It’s now April, summer vacation and tax time! To my fellow doctors, please don’t forget to file for Income Tax Return on or before April 15 to prevent penalties.

It’s now April, summer vacation and tax time! To my fellow doctors, please don’t forget to file for Income Tax Return on or before April 15 to prevent penalties.

There are three kinds of charges or penalties in the late filing of Income Tax Returns, namely:

- Surcharge

- Interest

- Compromise

Case #1: This is a case of a 38 year old doctor who loves to procrastinate. Dr. Teka Lang was not able to file on time due to so many reasons and so much procrastination. His tax payable is 10,000 pesos. He was able to go to BIR to file his ITR only after 10 days.

How to compute for the charges:

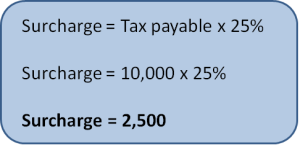

- Surcharge – a 25% surcharge is imposed on a taxpayer for failure to file the ITR on or before the due date.

The following cases will warrant surcharge of 50%:

a. In case of willful neglect to file the return on time

b. In case of false of fraudulent return that is willfully made

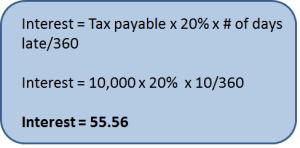

2. Interest – 20% per annum is used or such higher rate as prescribed on any unpaid amount of tax, from the date prescribed for the payment until it is fully paid

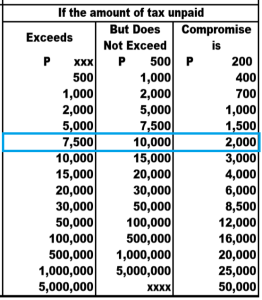

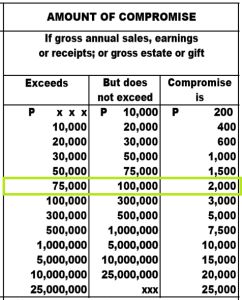

3. Compromise – we need to refer to Revenue Memorandum Order 10-2007 for the table of Revised Schedule of Compromise of Penalties

3. Compromise – we need to refer to Revenue Memorandum Order 10-2007 for the table of Revised Schedule of Compromise of Penalties

Compromise penalty for Dr. Teka Lang is 2,000 pesos.

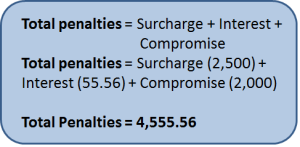

Now, let us total it:

Total Tax to be paid = Tax Payable + total penalties

= 10,000 + 4,555.56

= 14,555.56

Since Dr. Teka Lang likes to procrastinate and did not listen to warnings of filling on time. Instead of paying only 10,000, he ended up paying 14,555.56.

Diagnosis: Dr. Teka Lang has Procrastinatinosis Type I

Recommendation: File earlier next year

Case #2

This is a case of a 28 year old doctor. Dra. Dina Lang, the younger sister, is just a freshly board passer and had done few moonlights and duties. Her total earnings for the entire time she was working was only 80,000 gross income. There was no tax due on her return upon computation. Because of that, she opted not to file on time. Thinking, “I have no tax due.”

Is there a penalty?

If there is no tax due, in your return you are still required to file it on the time required by law. If you file late, there is no interest and surcharge to be computed, but there is still a compromise penalty based on your gross annual sales, earnings or receipts.

Dr. Dina Lang, now needs to pay 2,000 pesos instead of not paying anything.

Diagnosis: Dr. Dina Lang has Procrastinosis Type II

Recommendation: File earlier next year

Lessons:

- Gather all the necessary documents from your employer or institution where you work. Forms 2307, 2316 especially if you are in mixed income.

- File on or before April 15. Better if before to prevent long lines on the last day.

- Don’t believe anyone if they say there will be an extension of the deadline, because there won’t be.

- If you like my tips, and be up to date, subscribe here.

- If you like to help our colleagues hit the “Share” button below.

Update on the TRAIN Law 2018:

Helping you,

Do you want to retire young and rich? Ask me how.

