Last two Saturdays, September 19 and September 26, 2015, Eat Bulaga made a new history in Twitter from getting 12M tweets on #ALDubMostAwaitedDate and 25M on #ALDubEBforLOVE. I was reading all the comments that I could manage to read on, but one comment struck me the most. This one was obviously from not an “Aldub fan,” he says, “Why do Filipinos not tweet about more relevant topics instead of Aldub, like #stopcorruption or #lowerincometax or #taxreform.”

Last two Saturdays, September 19 and September 26, 2015, Eat Bulaga made a new history in Twitter from getting 12M tweets on #ALDubMostAwaitedDate and 25M on #ALDubEBforLOVE. I was reading all the comments that I could manage to read on, but one comment struck me the most. This one was obviously from not an “Aldub fan,” he says, “Why do Filipinos not tweet about more relevant topics instead of Aldub, like #stopcorruption or #lowerincometax or #taxreform.”

Well, don’t get me wrong, because I was part of that 12M and 25M who sent in tweets last two Saturdays of this month. I am also a part of the Aldubnation, in fact my whole clan is. But, come to think of it, there is also some truth to that particular tweet. What if, there are 25M tweets that will be sent about #LowerIncomeTaxPH. Would the government finally listen? Why am I telling you 25M?

Overtaxed Middle Class

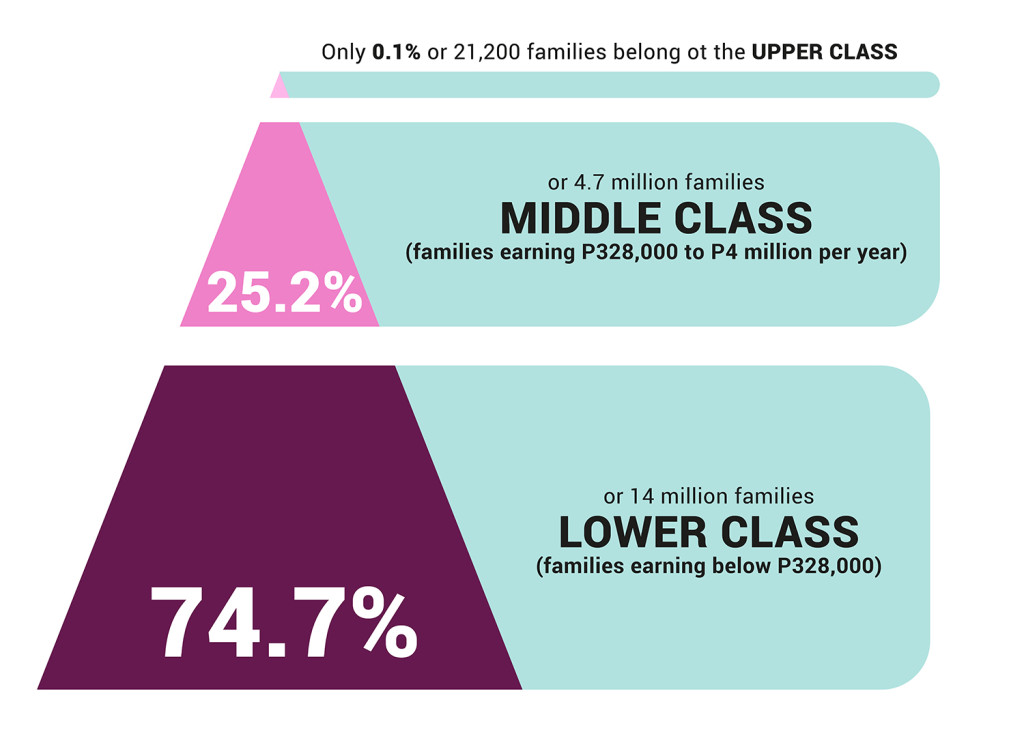

According to a study conducted by former Secretary General Romulo Virola of the National Statistical Coordination Board, over 74.7% of the population comprise the lower class, while 0.1% families constitute the upper class, the remaining 25.2% fall within the “middle class” or the 4.7M families with 5 members. They are the group who is heavily taxed in the Philippines.

Source: “Will the Recent Robust Economic Growth Rate are Burgeoning Middle Class in the Philippines” by former NSCB Sec-Gen Romulo A. Virola, et. al

Source: “Will the Recent Robust Economic Growth Rate are Burgeoning Middle Class in the Philippines” by former NSCB Sec-Gen Romulo A. Virola, et. al

What is the Tax Implication?

