When I say Lazy Investor, it does not mean a lazy person. It may mean a busy person, too focused on his work, career and studies and does not have enough time to study other things like investments. Maybe a doctor busy taking care of his patients or other career that occupy so much focus and concentration. So he delegates his investments to people who are learned and experts on that, for a certain management fee.

Allow me to share to you the different investment instruments you can use if you are one of these people.

Before that, let me discuss first the 3 prerequisites of wealth: Money, Knowledge and Time.

If you are going to ask me, which one is the most important, I would say TIME.

With money: any extra money you have, be it small or big, you can invest that.

With knowledge: having a little knowledge can be enough in investing. As I told you before, if you are too busy with your life, you can delegate investing to investment experts for a small management fee. In short, knowledge can be bought. You also call this, PASSIVE INVESTING.

Of the three, TIME my friend is one thing that cannot be bought; it is also one thing that if you have so little, it would cost you a lot.

This is greatly illustrated in Compounding Interest, that Albert Einstein introduced to us, he said it was the 8th wonder of the world.

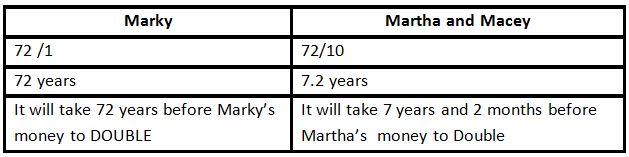

Albert Einstein Formula:

Rule of 72: Take the number 72 and divide it by the annual rate of interest that your money is earning to determine the number of years it will take your money to double.

Example:

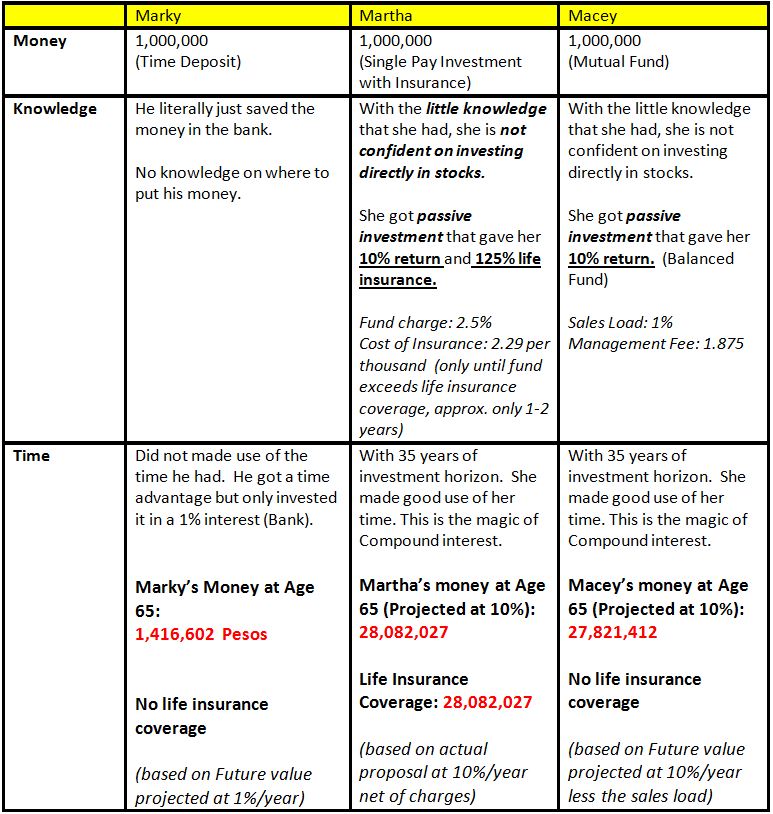

Marky, Martha and Macey are siblings, (triplets). When they were 30 years old, their dad passed away and left them with 1M each as inheritance. Being too busy with family and work, they decided to save or invest their 1,000,000 in different financial instruments.

Marky, being the conservative one saved it in Bank (as Time Deposit) he is scared of investing it in other ways since he thinks that he may lose it. The TIME DEPOSIT gave him 1% return per annum.

Martha invested in Single Pay Investment in an Insurance company. It gave her 10% return per annum and a 125% life insurance.

Macey wanted it in a pure passive investment instrument, called a Mutual fund. It also gave her also a 10% per annum return.

How many years would it take for their money to double. Based on Einstein’s formula.

72/interest rate = No. of years to double your money

Now let’s compare their Money, Knowledge and Time:

How about your money?

Where is it right now? In the bank (time deposit) or in your safe? How safe is it? How much is it giving you? Use the Einstein formula to know when will your money double its value.

In passively investing your money, there should always be a goal in mind. It is like going to your destination with a driver instead of driving your personal car yourself.

It is like going to Baguio where there are two types of bus to choose from. One bus is going there with travel insurance and the other going there without.

With almost the same investment return, which one would you use?

Which one can give you the assurance that if in case, you will not be able to get there, your family will still get back your bus ticket?

Invest wisely,

Let me help you invest your money while you are busy taking care of other things. Contact me here.

Read More:

- Saving Millions in Bank, How Safe it is?

- Hurdles of Financial Freedom (Mga Balakid sa Iyong Pag-yaman)

- What to do to Protect and Conserve your Wealth? Estate Planning Part 3

- 6 Secrets of Becoming the Rich Doctor your Family and Friends Think You Are

Addendum:

Single Pay Investment with Life Insurance – minimum investment is usually around 75,000 (depends on life insurance company. Top-up (additional investment) is allowed.

Mutual fund investment – minimum investment is 5,000. Top up is allowed.

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Hello Doc! Very nice article! Question though, with Martha’s single pay plan, why is the fund value the same with her life insurance? It says her life insurance is worth 125% of her initial premium (if I’m not mistaken)? Shouldn’t it be more than 28M, probably 29M (plus 1M initial premium)? Thank you 😊

Hi Sarah, at the start, the insurance is 1.25M for a 1M investment. Once the fund value exceeds the 1.25M, the life insurance follows the fund value. Hence, no more charges on cost of insurance (COI).

Hello! Thank you for this wonderful read. Just want to know which company is offering a Single Pay Investment with Life Insurance.

Thank you.

Almost all insurance companies offer this kind of investment. 🙂

Hi Doctor Pinky, a follow-up question of Sarah’s question, once the fund value exceeds the Face Amount, no more charges on the cost of insurance, but, how about the management fee and/or other fees? Are there no more charges too?

hi, sorry for the late reply. If the fund value exceeds face amount, yes no more Cost of insurance. The management fee depends on what fund you chose. could be 1.75% – 2.25% depending on the fund you chose (bonds or equity) but from the example, the value I showed charges are already deducted from it. Since it is based on actual proposal.