Further Readings:

- Part 1: The Ultimate Guide on How to Register as a Doctor/Physician in BIR

- Part 2: How to Issue Receipts: Guidelines for Moonlighters/Starting Private Practice

- Part 3: How to file INCOME TAX RETURN as a Physician

- Part 4: Penalties for late filing of Income Tax Return

- 6 Secrets of Becoming the RICH Doctor Your Friends and Family Think You Are

- Part 5: How to Compute your Income Tax Return

- 8 Facts Doctors Need to Know About the TRAIN and How it will Impact your Income Tax

Credits to: BIR and my personal accountant Ms.Gina Pascual.

Disclaimer: Though this article was based on reliable resources and comprehensive research, this article was provided for educational and informational purposes only, and doesn’t constitute formal professional advice. New laws, rules, issuance, and regulations may render this article obsolete or inaccurate in whole or in part. For more clarifications, please visit and inquire personally with your RDO.

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Hi! Thank you so much for you blog! I just have a question. I have already filled up form 1701 via E-Bir forms. Im just wondering what other documents I need to bring for filing at my RDO? I opted for 40% OSD and is categoried as having no payment returns. Do i need to show the books already?

Thank you so much!

Hi dra, just bring all that you have with you including the forms 2307 para you can prove na you need not to pay. But you still have to file ha. Kahit na no payment. or else, they can penalize you.

Thank you for your blog! It is very informative. Here’s my situation, I just started getting employed at a clinic since October 2014 and I’ve been receiving the BIR Form 2307. I looked up the Form 1701 and I’ve no idea as to how to fill it up. Maybe you can suggest CPAs who can help me out. Thanks!

If you are receiving 2307, it means your status is self employed. You really need to file your itr. But, the first question should be, are you already registered as a physician na? if not, that is the first step. My accountant is full as of the moment. Sorry, but in the future, if you still need one. Give me a heads up. I will ask her again.

Thanks for replying! Oh. I do have a TIN from way back in college, which I had to get for my drivers license. I did just recently find out that I needed to register as a professional. Question on that, will I be getting a new TIN? Having 2 TINs is punishable by law right? I was checking on the eReg at the BIR website and you could do it there. But am afraid that I might be getting another TIN.

Hi JC. One TIN lang per person. Yes, having 2 TIN is a crime. If you register, just provide your old TIN.

Would you know po Doc if the online eReg system would ask if you’d have an existing TIN? Just so I can register it as a professional? Am afraid kasi that if I click the submit button, I’d be getting a new TIN. Hehe.

This is the best site i ever had

Mam hindi po ako nakapag file ng tax last year may surcharge interest and compromise computation pa rin po ba

And pano po kinocompute yung tax due

In case of dra dina lang po bakit po wala interest and surcharge ang tax nia po

Hoping for ur answer to my inquiries

Tnx

Hi Philip, are you registered? If Registered ka, may penalty talaga. If di ka pa Registered or employee ka last year, no need to do anything.

Good day!

What will be the process if I missed my 2014 ITR filing. It just came to my attention when I am preparing to file my 2015 ITR.

Thank you.

text me here, regarding this. Can’t post my comment here. 09258895433

Good day!

I’ve been moonlighting in a medical clinic on and off as a reliever physician since late 2017 only working few hours per day, few days in a month. For 2017 & 2018 I have not filed for my taxes (ITR & what not) but I have been receiving form 2307 from the company HR. During my reliever days I would only earn around 10k a month.

I have recently (since around March 2018) signed a contract with the company as a retainer physician. This time I have a 4-day 8hr duty as a retainer.

My question is:

1. do I have to file taxes for the previous years?

2. Will the BIR know that I have failed to file previously?

I also haven’t filed for this year’s tax but I recently received forms 2307 since they give it by bulk, which was dated starting last quarter of 2018 (before I signed my retainer contract, but I was already a reliever) until recently April 2019. And now the HR is asking for a receipt. I dont know what receipt they are referring to.

3. Can I file it now or do i have to wait until next year?

4. Will there be penalties?

5. I dont really earn much, only around 30k in a month but definitely not more. Will I be subject to penalties , etc?

Thank you.

Question is, have you registered as a physician in BIR? Have you printed your receipts?

I haven’t been registered as a physician in BIR. I was advised by an employee in the BIR branch nearest to my residence, that I can wait until residency training or if I open a clinic to register in the BIR. Also, no receipts have been printed and the HR where I worked at has not asked for one.