The 74.7% (LOWER CLASS) of the population, which includes the minimum wage earners that does not need to pay income tax at all.

The 0.1% (UPPER CLASS) of the population has gained wealth from dividends or stock options. They have holding companies that enjoy bigger tax deductions than individual paying taxes.

Who is left now?

The 25.2% (MIDDLE CLASS) of the population. If we say middle class, they are families that are earning P328,000 to P4 M per year. Where you and I probably belongs. The heaviest taxed group.

Let me illustrate the tax impact to a middle class family in a story.

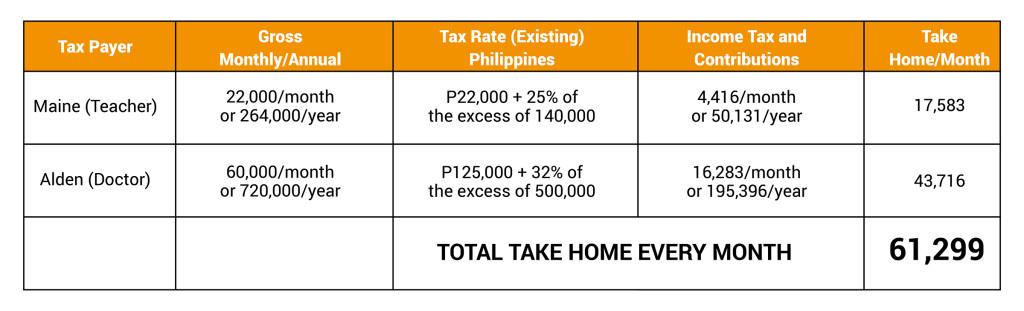

Alden and Maine are best friends since High school. Alden wanted to be a doctor, but Maine wanted to be a Teacher. In college, they parted ways to study their chosen courses. They both fulfilled their dreams and finally earned their degrees.

They met again, realizing they love each other more than friends, they decided to start a family, so they married. Maine, now a teacher earning 22,000/month and Alden who just started practicing as a surgeon earning 60,000/month. How much would be their tax here in the Philippines?

*Values are just Rough Estimates of the existing tax rate in the PH, other tax deductions are not yet included. The contributions included are from Mandatory contributions in: SSS, Philhealth and Pag-ibig.

*Values are just Rough Estimates of the existing tax rate in the PH, other tax deductions are not yet included. The contributions included are from Mandatory contributions in: SSS, Philhealth and Pag-ibig.

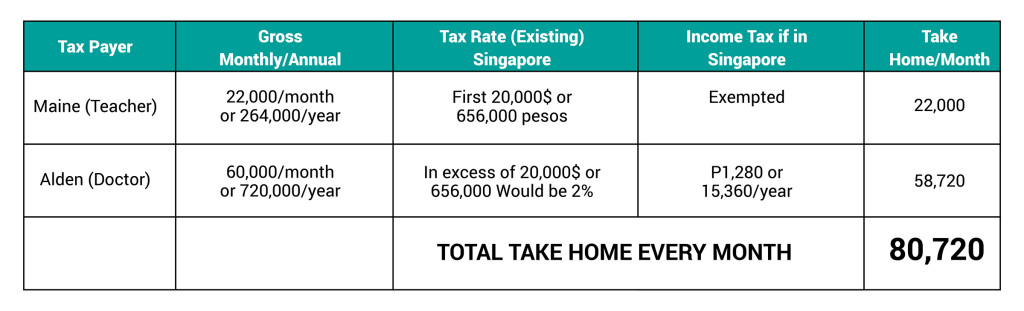

If you still do not know, the Philippines is one of the highest taxed country among ASEAN nations.

This ad in a newspaper cites the difference in taxes from our neighbouring countries, taken from the Instagram account of Senator Sonny Angara, one of the main advocates for reducing income tax rates.

This ad in a newspaper cites the difference in taxes from our neighbouring countries, taken from the Instagram account of Senator Sonny Angara, one of the main advocates for reducing income tax rates.

Now, let us take Alden and Maine to Singapore. Let’s assume they are earning the same (although that is impossible). How much is their tax now?

