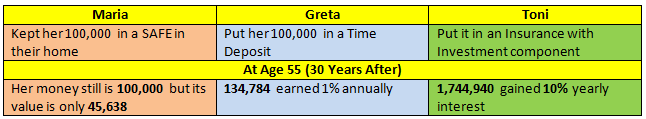

Let me introduce you to my three friends. Maria, Greta, and Toni.

They are all 25 year olds, they are friends, they like saving a lot, but they have entirely different personalities towards money. They also have a common goal, to travel in 5 Asian Countries at age 55 (the same time they want to stop working).

Since, they save a lot, the three of them have a 100,000 fund money to start with, intended for their trip that will happen 30 years from now.

Here they are:

Maria, the conservative one, handles money conservatively. She always wants to play it safe. She has the habit of putting money in the Piggy banks for coins and keeps her cash in a Safety deposit box. Her mantra is, it is safer there.

Maria, the conservative one, handles money conservatively. She always wants to play it safe. She has the habit of putting money in the Piggy banks for coins and keeps her cash in a Safety deposit box. Her mantra is, it is safer there.

Greta, on the other hand is much more modern. She keeps  her money in her savings account in banks and some are even in Time deposits. She knows, that it is safer there and have growth potential due to the interest.

her money in her savings account in banks and some are even in Time deposits. She knows, that it is safer there and have growth potential due to the interest.

Toni, the more candid one, armed herself with fresh concepts. She reads and takes the time to talk to financial consultants. She keeps an emergency fund and necessity funds in banks. But saves up by getting an insurance and investments that she knows, maybe risky a little but potential growth is very possible.

Toni, the more candid one, armed herself with fresh concepts. She reads and takes the time to talk to financial consultants. She keeps an emergency fund and necessity funds in banks. But saves up by getting an insurance and investments that she knows, maybe risky a little but potential growth is very possible.

WHAT DID THEY DO TO THEIR 100,000 fund? WHAT HAPPENED AFTER 30 YEARS?

MARIA

Let us discuss first what happened to Maria. Why is it that her 100,000 is now only 45,638?

You know what INFLATION is? This is the buying power of money. Even though she did not use the money, the money still lost its value.

This pattern indicates the median inflation rate of the Philippines, according to the (National Statistics Office) NSO.

Assuming at 4% inflation rate. The 100,000 pesos of Maria will then have a value of 45,638 pesos after 30 years.

GRETA

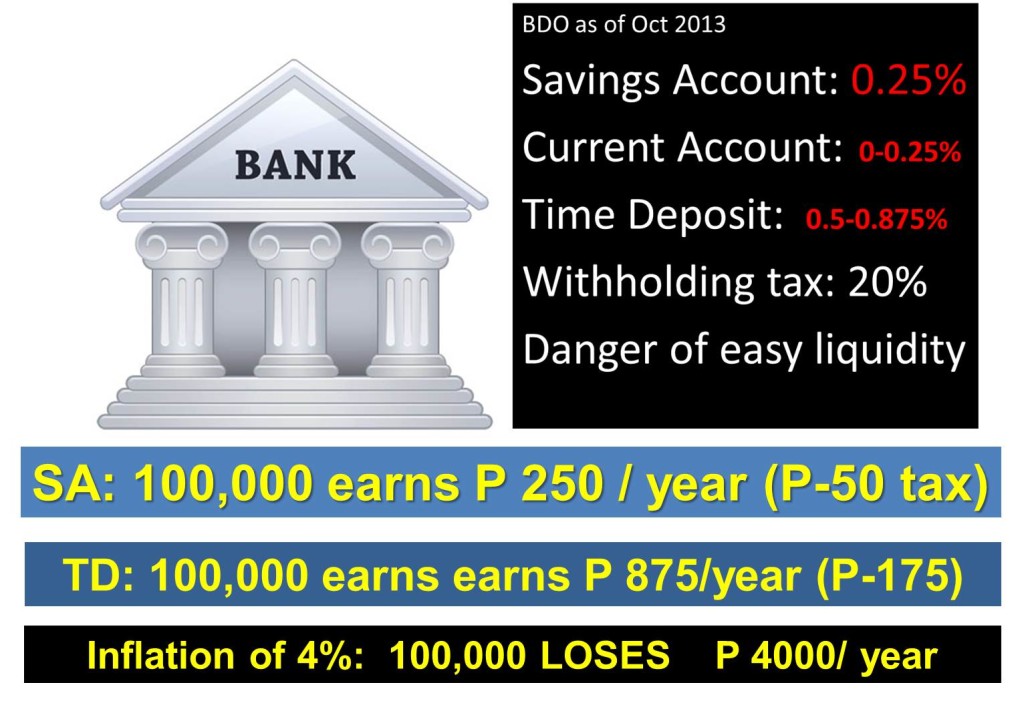

This figure will show you the picture. Account type with its corresponding interest rates.

Savings account just gives 0.25% annual return Vs 4% inflation.

Current Account savings (Checking Account) usually 0% return, only some have a 0.25% yearly yield.

Time deposit on the other hand gives almost 1% return vs 4% inflation (still).

The figure above shows that banks may not be safe after all. Plus the fact that all are subject to a 20% withholding tax.

Don’t get me wrong, but I don’t say banks are bad. They are good. But not good for your money that needs to stay for a long period of time. Banks are ideal places for necessity and emergency fund money.

TONI

Toni, studied the market, she accepted that there may be risks, but she knows that the longer her money is invested, it will just level-off the fluctuations of the market. She also managed her risks by getting an insurance and kept an open mind on the new alternatives of savings. She gained 1,744,940 from the original 100,000, 30 years ago.

So, who do you think of the three kept their money in a much safer place? Who do you think can accomplish the GREAT ASIAN TRIP? Maria may not make it at all. Greta, with the money she has may only go to 1 Asian Country on their list. While Toni can fulfill their Great Asian Trip Dream.

The Lessons here are:

- Begin by knowing the basics. The greatest enemy of money are not thieves, but INFLATION. It eats up your money ALIVE! Even while you’re looking at it.

- Always put your long term money, 2 points higher than Inflation. If you can’t manage that, Inflation will always WIN. It will always be a losing battle.

- Do not consult the people who do not know anything about money handling (this might even be your mom or your spouse). “Well, it depends.” Consult with the Financial experts. They studied and passed exams just to help you.

- Always keep an open mind. Know the Market and plan your goals.

- Lastly, and the most important of all. Don’t just plan. You need to ACT. Always remember:

“Planning without Acting is just Dreaming.”

When it comes to planning your future, NOW is always the best time to start. To learn more about Life insurance or if you need help with your financial plan/ goals, I will help you make it happen. Feel free to contact me.

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Saving in a bank is just having another wallet wherein you can deposit and withdraw money in anytime you need money. It is not a tool to add value to what you already have. In fact the bank uses your money for the bank to earn more than you should. You should put your money where it can grow to a certain percentage that is higher than the inflation rate. By then, you can say thay your money is growing.

Got my point Ms Debbie! 🙂

Thank you…..

Hi Doc. Pinky – just want to clarify if the friends used their money at age 55 or 65. We’re they 25 when they started and waited for 30 years or 40 years? I guess, it’s just a typo.

Thanks,

patient Rey

Hi Rey, thank you for pointing that out. It’s typo. will make the necessary correction. thanks