This is the part 3 of the series on protecting your wealth from Estate tax.

This is the part 3 of the series on protecting your wealth from Estate tax.

See part one of the Series: What is Estate Tax and How it can hurt you even After Death? Part 1 of Estate Planning 101

Let me start this part three with two stories.

Story 1:

This is a story of Lola Mapagbigay. Lola Mapagbigay made her wealth by successfully running a restaurant business with her husband. But then her husband died and left everything to her. She loved her financial independence, which enabled her to take care of herself as a widow and help her children and grandchildren. Since she had difficulty in settling estate tax when her husband died, she asks her lawyer friend what to do. She was advised that to avoid estate tax she needs to distribute her properties while she is alive. That included her food business to her 5 children through (Deed of Sale).

Unfortunately, slowly, her children and in-laws ease her the management of her business. There was nothing she could do. Since, she is not the owner anymore. Now, she said: “before I transferred my properties to them, they would come to me for help, now, I go to them begging for support.

Story 2:

A story about a couple who had only one child. They love their son very much and would not want him to have problems in estate tax when they are gone. The couple decided to put the titles of their properties, including their home under the name of the son.

The son got married and the daughter in law gave birth to their first grandson. They became very happy family since they live in the same house, when tragedy struck, the son died in an accident.

The death of the son – transferred all properties to daughter-in-law and her child. But the sad ending, the daughter-in-law got remarried, and the old couple is forced out of the house since she decided to sell the house.

Stories above are classic stories in Estate Taxes but so you know, they are true and happens every day. It is so sad that a person who worked so hard creating wealth for the family ended up with nothing because of poor planning.

We have already studied the first two settlement options in the second part of this series: Part 2 of Estate Planning 101. This part will discuss the other 3 options.

Previous two were:

- Liquidate Part of the Estate

- Borrow Money at Interest

Now, we go to the last 3 options which are very much connected with the stories above.

3. Donate Properties now (Deed of Donation)

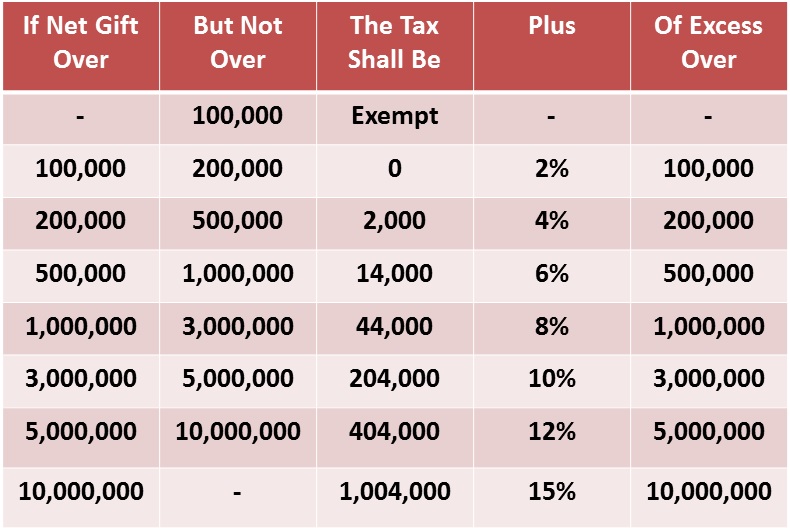

This is the third option that many people do. What they do is, while they are still alive, they transfer their properties to their heirs through Donation. You have to understand that if you want not to get taxed from estate tax, there is still no escape from this. If there is an Estate tax table, there is also Donor’s tax table. As seen below.

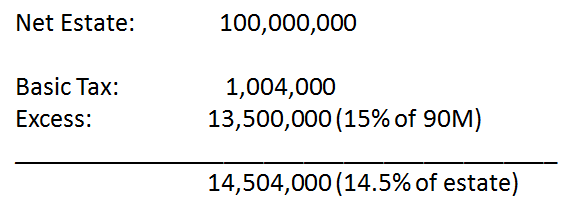

From the table above, if we compute for a 100M worth of Asset or Estate:

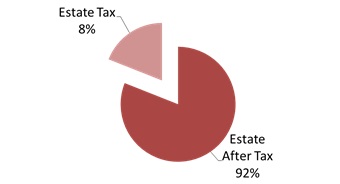

Meaning to say, there is no escape from taxes if you want to donate the properties now. You still need to pay 14M worth of tax. From looking at the pie graph below, you can see that the estate is still not whole. You were still not able to pass your wealth intact.

