When we say Millennials, these are the people that are born from 1980-1996. This year, these Millennials will be in the range of 20s to mid-30’s.

These questions came from a Millennial Reader, let’s name her Melanie. She is currently in college, passionately loving being young but still wanted to be a responsible Millennial. Let me share her questions and the answers I get from my research and personal inputs.

Melanie:

Hello Ma’am!

I just wanted to say Hi and I find your website so inspiring for my financial management.

I hope you can answer my questions below to help me out in my financial literacy:

These are my questions:

Melanie: How well do the young Filipinos, the millennials, know about saving money now? Are they knowledgeable enough to have a plan or are they still spending?

MYFINANCEMD:

According to a study of Visa, “Connecting with the Millennials,” the majority of Millennials are ambitious and money oriented, 81% of them want to make as much money as possible so they can enjoy better life experiences and can get where they want in life.

In the same study, they found out that 89% of Filipino Millennials relied most on parental advice. Only 8% of Filipino Millennials are most likely to seek professional financial advice.

Since, Filipino Millennials rely so much on their parents’ financial education, their financial literacy is also greatly dependent on their parents’ financial literacy level.

According to Standard and Poor’s (S&P) Survey last year on Financial literacy of Filipino adults, generally, only 25% are financially literate. Philippines is included in the bottom 30 of the worlds’ financial literacy survey. Among Southeast Asian Countries included in the survey, Singapore scored the highest with financial literacy rate of 59% and Cambodia with the lowest at 18% and the only other economy to score lower than the Philippines was Vietnam at 24%.

Although many Millennials are at the beginning of or have yet to start their careers, saving for retirement is also on their minds, since 11% of their money is saved for retirement, study revealed.

Melanie: Do the behaviors and habits affect the way Filipino Millennials spend and save their money?

MYFINANCEMD:

On spending, the Visa study, also found out that Filipino Millennials put aside 12% of their income on electronic gadgets, 13% on travel, 11% on grooming.

The one main distinguishing fact about millennials is that they are extremely tech-savvy. According to the landmark study I mentioned above, one in two Filipino millennials said they can’t live without their personal computers or laptops, while 37% said a smartphone is a “must-have.” The same study revealed that Filipino millennials use instant messaging on computers 73% of the time, as well as social networking sites, 71% of the time. The study further showed that Filipino millennials set aside 12% of their disposable income on electronic gadgets. (Business world)

Although Millennial have this mad love affair with technology and gadgets which proved to be a financial pitfall for most members of the Millennial group, some are actually using the power of technology to cut their spending and get discounts. They use technological research to look for: discounted airline tickets, food deals, travel packages and much more. To a certain extent, Millennial use the internet to make better financial decisions like comparing prices and even investment options.

In another article from ABSCBN:

Chartered financial analyst Gavin Lee said that, millennials begin saving at 22 to 23 years old, compared to “baby boomers,” who tend to start saving at their early 30s. But even though millennials are savers, they primarily park their savings in cash, partly due to the lack of other financial advice beyond their parents.

Since 89% of them really rely so much on their parents financial knowledge.

“It’s good that they’re saving, but it’s not good that they’re not putting it in more productive investments,” Lee said.

Melanie: Are there any financial consultations or programs on financial planning given to the people who haven’t gotten enough money to pay for these seminars and programs or those who can’t reach online consultations because of internet issues or don’t have internet at all?

MYFINANCEMD:

Well, Melanie, my blog: www.myfinancemd.com provides free financial education if you are techy and patient enough to read and really learn.

For those without internet, according to some recent articles and the latest SONA of the president, the present administration wanted to include “A mandatory financial education for all OFWs/Migrant workers and inclusion of Financial Education and Entrepreneurship in schools.” Which I hope will be a reality soon.

Melanie: With so much resources easily attainable, could those who don’t know how to manage their financial resources able to find education in financial management or about financial literacy?

MYFINANCEMD:

Although Millennials have so much resources on their hands, the “Connecting the Millennials,” study proved that, Millennials are still dependent on their parents for financial decisions. With Only 8% of Filipino Millennials are most likely to seek professional financial advice. It’s more of, how open-minded will our youth are going to be in the future.

If we compare the Filipino Millennials to Chinese Millennials on who they look for advice. Chinese Millennials relied more on internet researches with 70% relying on them for financial matters, and 34% of them are most likely to seek professional financial advice than the 8% of the Filipino Millennials.

Melanie: What would be the best solution to avoid the bad spending habits on children? What could be their starting point in saving money? Who would be the best teacher for children in this type of education in discipline? Why would they be the best people for young generations?

MYFINANCEMD:

The best solution for bad spending habits on children is education for the parents. The parents should start educating their kids while still young. But before that, Filipinos should first break their poverty mentality and not let their children inherit their lack of financial education.

