It’s only the first quarter of the year, yet, from all the happenings around the world, it seems like, we are already in the last quarter of the year.

From the financial point of view of most experts around the world, they fear that with all of these things happening, the economic collapse will arrive sooner than they think and here are the whys:

1. Corona Virus affects many industries

Airline and travel – It’s one of the largest industries in the world, with $5.7 trillion in revenue. It is responsible for an estimated 319 million jobs, or roughly one in 10 people working on the planet. And no sector is more at risk from the novel corona virus.

The travel industry and tourism have already taken a huge hit due to travel restrictions and canceled trips for both business and pleasure.

In our country, our very own Philippine Airlines is already laying off some 300 employees due to travel ban.

Not only in the airline and travel industry but also in:

Fashion

Conventions/trainings (because of travel bans)

Manufacturing

Almost all industries are affected in a way because of lay-offs from jobs of those industries above.

2. Disruptive Technologies replacing Humans

Population is rapidly growing around the world, we are projected to be 7.8 Billion people by this year, 2020.

Yet, many disruptive technologies are replacing humans almost every day.

Uber and Grab – replacing taxi drivers and public transport.

AirBNB – replacing hotels along with the staff.

Cellphones – replacing camera, video people behind. Staff, secretary.

Drones- replacing helicopter pilot and camera man.

Robots – replacing humans.

Machines – replacing humans.

The list is endless.

Although technology is great, the growing human population is suffering because of the need for fewer employees/jobs.

3. Global loan is about to burst

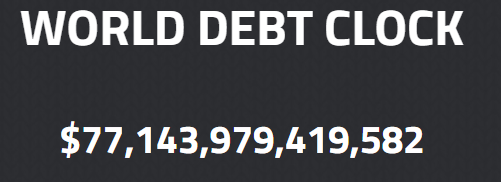

We have a growing debt. Our world is running on debt. As of the writing of this article, the world debt is around this much.

If you want to know how much it is now, you can look up the real time global debt here: https://commodity.com/debt-clock/

According to Lorimer Wilson, when the debt bubble bursts we are going to see economic chaos.

Never before has the world faced such a serious debt crisis. Yes, in the past, there have certainly been nations that have gotten into trouble with debt, but we have never had a situation where virtually all of the major powers around the globe were all drowning in debt at the same time. Right now, confidence is being shaken as debt levels skyrocket to extremely dangerous levels. Many are openly wondering how much longer this can possibly go on. With this, we should be getting ready.

This also means, if most of your money is in the financial system, especially, in the banks, your fiat money is not safe.

4. Natural Disasters occurring around the world

Bush fires in Australia.

Floods in Dubai.

Deadly tornadoes in Tennessee.

Sandstorms in Spain.

Earthquakes in different part of the world.

Locally, we have Taal Volcano eruption.

These top 4 things are happening right now. And if your only source of income is from your job, then, you might be in serious trouble.

5 Ways on How to be Ready (What you can do) right now:

- Build an Emergency fund that can last for 3-6 months in case something terrible happen to your source of income.

- Start creating another income stream that can help you in case of a layoff or in case you need to stay at home (during a lock down).

- Make sure you have insurances where you transfer the risk from yourself to the insurance companies that can afford those risks.

-

- Life insurance and income protection – for the lives of the income earning of the family (especially)

- Critical illness protection – so you will have money in case you are suddenly diagnosed with a critical illness due to a virus or any other disease.

- Disability insurance

- Car insurance – for your car, in case there is an accident

- House insurance – for your house, in case there is a natural disaster or fire that can burn your house to the ground.

- Start storing some of your money in Gold.

- Start studying and buying crypto currencies.

I will be talking about how to invest in Gold and Crypto Currencies soon, so watch out.

Let us be ready. Anything might happen.

Tough times never last, but Tough People Do.

Don’t forget to always remember that God will not leave us during these times of uncertainties.

Be Ready,

Read More:

- 2 Reasons Why You Should Not Save Money in Banks

- What does PMA Has to Say on Philhealth Premium Increase?

- The Shocking Truths You Didn’t Know About INFLATION – Part 1

- How To Know If You Are Qualified To Receive SSS Maternity Benefits

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023