Are you hiding from your friend from Manulife, Philam Life, Sun Life, Insular life, etc..? Are you being approached by these people quite regularly? Are you getting irritated and running out of excuses?

Are you hiding from your friend from Manulife, Philam Life, Sun Life, Insular life, etc..? Are you being approached by these people quite regularly? Are you getting irritated and running out of excuses?

You need to read this.

I have gathered the most common excuses for all time and reading this will save you from further using your Gray Matter, in layman’s term, “brain.”

The Calendar of Excuses!

January: Naku it’s after Christmas season, you know, I had so many expenses last month, I even have debts on the credit cards. Let me have a breather and pay them first. Then I will call you after I have finished paying all my outstanding dues“

Febuary: “It’s Valentines season, my husband and I are planning to go to Singapore for our second honeymoon, maybe next time. I’m really, really excited! I hope you understand!”

March: “Mare,I have to pay the remaining tuition fee so that my child can take the test and graduate in Grade School. Malapit na sya matapos, promise pagtapos nya!”

April: “it’s summer! The whole family is planning to go to Boracay for a 5 days vacation. It’s our most awaited trip of the year!”

May: “Enrollment time. You must understand how expensive it is to have 3 kids in school.”

June: “We have to buy so many things for the kids. Bags, books, notebooks, pens, pencils and lunch.”

July: “Naku, our house was flooded twice this month, we need to replace the sofa.”

August: “Ghost Month. They say it’s bad luck to invest this month.”

September: “I always wanted an SLR camera, sale sya sa mall, sayang naman. We are buying it this month.”

October: “Sembreak! We are going to Batangas for a beach with the kids and the whole family. Wanna join us?”

November: “Enrollment time again for my kids. Next month, I will have extra money because of the 13th month pay!”

December: “Christmas time and New Year time. Alam mo na!”

There you go! Well, possibly, some of the excuses above might be logical and true, but my point here is, you will never run out of excuses. You can always procrastinate. Filipinos are fond of that. “Bukas na lang! Tsaka na! If madagdagan sweldo ko.”

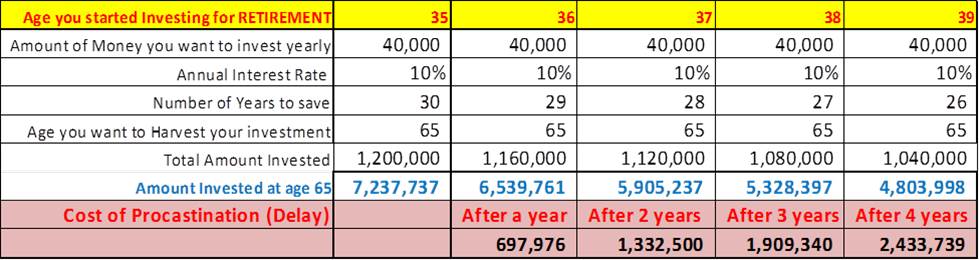

There could only be ONE problem, PROCRASTINATION could be very expensive. Take a look at the graph below.

The graph above shows saving of only 40,000 a year or 3,333 a month or 111 pesos a day or one Starbucks brewed coffee a day.

If you delay for a year and used the excuses above, and a difference of 40,000 extra investments it will cost you almost 700,000 pesos. After 4 years of procrastination (difference of only 160,000) can cost you 2.4 M.

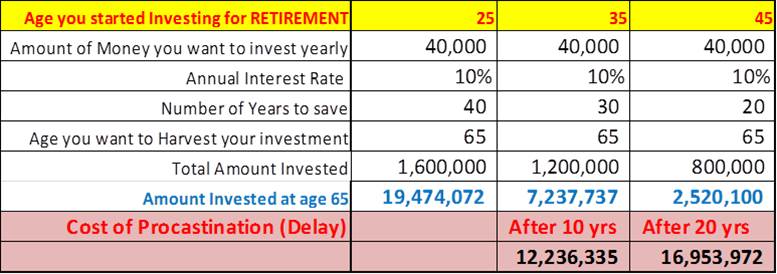

Still not convinced? Let me do it every 10 years of excuses:

The difference between saving at 25 and at 35 is 12.2 M pesos.

Always remember, you will never ever run out of excuses. At the end of the day, it will be YOUR future that we are talking about NOT your financial advisor’s future. She is even doing you a favor in educating you. How many times I have heard, “sana dati ko pa nalaman to.” (how I wish this was told to me earlier).

Saving and investing is a decision. There will be many excuses you can come up with your own, but once you will be firm in your decision, no measure of excuse is worthy enough to endanger your future. So you decide and act now.

Maybe it’s time to listen to what your financial advisor has to say.