You can read more on this here:

- 5 Money Habits to Avoid Telling Your Kids (To Break their Poverty Mentality)

- Money Learning Activities For Kids (To Break their Poverty Mentality)

- How can your Financial Success be the Formula for Failure to your kids (To Keep them grounded)

Melanie: What is the main reason for Filipinos having financial crisis? Could this issue be avoided if they were able to use financial knowledge?

MYFINANCEMD:

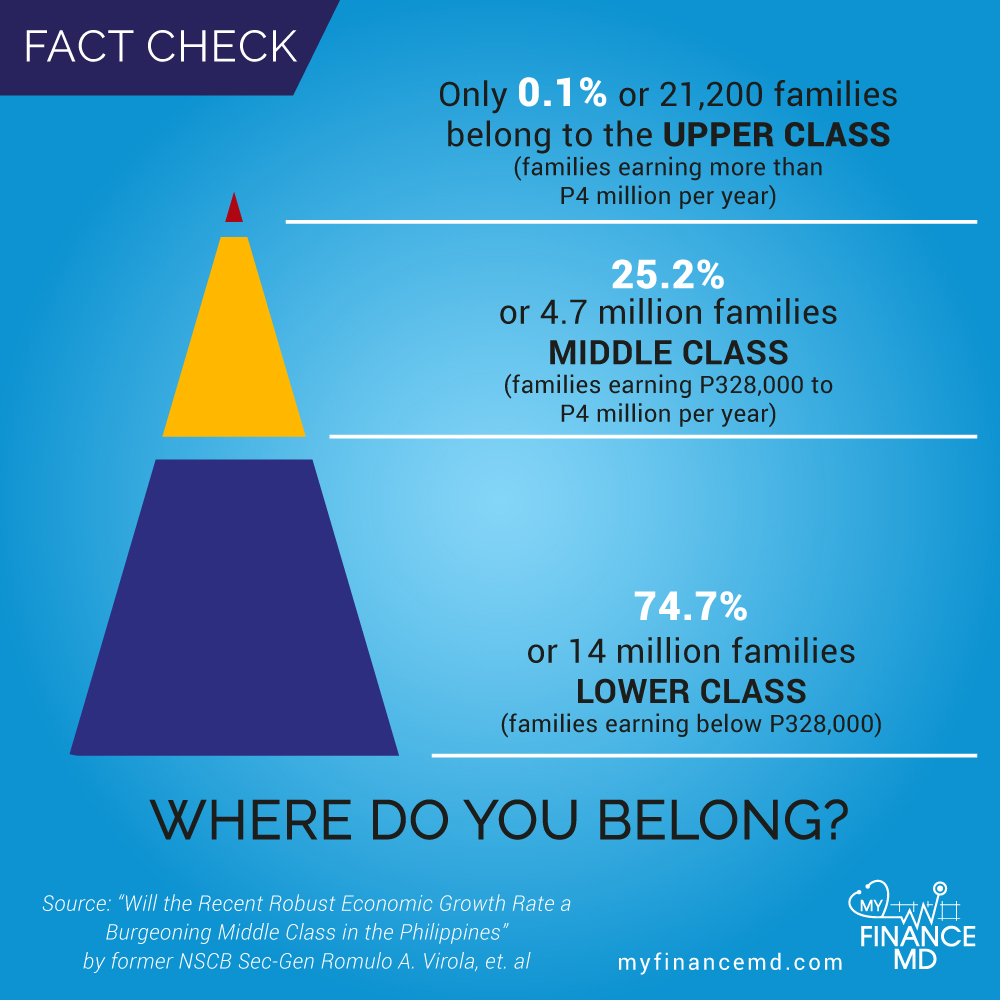

Look at this graph on how poor we really are:

How do we change our statistics? Let us all unite to become a Patriotic Rich.

See this post:

How to Become Patriotic in the Philippines by Becoming Rich

And Hopefully this will also happen:

Mandatory Life Insurance for All Filipinos

And also, our society is chronically financially sick. Just like if we have physical sickness, the best way to get better is to seek help to professionals, like doctors. If we are financially sick, who do we seek for help? Survey says, Filipino Millennial seek their parents for guidance, that is great if their parents are knowledgeable enough to guide them.

Filipinos in general should not be afraid to seek Financial Doctors for their financial diseases. The best way to heal is to get the right Doctor to give you the best medicine. Get help from financial consultants and experts in the country.

If you need help, I am just an email away. Contact me here.

Your Financial Doctor,

MYFINANCEMD

PS: Thank you Melanie for reading sending in your questions, I do hope some of your fellow Millennials and some Baby Boomer parents learned from this article.

Read More:

- 5 Insider Tips on Finding the Right Financial Advisor for You

- Top 14 Illnesses of a Financial Sick Filipino

- 6 Smart Ways on How to Spend Your 13th Month Pay

- Credit Card: The Bad, the Ugly and the Good

- The Best Gift for Yourself this Christmas that could last a LIFETIME

SOURCES:

Connecting with the Millennials – a Visa Study

Other sources are stated in the article

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023