I’m back!

I have just given birth to my second child 3 weeks ago via Caesarian section, therefore, I apologize for my long absence. But because I love you all, my dear readers of MyFinanceMD, I am blogging this article while recovering and taking care of my little ones.

I will start by stating this fact:

In finance and life in general, always remember this:

“The more you know, the less you pay. The less you know, the more you pay.”

These are the lessons I learned along the way of having two beautiful children, and hopefully, new moms and new parents can learn too.

TIP #1: Make sure you have an updated payment in your SSS contributions.

This is perhaps one of the most important saving tip you need to understand. I learned this the hard way. I was not able to get this (maternity benefit) from my first born because of ignorance, and it hurts.

“The less you know, the more you pay and Ignorance has a price to pay”

For employed:

Make sure your employer has an updated SSS contribution for you.

For self-employed/voluntary:

If you can pay the highest contribution as you can, please do. Because maternity benefit will depend on your contributions.

What are the Qualifying Conditions?

- The member has notified SSS thru employer if employed or SSS directly by filling up MAT-1 for voluntary contributions. Ultrasound result with expected date of delivery is required as an attachment upon submission.

- Paid at least (3) monthly contributions within the 12-month-period before the semester of childbirth, miscarriage or abortion.

How much are you going to get from SSS: Here is a sample computation:

*This means that, if you are paying the highest contribution (Php1760 as of this writing), and you paid for it for at least 6 months prior to birth, then, you will be getting, Php41,600 as your SSS maternity benefit. Yey! I am excited to receive mine soon.

*This means that, if you are paying the highest contribution (Php1760 as of this writing), and you paid for it for at least 6 months prior to birth, then, you will be getting, Php41,600 as your SSS maternity benefit. Yey! I am excited to receive mine soon.

Limitation of Maternity Benefits:

- Payment can be made only for the first four (4) deliveries, on or after March 13, 1973

– Abortion and miscarriage included (effective May 24, 1997) - Payment of maternity benefit will limit you in availing sickness benefit for the same period of confinement.

TIP #2: Make sure that you have an updated PhilHealth contribution too

Expectant moms may expect PhilHealth benefits of varied coverage, depending on the type of delivery, whether normal or caesarean. It also depends on the type of hospital or medical facility where the procedure takes place.

For normal deliveries in hospitals ranked level 2 to 4, the Philhealth maternity benefits are the same as those stated above. The total receivable amount is only Php6,500, however, broken down as P5,000 for the medical facility and professional fees, and Php1,500 for prenatal care expenses. Mothers who give birth via caesarean section are covered by Philhealth maternity benefits with a total fixed amount of Php19,000.

Bonus tip: Make sure you have updated your MDR (Member Data Record) of your PhilHealth, and bring along a copy with you in the time of giving birth. It is a requirement in the hospital.

TIP #3: Do your pre-natal check-ups and start saving monthly until delivery (Prepare for the worst)

From getting your prenatal check-ups, you may have a pretty good idea if you can deliver via NSD (Normal Spontaneous Delivery) or via CS (Caesarian section). If you are going to save money for your delivery it is better to prepare for the worst. Save up as if you are having a Caesarian delivery.

Scout and decide which facility you are giving birth. Know their rates. Save monthly, it is better to be over–prepared than under-prepared.

Actually, the best time to start saving is when you were still planning to have a child. The second best time would be, once you knew you are pregnant.

TIP #4: Decide to breastfeed even before you give birth

Besides being a financial consultant, I am a lactation consultant too. Therefore, I can say that breastfeeding not only will give the best nourishment and best food for your child but you are also getting the cheapest alternative because it’s free.

See my previous post on this: Breastfeeding is Love http://www.myfinancemd.com/breastfeeding-is-love/

In summary, in that post, I was able to tell you (more or less) how much you can be able to save if you breastfeed vs formula milk.

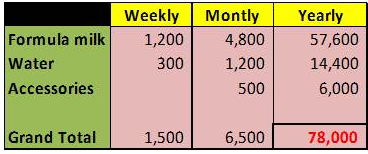

The table above speaks for itself. It only means one thing: you can save more or less Php78,000 pesos a year. And this much savings can be put in a better investment, like saving for your child’s education for the future.

If you think you cannot do it while working, think again. I am a full-time breastfeeding and working mom, but I survived. You can get some help from a lot of peer breastfeeding moms in your place too.

Breastfeeding my 18 days old baby. Breastfeeding is such a special moment for a mother and her child.

Breastfeeding my 18 days old baby. Breastfeeding is such a special moment for a mother and her child.

Why decide to breastfeed even before giving birth?

Breastfeeding is not an easy ride, believe me. Ask women who breastfed their child, they can attest to that. It is very challenging and will greatly test your resolve. Deciding to breastfeed even before having a baby is important so that you will remain steadfast especially when you are encountering the difficulties of circumstances attached to it.