*Values are just Rough Estimates of the existing tax rate SG, other contributions and deductions are not yet included. Source: www.iras.gov.sg

*Values are just Rough Estimates of the existing tax rate SG, other contributions and deductions are not yet included. Source: www.iras.gov.sg

A Netizen recently caught my attention, when he says:

My Tax in Singapore for earning 1M pesos would only be 6,000 for the whole year. If I stay in the Philippines earning 20,000/month or 240,000/year, my tax would be 48,000 pesos.

Working in the Philippines is a scam, you are paying a premium for a very poor quality of service.

Now, Let us Compare

An extra 233,028/year or 19,419/month would be a lot of help to a middle income family:

- This could mean, they can now afford to buy a HOUSE with a monthly mortgage of 5,000-10,000/month, perhaps this could lower the informal settlers around the Philippines. There are some middle-income families are also informal settlers. Especially those earning 328,000/year with more than 5 family members.

- This could mean an EDUCATION PLAN that can be used to plan for their child’s education up to college, causing lesser drop-outs in school. Statistics tell us, out of 100 who enter elementary only 65 graduates, out of 65 only 43 graduates High school, from 43 who graduated High school only 23 enters college, from 23, only 12 will get the degree. (Philippine Human Development report, UNDP). How to get more than 50% discount for your child’s College Tuition fee

- This could mean they can start investing/saving for their RETIREMENT PLAN. According to a SSS survey, out of 100, only 2% of the population can retire comfortably and the remaining 98% depends on either: their family, charity or the government. The Filipino Retirement Scenario, Find Out Where will you Belong in the Future

- Contrary to what the government believes, this could mean MORE TAX COLLECTION for the government. Lower taxes could mean better compliance and greater purchasing power for an ordinary person like me and you. Greater VAT collection for the government. All goods, services and consumption are taxed with 12% VAT.

- This could mean more business money that could be put up. Making each of us ENTREPRENEURS thus creating more jobs to our fellow citizen thereby uplifting others in their situation too.

- This could mean more people buying LIFE INSURANCE and HEALTH INSURANCE, thereby, lessening Filipino independence to the corrupt government officials. In cases like a death of a family member or major sickness, people won’t go to a Politiko asking money “Pampalibing” or “Pampagamot” – which could even push these Politikos to corrupt practices, justifying their acts as what they get, they are given to people too.

Tax Reform

I’m not saying to have a tax bracket like that of Singapore now for the Philippines. I am just one of those people who want a reform, amend or revisit of our income tax system which remained unchanged since 1990’s. Senator Angara says in an article in Inquirer- Overtaxing working Middle Classes, he said “I discovered that the percentage and tax brackets have remained unchanged since the 1990s.”

In 1990, when a Jeepney ride would just only cost you P1.25 vs P7.50 now, our income tax system remained unchanged.

A P12,000 /month would be a lot of money in 1990’s, but now? I don’t think so, yet, they are taxed the same.

Rich People = Rich Country

They say, GNP (Gross National Product) and GDP (Gross Domestic Product) will tell how rich the country is. But do you know that GNP and GDP are just the sum total of how rich the people are in the country? It measures how much each Filipino (all over the world) and those people (living here) earns in a particular year.

“It only means if the PEOPLE are rich, The COUNTRY is also RICH.”

There is no such thing as, making the country rich by making its people poor through over taxing.

Sa Tamang Panahon

Sec. Purisima and Commissioner Henares says it is not the right time to reform the income tax system. See article by Inquirer here.

But to those of us who says “Ouch!” and feels the hurt every time we pay taxes, and every time we look and ask: “Where are the taxes going?” Tax reform should have been done even earlier. I know there are also lawmakers already lobbying for tax reforms like tax reform proposals that have been put forward by Senator Juan Edgardo M. Angara (Senate Bill 2149), Senator Paolo Benigno A. Aquino IV (Senate Bill 1942), and Senator Ralph G. Recto (Senate Bill 716). I hope they won’t give up.

Philippines has approximately 100M population, 25% of that is 25M, if only we send in 25M tweets telling we want tax reform now or #LowerIncomeTaxPH, maybe, we will trend around the world. Just maybe, we will be finally be heard by the President, other law makers of the country, Department of Finance and BIR.

