“Baka katulad yan ng CAP, baka bumagsak din ang kompanya na yan.” One of the most common remark or question I have heard in life insurance industry.

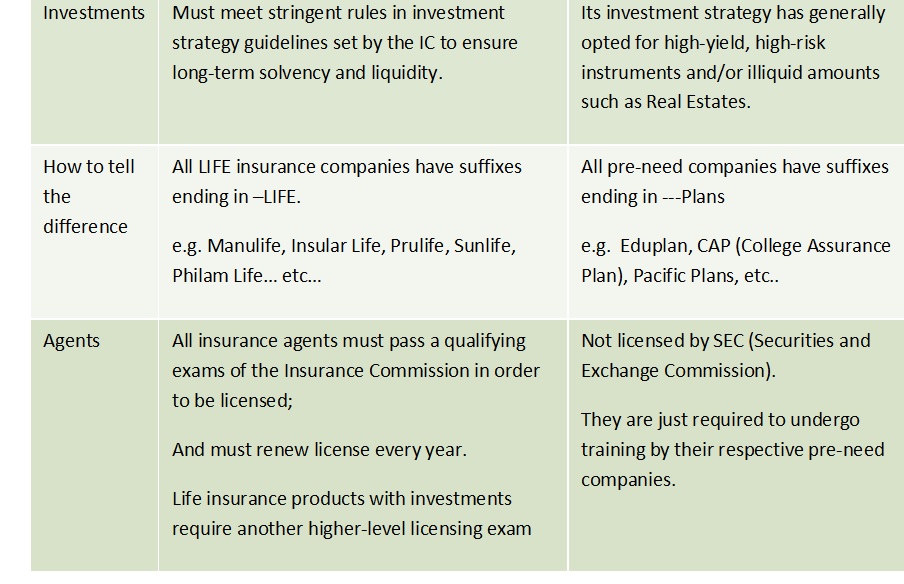

I don’t blame people from thinking that way, since, I, myself, was a victim of pre-need education plans before. But since now that I know better, what I do is to educate people the best that I can. But before jumping to any conclusions, I would like to help in educating the public. The difference between “life insurance companies” and “pre-need companies.” Here are several points to consider:

It is important to observe what is “open-ended plans” means.

If we are to trace back our country’s history. Do you remember the regulation of petroleum in the country? Do you remember that before 1992, oil was regulated by the government? Meaning, petroleum companies that time were being controlled by the government? When only Shell, Caltex and Petron existed that time? Then 1992 came, “regulation” becomes “deregulation” meaning prices are now not controlled by the government.

If you remember now, not only oil/petroleum was regulated, but also, education (tuition fees), health care system, shipping industry and many others.

The PRE-NEED industry now became in trouble. Since they have an “open-ended plans” — they made their promises (education tuition fees) before the deregulation begun. Tuition fee skyrocketed and continues to do so until now, with around 10-15% annual increase. To add up to the existing problem, the pre-need industry did not stop at selling open-ended plans even after the deregulation begun. As a consequence, pre-need companies begun failing in fulfilling their promises.

I, too, was a victim of the circumstances that time. My mother got an education plan for me (pre-need company) and when it was time for my college, they just gave 10,000 every school year. From previously promising whatever the prevailing tuition fee that time.

Although differences do exist between the two industries, both can mutually work together to serve the financial needs of an individual person in terms of protection, savings, and wealth conservation. What is important to consider is the capacity of these companies to uphold good governance, and to handle their operations well in a manner that protects above all, the interest of their policy holders.

I am not saying it is not good to get a preneed plan nowadays, but be aware of an open-ended offers. And make sure the company you are dealing with is trustworthy. I hope this post will clear up questions in the mind of the public. This link will show a list of distressed preneed firms and pre-need companies that are slowly disappearing. And after reading this post, I know now, you are educated.

If you have any questions, or you think you are now ready to get your own life insurance, feel free to contact me!

READ MORE:

- Top 10 Life Insurance Companies in the Philippines 2015

- 7 Life Insurance Riders You Need to Know that could Save Your Life

- TERM Life insurance, the Cheapest Life insurance Ever!

- 3 Genius Reasons Behind VUL (Variable Unit Linked) Insurance

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Love your article doc Pinky! This will definite help us financial advisors to answer this type of question because it is often being asked by our clients. People have this misconception that pre-need companies and LIFE insruance companies are the same. your article will help educate people regarding the difference. Thank you for sharing this information doc.

glad to be of help martin!

Hi Doc, great job!

Love the infos I get from your articles. May I raise some questions/ clarifications?

I was informed that ‘open-ended’ preneed plans are now ‘sanctioned’ or not allowed by the SEC anymore (I assumed it is still the regulating body).

Second; that they are also regulated by the same body to set aside 5% in cash and only almost 10% for high yielding instruments like stocks, contrary to what I’ve read in this particular article. Further, the rest or the bulk of the percentage goes to short term investments and therefore, you can calculate or conclude that pre-need plans may give you a little as much as the prevailing interest rates? Thanks so much.

Gud pm ms pinky,i begin eip at bdo year 2012.ask ko po kung good move po b yung ginawa ko?im only a housewife and sad to say wala po akong alam pagdating sa investing.i am dreaming to achieve a financial freedom someday pero ndi ko po alm kung panu ko un magagawa?ask ko n rin po kung wise po ba kumuha ng traditional life insurance?meron po kc s generali offer.maghuhulog for 10yrs ng 23k then when i die my family will receive 1million.tnx po and godbless!

Hi ms Geraldine sorry sa late reply. Insurance is always a need especially if you have dependents. Just make sure you have a trusted company and trusted advisor as well. Just read on. You may contact me for a lecture on how to really reach your goals thru investments. I can teach you how. Here is my email: myfinancemd@gmail. Com

Very informative article.

Hi Doc Pinky, How about mutual funds? Most of them are open ended. Can investing in them pose risk of losing your hard-earned money as well?

Hi, yes, you can lose money in mutual funds because it is an investment. But you will only lose money there if you go out when market is low. It’s all about timing when to go out. And mutual fund is totally different instrument from insurance and pre need products. Mutual funda is pure investment. 🙂

Hi doc, i have variable life insurance…im thinking of just making top ups as my investment…i thought it would be the same as putting my money in mutual funds coz im going to pay fund managers just the same…in the company im in, they will just take 5% from my top up and put the rest to investment..i think it more aor less the same with putting it to a mutual fund….is this analysis right or not? Thank you.

Yes, that would be fine. It will also effectively increase life insurance coverage to 125% of the top up.

Dr. Intal,

May I know your thoughts (including similarities, differences, advantages, and disadvantages) what is better between a life insurance and a health insurance?Can I request that your reply/advise be also sent to my email address I wrote on the space provided in this article? Thank you in advance.

hi, you can read about your question in this post:

http://www.myfinancemd.com/differences-health-insurance-hmo-philhealth/

Hello Doc. 🙂 I read this post of yours last week. I also downloaded your free e-book. I am a new Insurance Agent. Your blog is very helpful. Thank you. 🙂

Thank you