Are your finances in 2016 – just barely breathing?

If the answer is yes, then, it’s time to do the CPR, before it’s too late.

C – Communicate

P – Plan

R – Review

Communicate

If you are married, has a partner or part of a family, then, preparing family finances is more than a one person job. Make sure you sit down with your spouse or partner or significant family member to talk about finances.

Communicate and work together for this year’s finances. Budgeting, preparing for family emergencies/uncertainties, financial goals planning and savings will be your topics for discussion. The most important thing is to COMMUNICATE and TALK to each other.

Plan

The moment you made your DREAMS into a PLAN, it becomes your driving force to make it real.

Steps in Planning:

- Identify your goal.

- How much will that take you to make it?

- What will you do to make it a reality?

“Don’t call it a Dream, Call it a Plan!”

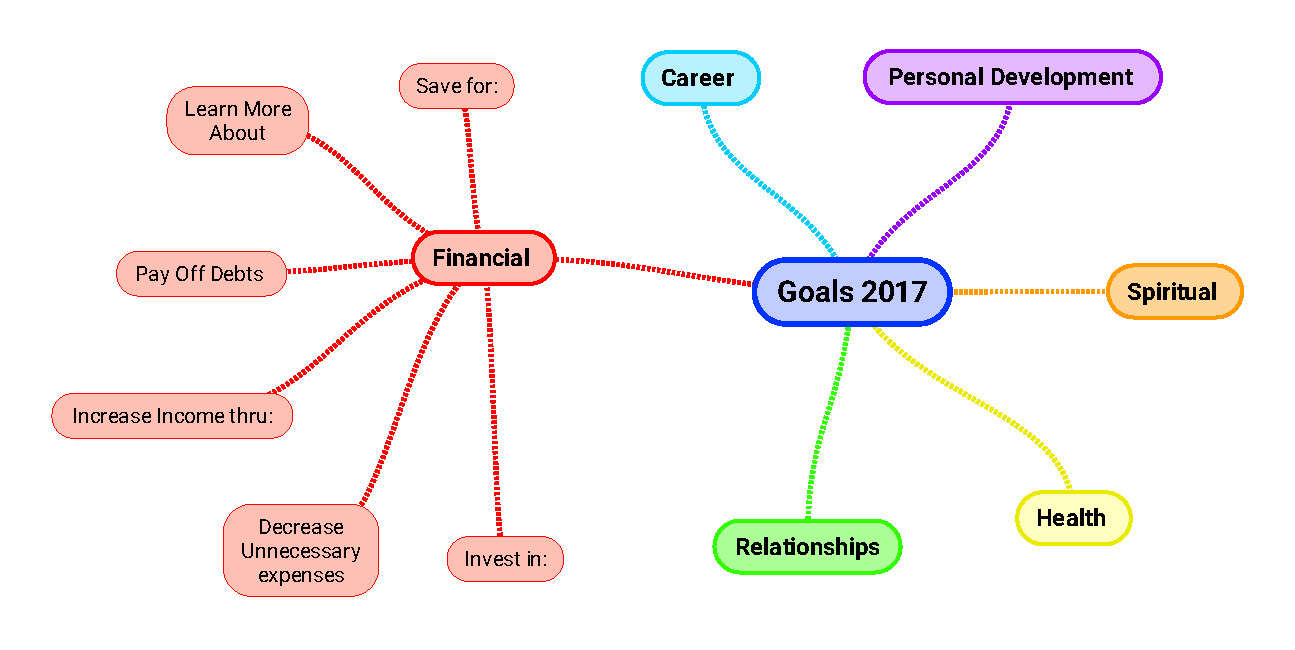

It may be useful to use a mind map template like this in brainstorming with your plan. Just fill in the blanks.

Download PDF version of this template here. Fill in the blanks.

Review

It’s good to learn from your past. Your last year’s finances, if properly recorded will be the backbone of your present year’s financial plans. It will tell you what should not be done, the mistakes you don’t want to repeat and the things that should have been done; hence, the things you would want to pursue this year.

Let me share my latest financial report of my family and you can do it too.

See the snapshot of our Family Financial Report below.

Family Financial Report includes:

- Income and Expenses for the whole year.

- I use this APP to record my income and expenses last year. This yer, you can use it too. See post.

- Use excel for graphs.

- Latest Net Worth.

- Debt Consolidation and Update.

- This summarizes the present outstanding balance of your debts and the date of its maturity.

- You can use SNOWBALL TECHNIQUE in this POST, to help you pay off your debts easier. Download the excel file.

- The Family’s Financial Goals

- Which I showed you in the above template. Download the template above.

Knowing where you are right now and where you are going are the first steps towards financial recovery towards fulfillment.

Activities we did while discussing our own Family Financial Reports:

- jotting down ways on how to increase income and decrease; unwanted expenses.

- how to increase Net Worth monthly;

- setting up new income generating activities; and

- setting up goals and learning from the past.

Me and my Husband, planning together:

Achieving success in your finances depends on you. The ability to sit down, communicate, plan and review is the way most geniuses designed their masterpieces. – MYFINANCEMD

Helping you resuscitate your Finances,

Your Finance MD,

If you want to start planning but don’t know how, let me help you:

Contact me here!

Read More:

The New Money Saving Challenge this 2017:

How to Compute your Net Worth:

Debt Consolidating and Snowball Technique

For Doctors:

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Downright impressive! Again, I learned something new just from this post alone. This is really worth emulating. Many thanks.

Thanks Nhel. Share away. 🙂