4. Sell Properties (Deed of Sale)

Another option that other people resort into is selling their properties to their heirs while they are still alive. By doing so, the properties to be sold should be considered Capital Asset and should satisfy the Tax Code. By selling your properties to your heirs, there is still the 6% Capital Gain’s Tax and another 2% for other fees. Meaning to say, there is still a tax, although a lot lower than the previous ones. If we compute it in a 100M worth of estate, it is still 8M pesos worth of tax.

If you look at it, options 3 and 4 are doable and maybe advantageous for some. But, if we go back to the two stories above, these options were probably what they did.

The most dangerous part of the options above is: you are loosening your reins to your wealth while you are still alive. You are giving it away even if you still need it.

From the different settlement options above, you need to ask yourself:

What if, I gave my property now, but my son pass away first? My property goes to your daughter-in-laws you don’t really know before.

What if I distribute my business now, I won’t be the owner anymore? How sure am I that people that I transferred my property with will really take care of me?

As Atty. Angelo Cabrera says in his book, “Thy Will Be Done” – Understanding the What, Why & When of Estate Planning,

“Blood is thicker than water, but money is thicker than blood.”

How many siblings go to war because of money or inheritance? It is all over the news. So, if you think that your sons or daughters will not fight over wealth, well think again.

We are now down to the last option that for me is the best one.

5. Creation of New Estate

What if money can be made available to pay the estate tax?

What if there is a plan that could generate the estate tax money?

This last option that I am going to tell you, is for me, the best option there is. It is also very simple. It is the creation of a new estate through LIFE INSURANCE.

If your estate tax liability for 100M estate is 19.2M, then get a life insurance equivalent to that liability. If you are going to take a look at the pie below, there is no part of the estate that needs to be liquidated just to pay the estate tax. There won’t be a problem in loosing power or ownership prematurely, since you can hold on to it up to the last minute of your life.

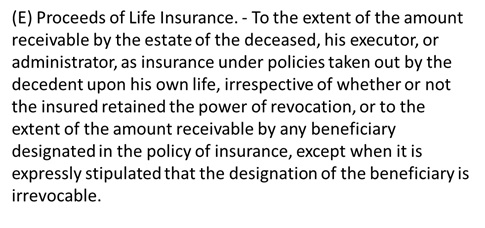

Tax code below will also tell you another advantage of using life insurance as an estate planning tool.

This is powerful because it only means that if you designate your beneficiary as an irrevocable beneficiary, this will not anymore be included in your taxable estate. The 19M life insurance is tax-free. how cool is that?

Although this option is very simple, sad to say, not everyone can do this. Because too often, when people gets interested in protecting their wealth, they are already old and have many diseases that may make them, UNINSURABLE.

That is why if you think you are still too young to be thinking about estate taxes, think again. It is better to set up estate protection as your wealth grows than wait for it to grow first then protect it. It may be too late then.

And if you think you don’t have that sizeable estate to protect now, think backwards, do your parents have an estate they need to protect? Remember, you are their heir. Do you think you can pay the estate tax dues if they are gone? Show them this series and do something about it or suffer the consequences of their inaction.

“If you don’t mind that the Government would be your biggest beneficiary, then you don’t need to plan.”

Helping you protect your wealth,

Sources: “Taken from THY WILL BE DONE – Understanding the What, Why & When of Estate Planning by Atty. Angelo M. Cabrera, ELYON Publishing House,” Tax code of the Philippines and BIR website

Watch out for the next part of the series. Make sure you won’t miss it by subscribing here for free.

Few more good reads:

- Part 1: What is Estate Tax and How it can hurt you even After Death?

- Part 2: Estate Tax Settlement Options: What to do to Protect your Wealth?

- Part 3: What to do to Protect and Conserve your Wealth?: Part 3 of Estate Planning 101

- Part 4: Giving your Wealth too Soon? How will that hurt you too?