TIP #5: Use cloth diaper the soonest you can, preferably starting from your first born child

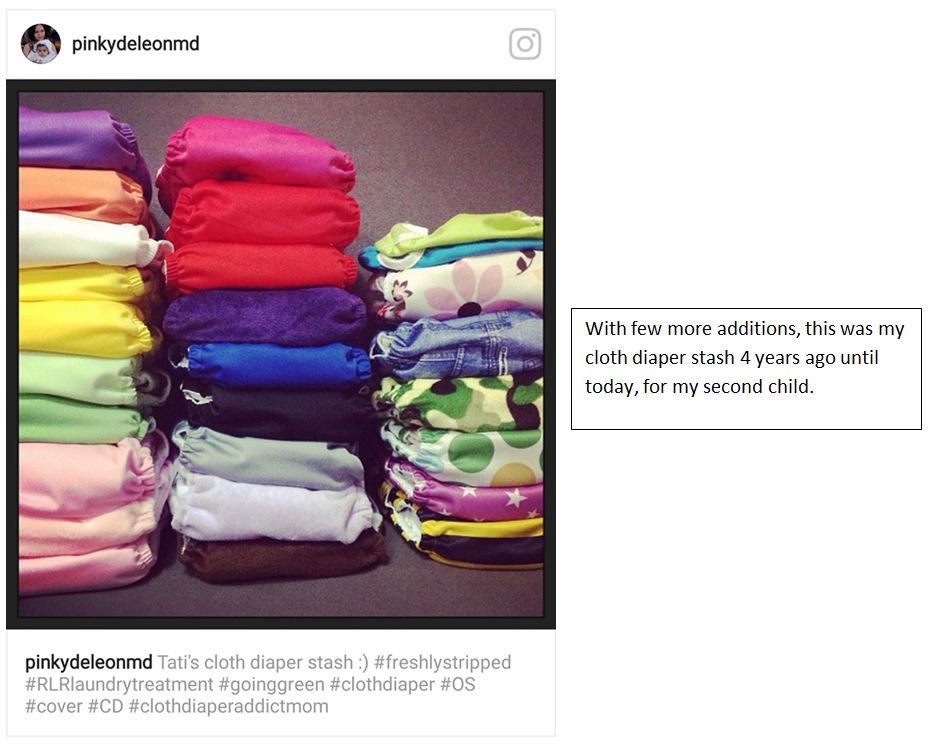

I was able to buy 30 pieces of cloth diapers for about Php10,000 pesos for my first child. Consider additional water and soap to wash those, let’s make it Php15,000 expenses for my first child, until she was potty trained.

Since I already used cloth diaper for my first child, guess what? I don’t need to buy anymore since all her cloth diapers are still good as new, ready to be used to my second child.

For my second child, I don’t need to buy any more since all the cloth diapers are still in good condition. Let’s just say, 5,000 expenses for a year, for the additional water and soap to wash those things.

Now, let us see, if you will use a disposable diaper:

I got this from theasianparent.com: (https://ph.theasianparent.com/cloth-diapers)

It says:

A twelve-piece pack of diapers costs about PhP150 or PhP12.50 each. So if a child uses 8 disposable diapers a day, which means you would have to shell out Php100 per day or a total of Php36,500 a year! That’s Php73,000 gone to waste, assuming your child is potty-trained by two years old.

You can save 36,500/year or 73,000 (until potty trained at 2 years old).

Bonus tip: Choose neutral colors and designs, that way, you can use it again for your next child.

TIP #6: Use cloth wipes

Since I am already using cloth diapers, why not go all the way and use cloth wipes too. Thinking of newborns and how often they pee and poop, will make you need to buy a lot of baby wipes. The 80-pieces baby wipes costing 100 pesos per pack will make you use 2-3 packs per week and that would mean Php15,600 pesos/year or Php31,200 for two years.

I used cloth wipes, nonetheless. You can just cut a piece of fabric like cotton, flannel, and microfleece and sew the edges using a zig-zag stitch on a sewing machine.

See a step-by-step guide on how to make cloth wipes here: Thinking about cloth diapers – http://www.thinking-about-cloth-diapers.com/make-cloth-wipes.html

For both cloth diapers and cloth wipes, saving money is not the only advantage, here are the others:

- They are non-toxic

- Helps prevent rashes because they don’t have harmful chemicals

- Ease in potty training – study shows they are potty-trained sooner

TIP #7: Prepare a wish list for your Baby Shower or Gender Reveal Party

Since baby showers are getting more and more popular here in the Philippines, better take advantage of it. You can list down your “wish-list” and disseminate the lists to your friends that will come to the baby shower or gender reveal party. They are always kind enough to understand that you really need it. If you can get a gift registry in a certain shop, the better. That way, your family and friends will not be buying the same item in your list.

