“I am prepared for the worst, but hope for the best.” ~ Benjamin Disraeli

We all face risks: risks of early death, getting sick, meeting an accident and facing disability. Insurance is a way we can be prepared for the worst. Since all the risks not only come with pain and suffering but also can hurt your finances.

This is an update of my previous posts:

It’s November 2015, the Insurance commission has already released the 2014 ranking of the top insurance companies in the Philippines. They usually release the rankings of the previous year every August of the current year.

Since this is an unbiased review, I will not only highlight one category just to make one insurance company look good. I will be enumerating all the rankings in all categories from the Philippine Stock Exchange (PSE) and Insurance Commission (IC) and now I included Forbes. That’s why this is an UNBIASED review.

First Category: Top Companies in the Philippines, According to Market Capitalization by the Philippines Stock Exchange (PSE)

Investopedia defined Market Capitalization as – the total dollar (Peso) market value of all of a company’s outstanding shares. Market capitalization is calculated by multiplying a company’s shares outstanding by the current market price of one share. The investment community uses this figure to determine a company’s size, as opposed to sales or total asset figures.

Please note from the 20 companies in the Philippines stated below only 2 companies are from the insurance industry. Manulife Financial Corporation still landed at the number 1 spot with 1.3 Trillion Pesos Market capital, and Sun Life Financial Inc. still in the second place with over 870 Billion Market capital.

Source: Philippine Daily Inquirer

Second Category: Top Insurance Companies, According to Net worth by the Insurance Commission (IC)

Investopedia defined Net worth as – The amount by which assets exceed liabilities. The company’s net worth is calculated by subtracting the liabilities from the assets.

The leading insurance company is now Philam Life (28B worth of Net worth) who came in second last year. Insular Life now went down to second place from previous top place last year.

Source: Insurance Commission

Third Category: Top Insurance Companies According to Paid-Up Capital by the Insurance Commission (IC)

Investopedia defined Paid-Up Capital as – The amount of a company’s capital that has been funded by shareholders. Paid-up capital can be less than a company’s total capital because a company may not issue all of the shares that it has been authorized to sell. Paid-up capital can also reflect how a company depends on equity financing.

The leading insurance company in this category from last year and still is: Generali Philippines with 1.5 B Paid-up capital

Source: Insurance Commission

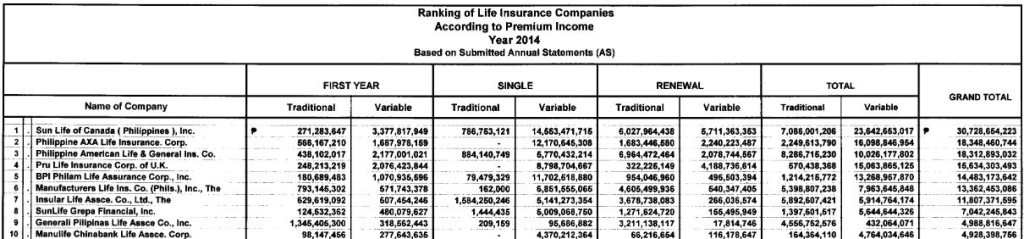

Fourth Category: Top Insurance Companies, According to Premium Income by the Insurance Commission (IC)

Investopedia defined Premium Income as – revenues that an insurer receives as premiums paid by its customers for insurance products. When a customer purchases an insurance product, such as a health insurance policy, the customers cost for a specified term of the policy is called the premium.

The leading insurance company in this category from last year and still is: Sun Life of Canada (Philippines), Inc. with over 30 B Premium Income.

Source: Insurance Commission

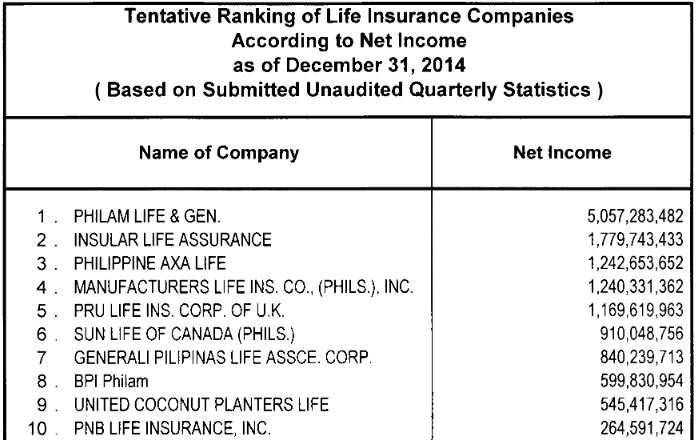

Fifth Category: Top Insurance Companies, According to Net Income by the Insurance Commission (IC)

Investopedia defined Net Income as – company’s total earnings (or profit). Net income is calculated by taking revenues and adjusting for the cost of doing business, depreciation, interest, taxes and other expenses.

The leading insurance company in this category is: Philippines American Life (PhilAm) with over 5B Net Income.

Source: Insurance Commission

Another Category: World’s Top Insurance Companies (by Forbes)

This is a new category I am introducing. Not all companies here are in the Philippines but some companies are. Although you have to take note that the companies as follows focuses on insurance companies with the largest revenues across the globe (in no particular order).

