnostic System in computing their needs. Can you share this excel program how to compute their needs. Thnak you God speed for more Blessings to come

Hi, it’s a bit complicated if not explicitly explained personally po eh. 🙂

Praktikal po ba para ke “Norbert” na kumuha ng 11M life insurance policy kung ang sahod nya e 40k a month?

Rough estimate he needs, would be time 10 of his annual salary if he has dependents. But it also depends how much he needs for his family. You can consult a financial consultant to know the right amount he needs based on his real need.