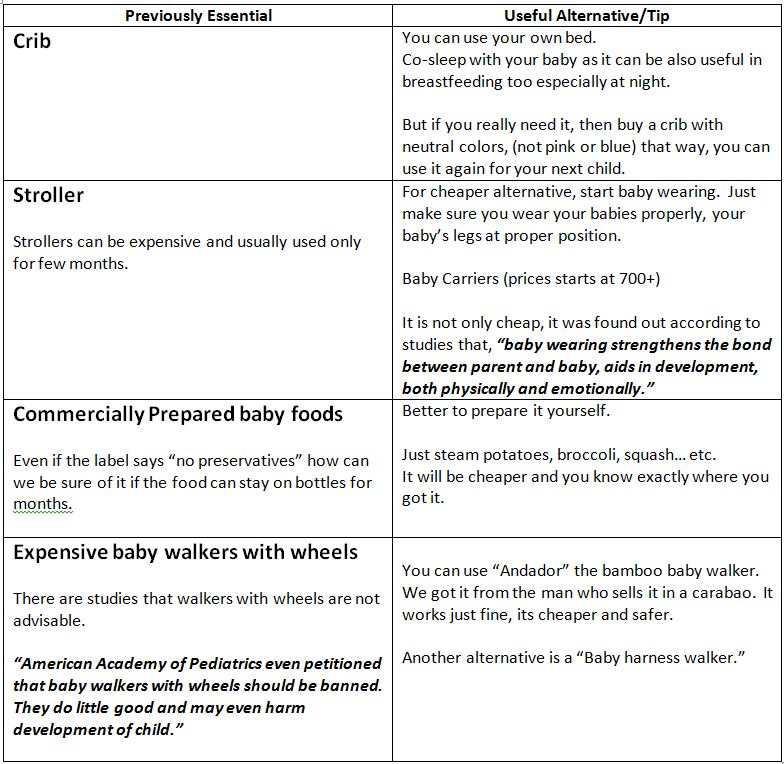

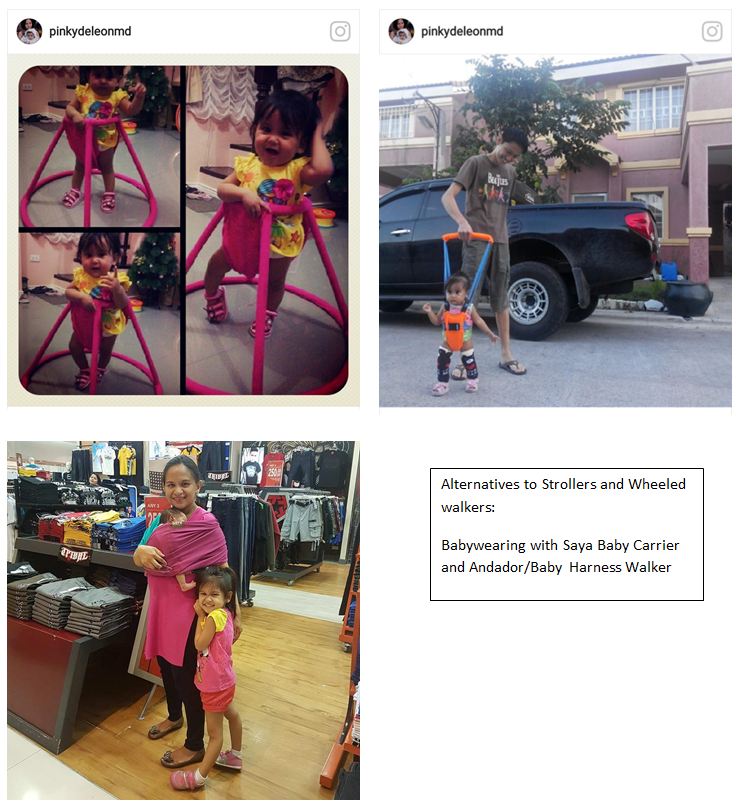

TIP #8: Use useful alternative

Since babies grow so fast, there are a lot of things that will only last for a few months. If you can borrow a crib or some clothes from your friends or family who recently gave birth too but older than your kid, the better.

Ore use useful alternatives, which are the following:

TIP #9: Baby Photography

For those who wanted to capture their newborn’s first days, there are many budding baby photography that are cheaper and much better alternative than those photography studios you see in malls.

I personally recommend Keno & Krit Baby Photography. They are very professional, very patient with children, their studio is perfect for newborn and their price is 1/5th the price of the one I got for my first born (a photography studio in ATC).

See the baby pictures below.

Those are tips I want you all to know especially for those who are planning on having a baby soon, presently pregnant, or even the new parents. I hope I was able to help in few ways I can, so that you can channel your finances from the savings you got here to those areas that matters more.

See more post below on where to spend the money you where ale to save here. God bless you all. Always remember that, having a baby is always a blessing. Enjoy parenthood.

For Your Financial Health,

Read more:

- The BEST INVESTMENT Vehicle for Your Child’s Education

- How to get more than 50% discount for your child’s College Tuition fee?

- Breastfeeding is Love

- 5 Money Habits To Avoid Telling Your Kids

- 10 Signs You Are A Money Smart Mom

- Money Jars (for kids to teens) – Explained from Magandang Buhay Show

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Congratulations to your new Baby Doc. 🙂

Jack of all trades po tagala kayo, nakakatuwa. 🙂

God bless always po. 🙂

Thank you for keeping more Filipino’s educated on many important things in life for ‘free’ and with your first hand experience.

Wonderwoman po kayo Doc Pinky! 🙂

-Hayzel

Thanks Hazel. 🙂