I’m not a famous person, my voice is just a small voice wanting to be heard, but, if all the small voices of the 25M like me speak up, I believe we will soon be heard. We have shown that we can break the world record of the most number of tweets sent in a day as an Aldubnation. Now, I challenge the whole nation not just the AlDubnation to speak up! I also challenge those voices louder than me that could step up and lead us to tweet altogether to hit 25M tweets with the hashtag: #LowerIncomeTaxPH.

Would the world finally listen? Would our government finally open its blind eye to us? Or would they just tell us again and again, “Sa Tamang Panahon?” (When would that be?)

Thank you for reading. Hit the Share button if you are ONE in our advocacy in uplifting the lives of our people.

Don’t forget to subscribe here for free!

*Disclaimer: Income tax computations are Rough estimates and was based on the existing income tax brackets by PH and SG. Not all deductions and Contributions are factored in.

Read More:

- Part 1: What is Estate Tax and How it can hurt you even After Death?

- FILIPINO DOCTORS AND TAXATION Part 1: The Ultimate Guide on How to Register as a Doctor/Physician in BIR

- SSS Retirement Benefits, Updated 2014 Is it enough for your Retirement Needs? Find Out now!

- How to get more than 50% discount for your child’s College Tuition fee

- Top 10 Life Insurance Companies in the Philippines, Unbiased Review

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Great read. A must read for all tax payers in the Philippines. #LowerIncomeTaxPH

grabe, ganun pala tax dito. Sobrang out-dated na. Time to reform. #LowerIncomeTaxPH na

Very interesting article! Taxpayers of the philippines must be aware of this. Great job doc pinky

Ramdam na ramdam ko talaga ang 32%. I have 5 kids. Kahit gano katindi ang trabaho, kailangan. Sana makinig na ang gobyerno natin. #LowerIncomeTaxPHNow

#LowerIncomeTaxPH

I belong to the middle class -.- #LowerIncomeTaxPH

Good read…go for #LowerIncomeTaxPH

A commendable attempt to disseminate information by catching people’s attention via AlDub.

I thank Aldub because the following they created can be tapped by the attention they get to deal with real issues like this.

Losing out1/3rd of my income to taxes that I don’t see going anywhere has really crushed my soul. It drains your will to live. It’s at a level that socialist countries have, yet we get none of the benefits of a socialist country like quality free medical services.

Doc Piky, the comparison of incomes should have been made equitable as well. A Singaporean Teacher (0-5 years experience)and Singaporean Doctor (starting out) would have a total family income of about SGD116k/year. This information is available in one of the free pay scale websites. If you are a foreigner, then housing, medical plan and schooling is pretty expensive. If one is a citizen, they have a lot of safety nets and discounted (basic) services.

Perhaps a better comparison would be Thailand.

hi Sir Garry, i know that there is really a big difference in terms of income….

That is why i state there:

“Now, let us take Alden and Maine to Singapore. Let’s assume they are earning the same (although that is impossible). How much is their tax now?”

I just applied the Income tax bracket computation in SG. The purpose of which is just to see how income tax rate brackets apply in PH and SG.

Thank you for reading.

I’m an ofw and i enjoy being tax exempt in middle east. gross salary is your net salary without any deductions.

Hi, Dr. Intal, correction lang.

Dr. Virola was the SG not of the “NSO Coordination Board” but the “National Statistical Coordination Board” or NSCB. NSO was a separate entity from the NSCB. They are now both merged into the PSA (Philippine Statistics Authority) along with two other agencies (BLES and BAS).

Done with the necessary correction. Thank you Ms. Ara. 🙂

naiyak ako madam. 🙁

Nakakaiyak po talaga. 🙁 #LowerIncomeTaxPH

Hi Doc –

This is a very interesting article. I have been working for quite sometme now and the tax withheld is really high. I just have a few questions and please enlighten me and correct me if I am wrong.

Status quo as discussed in this article, the middle class is paying tax the heaviest. The tax income is a great contributor of the countrys budget right? Now please let me your thought on the following items.

1. The number of beneficiaries is higher (lower, middle and upper) vs the number benefactors (or taxed classes middle and upper).

2. If number 1 is true then lowering income tax for middle class without requiring the lower class to pay tax and without increasing the income tax of the upper class may lead to a possible issue in the budget?

3. The lower income in SG but better services tells me that most of them are working and contributing to the national budget.

