If you think life insurance is very expensive and if you believe they are only for the middle class and rich. Well, think again, if you can smoke 5 cigarette sticks a day or waste some coins in the wishing well. You can might as well get yourself a life insurance. That’s what we call Term Life Insurance.

If you think life insurance is very expensive and if you believe they are only for the middle class and rich. Well, think again, if you can smoke 5 cigarette sticks a day or waste some coins in the wishing well. You can might as well get yourself a life insurance. That’s what we call Term Life Insurance.

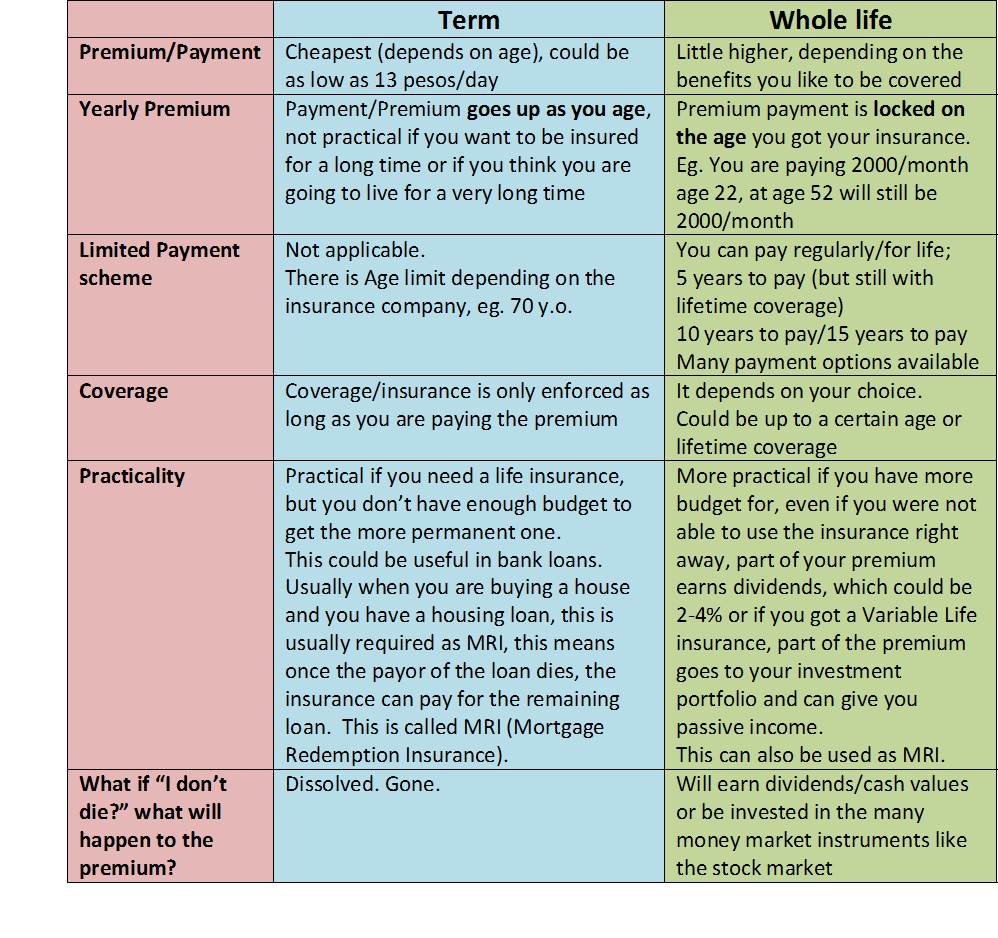

Term life insurance is a life insurance, which provides coverage for a fixed payment for a limited period of time. After that period expires, coverage becomes nulled. In simple terms, Term insurance means Temporary insurance. It is the cheapest life insurance you can get. But, it depends on your age. It may be as low as 400 pesos per month or roughly 13 pesos per day.

As compared with a Whole Life Insurance, which is a more permanent plan. This is usually the normal policy, you can get to an insurance company. This is almost always the plan that is being proposed by an underwriter. Permanent life insurance has different types.

For a much easier reading and for the sake of comparison.

If you guys still don’t get it. Term insurance is like a Car Insurance. If nothing happens to a car for the entire year, your 30,000+ premium you paid in your Car insurance is expired. But however, almost everyone, especially with a young car, gets a car insurance since they need a car insurance in case of damage or potential accidents while driving. That is Term insurance.

Well, not all is lost with Term insurance. It is still better than having no life insurance at all. And the best thing in it, is its COVERTABILITY. It could be converted to a permanent insurance with no need for health declaration as long as the policy is enforced. So, if you need an immediate boost to your insurance coverage, especially if you are expecting something like a loan, or you want a coverage, but still do not have money to get the more permanent plan, this is the way to go.

But before purchasing one, consider know first the terms you need to know in buying a life insurance. Continue reading here.

When it comes to planning your future, NOW is always the best time to start. To learn more about Life insurance or if you need help with your financial plan/ goals, I will help you make it happen. Feel free to contact me.

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

i love all your articles , i learn a lot that now I'm an insurance advisor ,, keep it up! God Bless dra. pinky. 🙂

I learned a lot from your ebook and all the articles i read. Thank you so much…. God bless u and more power !

Thank you Dra.

Good day. In the Pre-Need Code of the Philippines the following examples of pre-need plans were enumerated: life, pension, education, internment, etc. I would like to know what is the difference between a pre-need life plan and a life insurance?

http://www.myfinancemd.com/what-is-the-difference-between-a-pre-need-and-a-life-insurance-the-most-frequently-asked-question-before-buying-a-life-insurance/