Start your financial literacy journey right by reading: How to Prioritize your Finances: The Financial pyramid. Start preparing for your retirement now!

Let me help you with your financial goals now. Contact me here. It’s time to act!

your dreams should be bigger than your excuses,

Read more:

- The First Key to a Meaningful Wealth—If you don’t have this, You will never be Wealthy!

- Hurdles of Financial Freedom (Mga Balakid sa Iyong Pag-Yaman!)

- Top 10 Life Insurance Companies in the Philippines 2015

- 5 Insider Tips on Finding the Right Insurance Agent/Financial Advisor For You

- Your Money’s Greatest Enemy

To all Financial Advisers out there or those who wanted to be one:

I invite you to level up your financial advisory career! Get this Ebook for FREE! Click Here.

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Great analysis. I will use it to help my friends be financially stable also and especially for me. 🙂 I like this page

I am 55 years old and I want to retire at age 62. I am currently an OFW working in Dubai. Could you please advise me as to how much I need to invest annually to have at least something to rely on financially when I retired?

Appreciate your advises.

Thank you and regards,

Romeo

hi sir romeo, I will send you private message. 🙂

Good for us Doc Pinks, we work in the financial industry so alam na natin ito, that’s why we act as early as possible. What about those who have no clue? Such a great article to kick start making that decision to start investing.

Can i repost it in Facebook ? tia

sure po. thanks:)

sure, no problem.

Hi! how do you calculate the amount invested? 🙂

amount invested: amount invested for a year (amount you want to invest Times # of years you want to invest). e.g. 40,000 x 10 = 400,000.

Im confused as to how you were able to compute amount invested at age 65? errr…my previous post was deleted.

hi kenji, you can be able to get it by using the FUTURE VALUE formula using 10% rate. You can use the Excel to do it. 🙂

I was able to search online on how to calculate the amount invested through compound interest. Thank you, but how do I get these kind of amount invested? Is this through the insurance you are offering? or from a policy? Thank you for replying.

hi kenji, sent you an email. 🙂

gusto ko po mag invest kaya lang nakakatakot po sa mga philam life and other insurance… before po nag invest ako ng educational plan, only to find out magsasara ang CAP, nawala lahat… san po ba maganda mag invest

hi Leiah, please read this new post: http://www.myfinancemd.com/what-is-the-difference-between-a-pre-need-and-a-life-insurance-the-most-frequently-asked-question-before-buying-a-life-insurance/

this will remove all your fears!

hi doctor Pinky,

I find most of your posts interesting specially this one. i just want to ask the following:

1. Which among the financial institution has the strongest foundation? I mean, I don’t want to invest in a company like CAP which in the end, It went bankrupt and left all investors hanging..

2.) Are these institution still reliable, lets say after 30 years? Reliable means that I can benefit fully after the maturity of my investments…

2. Do they have always an annual rate of 10%? and are they compounded annually?

Thanks and please post some more retirement techniques.

More power..I will post this on my FB..

hi jun,

i sent a PM to you, i will make you a favor and make you, your own personal retirement plan for free. 🙂

to answer your question: read my new post:

http://www.myfinancemd.com/what-is-the-difference-between-a-pre-need-and-a-life-insurance-the-most-frequently-asked-question-before-buying-a-life-insurance/

thanks. happy reading!

Great table. I have never seen the cost of procrastinatiin quantified as clearly as this post! I want to cry for my 10 years’ procrastination…

Hello Doc Pinky, I was astounded by the figures, the power of compound interest indeed. But mostly amused by the monthly excuses! Sapul ako. =)

My husband and I are both OFW and the reluctance to invest comes from the fact that we are not “physically” there to manage these investments. Sadly there are horror stories where family members failed to remit/pay as instructed. How should we handle our retirement? We are both 37 by the way, with a 2 year old.

Thank you.

Hi Rutchel,

I sent you a PM in your email. I hope you open it. Better kasi if we talk privately for your protection. Will wait your reply on email. If you don’t receive it, you can email me: myfinancemd@gmail.com

Hi doc, can I use your sample table and post it in facebook? Thanks!

Sure sheryl, just kindly indicate you got it from : myfinancemd.com 🙂

Hi po doc pinky, i stumbled upon your post and since then i’ve been visiting your blog in over a week. You’ve given a very outstanding information about finances and i couldn’t be more grateful. I’m 16yrs. old and i’ve come out of my shell to ask you for guidance about insurance and investing. I know im young but im serious about this. And i guess the saying that im too young to start thinking about my future doesnt apply to me. I hope you can help me in this regard.

Thank you and God Bless! 😀

hi frances,

Thank you for your letter. I am happy for you since you are so young. you are one of my youngest that seek a consult. I have an email for you, so that we can communicate privately. email me: myfinancemd@gmail.com