Egypt’s pyramids, are one of the oldest structures of the world. Perhaps, the very reason that it existed for more than hundreds of years and up to now, is because of its very form. A strong base is built first at the foundation which held up the whole structure up to the summit.

The same thing when it comes to money matters. When it comes to a financial pyramid, a very good foundation can make your finances unshakeable, strong and solid. In order to build a very good foundation, you should learn how to follow a certain order of building it.

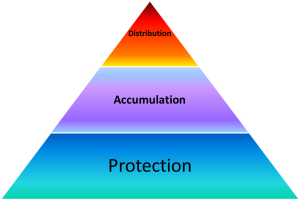

Starting from the bottom, which is protection, followed by wealth accumulation and finally, wealth distribution and preservation at the tip.

Let me discuss with you the Order:

1. PROTECTION: BUILD A SOLID FOUNDATION

These include:

Risk Protection: Life insurance, Critical Illness Insurance, Total Disability Insurance,

Auto and Home insurance

Debt Reduction

Will writing

Emergency Fund

Starting Systematic Fund

- Life is full of uncertainties, be sure you will always have a fall back in cases of unexpected occurrences in your life like early death, critical illness or disability.

- It is likewise important to have an Emergency buffer fund, which is money saved for emergency purposes.

2. ACCUMULATION: GROW WEALTH

Investing

Diversification

Retirement Planning

- Once you already have protection, it is time to grow your wealth thru accumulation by investments. Saving in bank is a bad idea if you want to grow your money. Here’s why.

- This is also the best time to plan for your retirement. Always remember, the FUTURE is longer than the present. If you are working only for the PRESENT, what will happen if you stop working? Life has to continue. The money you saved in the present will be spent in the future, make sure it could last you until your last breath.

- Diversify your investments, don’t put all your eggs in one basket.

3. DISTRIBUTION: WEALTH PRESERVATION

Retirement Income

Long-term care

Estate Planning

- Once you have accumulated your wealth, it’s time to protect it and make sure it stays with you and your family. Learn how to spend your retirement income and protect your estates from tax thru Estate Protection. More details to come in the next few posts.

I discovered that many Filipinos are now beginning to really like INVESTING. They love growing money and building wealth, which is respectable. But most jumps ahead to the 2nd part of the pyramid without protecting oneself first. That would not stand for a very solid pyramid.

- What will happen if the investor suddenly became ill?

- What will happen if the investor dies prematurely?

Always begin at the bottom going up, never up going down. It is important to construct a solid base first by laying aside money for emergencies and insurance. Then work yourself thru investment, then learn to protect your wealth.

Start your financial fitness now! Learn the basics and start building your solid foundation now. Subscribe here.

Let me invite you to take the challenge of knowing your Financial I.Q. Click Here!

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Thanks doc pinky sa mga articles nio.madami akong natututunan.godbless and more power!-geraldine

Thank you po. See you soon.

Hi, may I ask, investing in a business is part of accumulation level right? Thank you very much!

Yes. 🙂 but be sure you also have good foundation (protection)

helpful article..i like it