I am not really good with economics and taxation so would appreciate more a response with simpler terms. 🙂

I hope they will push this. #LowerIncomeTaxPH

Thanks and Best Regards

Hi Adie, is your question about, what will happen if we lower the tax? would there be a issue in budget? – as for me, i think, lowering tax may have a short term impact, but Long term effects like: greater purchasing power for all will benefit us all (greater VAT collection), creation of new businesses thereby creating more jobs and many more. Those I believed are the Long term effects. And for me, why burden the tax payers who really pays. Why does not the government run after the Tax Evaders, instead of getting all the collection from us. If they run after the tax evaders, they can even collect more that what the middle income are giving.

Thanks Doc –

Do you believe po it is fair to tax the lower class too at the same moment we lower income tax rates for middle class? I have learned in taxation back in college na there are other countries who have higher tax rates for low income to encourage them to earn more?

For me lang po, masyado po xang unfair para sa atin na tayo (middle class) ang taxed the heaviest to provide project na most of the time ang lower class lang ang nag.eenjoy like public education and public hospitals etc.

I dont mean to belittle the people in lower class pero i think ito po ang nangyayari.

And tama po yung comment sa baba ni Jecarmie Janoras Tilos that echoes my sentiments here. 🙂

nahirapan kc magintindi ng report ang mga politiko kaya masasabi lang nila “which programs will suffer?”

Yes to Tax Reform!

this is applicable to everybody specially the middle class where i belong aldub fans or not, concerned pa rin kami lahat

#lowerincometaxPH

I love this article!

ok.. well help #LowerIncomeTaxPH

#LowerIncomeTaxPH

Well even if 25 million Filipinos tweets for #LowerIncomeTax it will not change a thing because our government is so corrupt and will rather play deaf instead of taking actions.

unfortunately, this attitude is what makes the philippines what it is.. filipinos’ desires just extend as far as for their own families, whether they are from lower or the middle or the higher echelon of society.. indeed hate is not the opposite of love, indifference is. and indifference is stagnant, not progressive.

The working class is the most neglected class in the Philippine setting. Why? Just take a look at the political campaigns, always for the poor, the needy the helpless. Who gets voted as Politicians? They are the puppets of those on top of the pyramid (which has the means to

manipulate honest tax payment) while us, the working class gets tax deductions from

our salaries outright. Then all our taxes go to the non-contributing group, the liabilities of the state and the puppets and their puppeteers. What's left for us? Uncertainty. #LowerIncomeTaxPH

Thanks a lot for this post.

Yes to Tax Reform!

I go for this! and this must be done! #LowerIncomeTaxPH

It’s a great read and good point…I just noticed also that going against a fad is like being a party pooper, no one likes you. Your motive is good, your wisdom is right, but I’m enjoying the moment, why be such a troll? (disclamier: not an aldub fan, nor pastillas). I think these kinds of ideas should have their own place, you’re so creative enough to get the data, the presentation looks good, but the kids want hotdog, get it? Maybe if we are more creative in selling these ideas, you don’t need to #copy viral tweets. peace!

Good read. I support #LowerIncomeTaxPH

Minor comment lang on your computation – you should also factor in 13th month in the annual income since it’s required by our law. Everthing else is spot on. Great article! #LowerIncomeTaxPH

#LowerIncomeTaxPH.

i belong to the middle class! #lowerincometaxPH

#LowerIncomeTaxPH

#LowerIncomeTaxPH

#LowerIncomeTaxPH

#LOWERINCOMETAXPH Please naman…

I did comment on one of the Tax Reform articles about this too, why not tap the whole Aldub nation to participate? I’m sure majority or all of them are pro tax reform and wouldn’t mind tweeting #LowerIncomeTaxPH alongside #Aldub 🙂

[…] http://www.myfinancemd.com/aldub-and-philippine-tax-reform/ […]

Thank you for this article Dr. I’m an overseas professional but i always take time to read and be informed of the current situation of our Inang Bayan. Funny i was an Aldub fan too thats why i’m curious with this post. Anyways, one of the reason why i moved from working in the country is TAX! I’m in favor in lowering tax income. Think of the channel this tax has been go through compare with collection of tax thru VAT. Income Tax were collected by BIR thru withholding tax from our monthly salary (Government handling where trust is an issue) while VAT, its fixed and is collected from companies. i think this proposition deserves an attention too!