This list is of No Particular Order as of January 2015: (Investopedia)

(highlighted are Insurance companies that can also be found in the Philippines)

AXA

Zurich Insurance Group – Zurich Life Philippines was acquired by Manulife Philippines (2003)

China Life Insurance

Berkshire Hathaway

Prudential plc – this includes Prudential UK

United Health Group

Munich Re Group

Assicurazioni Generali S.p.A.

Japan Post Holding Co., Ltd.

Allianz SE

Some of the other reputable names in the insurance business are:

- Manulife Financial Corporation (MFC)

- ING Group (ING),

- Prudential Insurance Company of America (a subsidiary of Prudential Financial, Inc., PRU),

- AIA Group Ltd., Ping An Insurance Company of China, Ltd.,

- American International Group, Inc. (AIG),

- MetLife, Inc. (MET). – Metlife Philippines was acquired by Manulife Philippines (2002)

Read more:

World’s Top 10 Insurance Companies

Although I represent a great insurance company, I dare say, all life insurance companies are very much the same. They are all stable, have solid foundation and all are reliable.

If until now you are still scared that insurance companies may fall short of their obligations, see here:

For me, the more important thing that you have to consider in selecting the right plan for you is choosing the right and reliable insurance agent/financial advisor that you can depend on. The right insurance agent for you will understand you and will guide you on the best possible plan that will suit your financial goals and budget.

Read “5 Insider tips on choosing the right Insurance Agent/Financial Advisor for you.”

In buying a life insurance, don’t let procrastination get in your way. If you don’t know anyone that can guide you in choosing the best policy for you, let me help you with that.

You may contact me here.

Good luck on finding your trusted Insurance Company and Financial Advisor,

Related readings:

- The Top 10 Life Insurance Companies in the Philippines The Most updated and Most Unbiased Review 2014

- Life Insurance, How much is Enough?

- 10 Things You Really Should Know About Your Life Insurance Policy You Never Knew

Sources:

Insurance CommissionPhilippine Daily Inquirer

Philippines Stock Exchange, Market Capital Category

Investopedia

To all Financial Advisers out there or those who wanted to be one:

I invite you to level up your financial advisory career! Get this Ebook for FREE! Click Here.

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Hi Dr. Pinky! I am one of your avid readers. I want to ask why did you include Market Capitalization even if not all Insurance Companiea are publicly listed in the PSE?

Hi Josh, I need to include all the categories. Market Capitalization is one of the standard category in ranking life insurance companies even around the world.

Only 2 insurance companies in the Philippines are open for public ownership.

yes. I just placed all categories for public to see that rankings have different categories Ron. Thanks. 🙂

hi Dr. Pinky i just want to ask about kaiser health insurance im searching for it but its not here. Do you have any idea about this health insurance? Thank you for your patience to reply.

hi Kaiser health insurance is an HMO. not a life insurance kaya it i did not include it here. I may post about HMOs in my future blog posts so please do watch out.

okay po Dr. Thank you very much

Hello Dr, I just want to ask, among all of the categories listed above which would be the most useful basis as to the stability of the insurance company since investment to them is long run. I’m planning to get insurance plan but not yet decided on which company. I hope you can help me Thanks in advance!

Hi Jane, market capital is a major factor since it is the “price tag” of a company. “Net worth” also is a good basis.

Thanks again Dr. Pinky for another useful information. I have just read your other later blog about these Top 10 Life Insurance. I am researching right now because my husband have some insurances already and that includes Kaiser which I learned from here that it is an HMO. I will be getting my own insurance by next week and I feel like based on your blog is that we are on d right life insurances 😉

Glad to be of help. In case you want me to be your financial adviser, contact me in my email: docpinky@myfinancemd.com 🙂

Hi po Dr. Pinky, gusto ko lang po itanong kung ang Benlife insurance po sa ngayon ay stable pa rin po ba…kumuha po kc ako. Gusto ko po kc malaman kung tama ba yong napili kong insurance. I hope you could advise and thanks in advance.

Hi Jef, you can look up on it. Look into the website of Insurance commision of th Philippines. If it’s there, then that’s good.

Good Day Doc.

I’m a little bit concerned. I got a life insurance from Pioneer just recently. A friend of mine recommended it and arranged a meeting with the Financial Advisor. Though it was explained to me the perks of the product but I’m still confused with the “stock market” thingies, “maturity”, net worth. etc and alike. Furthermore, I don’t even know what product I have availed, specifically since I really don’t have any idea with these kind of stuffs and I was in hurry during the meeting I wasn’t able to ask questions. I felt like I was forced to make a decision right on that moment and I don’t know if I should continue it or not. Any insights Doc? Badly need it. Thanks. Your reply would be very much appreciated.

Hi JP, sorry for the late reply. Did you pay na already? Please email me for better communication. docpinky@myfinancemd.com

thank you so much Doc for taking the time to read and reply to me. I already emailed you na po 🙂

naguluhan ako sa name. Anyway, I have a reply na to you in your email. Check it out. 🙂

Hi Doc Pinky, OFW po ako, ayos ba na ung wifey ko na lang po ang bilhan ko ng insurance, sinc emy owwa, phil health and PAG-IBIG naman po ako. Thanks sa reply.

hi Marlon, I sent you an email. kindly check, so that we can talk privately. Here is my email in case: docpinky@myfinancemd.com

[…] Top 10 Life Insurance Companies in the Philippines 2015 […]

[…] Top 10 Life Insurance Companies in the Philippines 2015 […]