- Part 5: The Real Benefits of Estate Planning

Top 10 Life Insurance Companies in the Philippines 2014: Most Updated and Most Unbiased Review

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Can a beneficiary who is a minor be designated as irrevocable? Thank you.

Yes. But you must know the consequences if you do. You cannot change anything in the plan without the signatory of the irrevocable beneficiaries. If the irrevocable beneficiary is a minor, you need to wait until he or she becomes 18, before you can change anything with your policy.

In USA, living trust is the recommended way to protect your assets. Can you create a revocable living trust in Philippines and transfer all the assets in to the trust? Thanks.

Reference below:

https://www.estateplanning.com/Understanding-Living-Trusts/

Possible but still not widely used in the PH. You need to consult a estate tax lawyer who is specifically knowledgeable on that. I recommend Atty. Angelo Cabrera

Is acquiring a property now and having it named to your children (ages 25, 20, 18) a good idea? The title will bear their names and equally partitioned.

The parents are acquiring a separate property also but this will solely be under their names.

Thanks for your help and the info you shared!

Godbless!

Hi Maris, it’s ok if you also know the risks involve. And if you have more than 1 property to give away, it may not be a bad idea at all. Kindly read also the part 3 of the series: http://www.myfinancemd.com/what-to-do-to-protect-and-conserve-your-wealth-part-3-of-estate-planning-101/

Hi Doc,

I just want to ask I have a joint account in the bank as well time deposits with my mom. I made this so that either me or she can transact if one us is not around. In law it will be freeze by the bank if one of us died? It means neither of us can’t withdraw the money? Please clarify my thoughts. Is this applies also with spouses with joint account? And please advise me what options I have. Thank you very much. More power to you.

Regards,

Liz

hi liz, yes, the law states that,”if the bank has a knowledge of the death of a person with an account he owes, or jointly with another, it would not allow withdrawal of the said account.” So, you are right, the account is frozen. If the Band has the Knowledge. I already as that too to a lawyer.

Hi Doc Pinky,

Thanks for publishing this article. I’ve been looking for such article for a while now on how to avoid costly fees when someone dies. Is it possible to create a revocable “Living Trust” and transfer all the assets in the trust? This way if one of the trustors (usually husband and wife) dies, the successor in the trust continues to manage and owns all assets in the trust. Thanks.

In the Philippines, trust as estate planning tool is not widely used pa. But yes, it is possible, but, since it is revocable trust, it is still subject to full estate tax. You can consult a estate tax lawyer for that.

This is the best explanation I have ever read. I read the “millionaire next door” but i didn’t understand how the rich evade such taxes when death comes. Thanks a lot Doc. I am afraid of subscribing because it brings me to another site but i have bookmarked your blog.

Thank you James. Tell me what else I can do for you. 🙂

Wow! Thank you so much for sharing this very well explained about the importance of estate tax.

Dear Dr. Pinky –

You might want to correct the fourth row 3rd column of the donors tax table above.

God bless.

Atty. AMC

Got it. Thanks Atty. 🙂

Donor’s table corrected.

Hi Doc,

I don’t quite understand the fifth option which is “Creation of a New Estate.” Let’s take your example. Does this mean getting an insurance (which I believe that for a life insurance equivalent to 19.2M, the actual cash you will pay is less than that), and this will be used to pay the estate tax liability?

Thanks.

basically, yes. get a life insurance equivalent to the estate tax liability.

Hello Doc,

The Insurance Code says that if a revocable beneficiary hasn’t been changed during the lifetime of the policy, it is deemed irrevocable. However, the tax code says that in order for a life insurance proceed to be tax exempt, the beneficiary should be defined as irrevocable EXPLICITLY. Can you enlighten me about this?

Thanks!

yes that’s true but from my readings, usually tax code will be followed on this. So better to change na lang.

Dear Dra. Pinky,

What if I register a corporation (with me and my wife as main controlling directors & shareholders and my heirs as minority shareholders), and transfer all my properties to the company as my in-kind capital investment. Will there be a tax in the transfer of my properties to the company? If me or my wife dies, then our heirs can continue to operate the company and do not have to pay a very large estate tax (only on the estate tax computed on the value of our shares in the company which we can keep to the minimum by including “friendly” shareholders who will endorse their shares back to us and my heirs without the latters knowledge to avoid ceding control of management while we are alive).