#LowerIncomeTaxPH

ang middle class ang laging kawawa nagbabayad na ng 32% sa income tax and then 12% sa vat so kailangan na siguro bawasan ang tax bracket para malaki ang take home pay ng empleyado kaysa mapunta sa ibang bulsa..kung malaki ang take home pay means more money para sa needs sa pamilya…

its just unfair kasi na ang middle class ang magbabayad ng malalaking tax and then makikinabang lang ang lower class..ang lower class ay tax exempt tapos sila ang nageenjoy sa serbisyo ng gobierno….

Hi..im both tax practitioner and aldub fan at the same time…i dont get ur style of connecting aldub in ur campaign..seriously? Unfortunately d 25M tweets may not be enough to move d hearts of our leaders as they can easily pocket equivalent amount any time…in ur status u can raise up this matter on proper forum nd express ur take on it…u write articulately just dat this method of expression may be misconstrued and may raise inadvertent reactions..we dont want civil unrest which will hurt our economy in d process…im all about ur idea just dat maybe ur knocking on wrong tree…tnx

#LowerIncomeTaxPH

I was in malaysia with friends last week and comparing economies. we were exactly talking about how lower income taxes could actually increase tax collection as people will have greater purchasing power, higher business potential, etc. I hope people in the government are smarter than they are now.

I dont think all aldub fans will go kilig if they tweet that, most of the fans comes from lower class. They dont pay taxes as much as you do.

good read. i too would like the income tax to be lowered to some extent and should be passed along the richer bracket. do you have an estimate as to how low is low enough? because tax is still necessary for some form of government.

devil’s advocate here: i dont like it when people compare the philippines to singapore because its a city state if the philippines was just metro manila then sure. well not actually because singapore has more money to support less people than metro manila. malaysia would have been more comparable because they have two seperate large areas but we run into the same difference malaysia has more money to support less people. most of the others in that list dont suffer with the logistic problems of shared growth by being a very fragmented archipelago and you know our incompetent government. any thoughts?

#LowerIncomeTaxPH

Wow excellent post. Very informative but at the same time sad. A country's economic well being is usually measured in the size of its middle class and our government is taxing them to death. Sigh.

#LowerIncomeTaxPH

May vat pa for all consumption. And vat charge to client wala din mapuntahan.

#LowerIncomeTaxPH PLEASE.

sana mag set tayo ng isang araw na yan ang gawin nating hash tag. at magkaisa tayo pilipino sa pagtweet ng marinig ang ating mga hinaing

#lowertaxincometaxph hope filipinos will focus more on relevant issues to help our country. Philippines is a very rich beautiful and rich country is just that some of government officials are not deserving to serve our beloved country. Mabuhay Philippines! God Bless you!!!

Let as unite #LowerIncomeTaxPH #Aldub #GodisGood

I may have missed something but according tot he chart:

21,200 – Upper Class

4,700,000 – Middle Class

14,000,000 – Lower Class

———————————

18,721,200 – All Classes

102,269,110 – Philippine Population (http://www.worldometers.info/world-population/philippines-population/)

Did I miss something?

#LowerIncomeTaxPH

Here is one thing that you guys will never appreciate. The current system that we have right now is designed to protect business owners, if you dont believe that ask your accountants or people you know who has a business. The corporations are so protected they can write anything off on taxes even vacations. Employees on the other hand, does not benefit the same reward. Because they dont really have any value with regards to job contribution and etc. They simply do what the boss say. The point here is, if you dont want to pay taxes, start your own business. There sre a lot of business out there you can do. But people are too lazy to do anything. They rather complain than take action!

[…] possible to enjoy both. A blogger named Dr. Pinky de Leon-Intal has even used the current craze to educate people about taxation and finance with her article, “AlDub and Philippine Tax Reform,” which I think is a great idea — using a popular phenomenon to get people to read what they […]

I support the move for a tax reform

#LowerIncomeTaxPH

#LowerIncomeTaxPH

The state think tank has already made a study “Why we should pay attention to the middle class”. To read the whole article, please visit the link: http://dirp3.pids.gov.ph/webportal/CDN/PUBLICATIONS/pidspn1513.pdf

I hope you can help us to disseminate this evidence-based policy research to DOF, BIR, Congress and Senate. Thank you for making the effort and concern for our people. Mabuhay ang Pilipinas!

Very well written.

Yung nasa chart po number of families with an average of 5 members yata. So yung 18.7M multiplied by 5 equals to almost 100M. Siguro nag-round down sila to 5 family members na average instead of the exact average.