Statistically speaking, only 2 out of 100 Filipinos plan for retirement. Although most Filipino workers have some kind of benefits like SSS Retirement or GSIS Pensions or company given retirement benefits.

Statistically speaking, only 2 out of 100 Filipinos plan for retirement. Although most Filipino workers have some kind of benefits like SSS Retirement or GSIS Pensions or company given retirement benefits.

How would you know if it is enough?

How do you compute how much will be your retirement pension from SSS when you retire?

Be your own judge if whether it will be enough for your own retirement needs.

Step 1:

First of all, you need to know your average monthly SSS contribution. If you are an employee, you can ask the HR or accounting of your company or you can look at your pay slip. If you are self-paying, I guess you know how much you are paying.

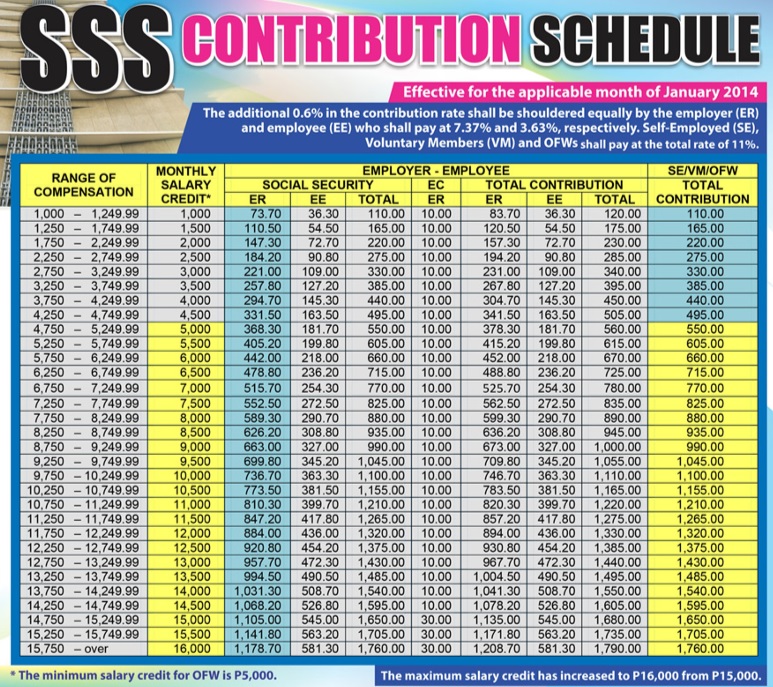

Below is the SSS Contribution schedule updated for 2014 and being used until today (2016), which estimates your total monthly contribution and employer’s contribution.

In the table above, note the following:

Range of Compensation – where your salary falls

Monthly Salary Credit (AMSC) – you can see that in the second column of the SSS table. It is the average monthly salary credit. This will be applied in calculating your monthly pension. (take special not to this)

ER column – is your employer’s contribution

EE column – is your monthly contribution.

From the table above, identify the following:

- Where your salary falls in the range of compensation (first column).

- After knowing the range of compensation, what is the AMSC (second column) of that?

Step 2:

Once you know where you stand, now, let us compute for the maximum pension you can receive.

Let us suppose you are receiving an average of P 16,000 monthly salary with 12 years of service.

From the range of compensation, you are in (see table 15,750 – over), your employer’s contribution (ER) will be P 1,208.70 and your contribution (EE) is P 581.30, for a grand total of P 1,760.00/month.

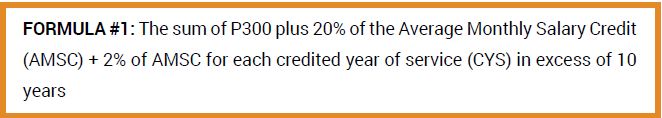

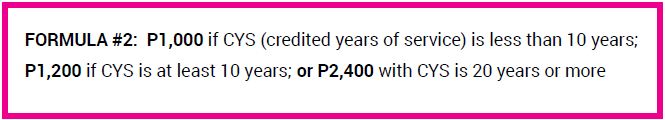

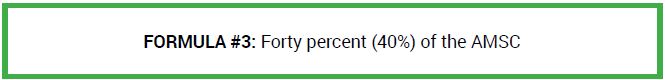

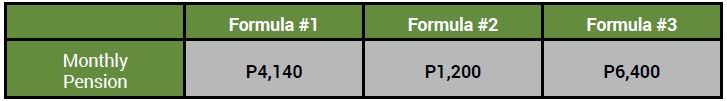

Based on SSS computation, there are three formulas which we can use in calculating your monthly pension. The pension will be based on the highest computation from these 3 formulas.

Monthly Pension (MP) = P300 + (20% of AMSC first 10years) + (2% of AMSC 2 years)

MP = P300 + (20%*16,000) + (2% *16, 000* 2)

MP = 300 + 3,200 + 640

Monthly Pension = P 4,140

Since you are a contributor for 12 years.

Monthly Pension = P 1,200.00

MP = 40% of AMSC

MP = 40% of 16,000

MP = 6,400

Monthly Pension = P 6,400.00

Step 3:

By comparing the 3 computation, we now choose the one with highest yield.

Based on above computations, the 3rd formula yields the highest monthly pension (P 6,400). Your monthly pension will be based on this amount.

Note:

- Computed above is the maximum monthly pension you can be able to receive for a 12 year contribution.

- If you are earning more than 16,000/month, it does not matter. It will have the same computation unless they raise the AMSC in the future.

- You cannot have a monthly pension unless you have given a minimum of 10 years or 120 months total contribution.

- If you contributed for less than 10 years, you will be receiving a lump sum benefit instead of a pension.

- If you have contributed different Monthly Salary Credit for all the years your have paid, the Monthly Salary Credit that you have contributed during your last 60 months before you retire will be used in the computation.

- If you are self-employed, you can still contribute on your own. You decide on which salary credit you want. Better get the maximum or P1,760 pesos per month of voluntary contribution to get the maximum benefit not only applicable for pension but also for other benefits like: sickness benefit, maternity benefit, loans, etc. (Read more here)

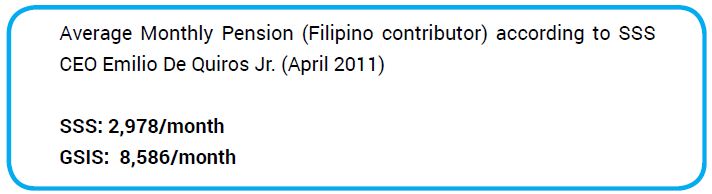

According SSS CEO Emilio De Quiros Jr. last April 2011, the AVERAGE monthly pension of Filipinos that they received from SSS is 2,978 pesos and GSIS on the other hand is 8,586 pesos.

The question is:

Would that be enough for you if you are to retire today?

Ask yourself. Ask Me. Contact me here and get free consult.

“Don’t simply retire from something, HAVE something to retire to.” – Harry Emerson

Helping you know your rights,

This is best used in laptop or desktop.

Note: To all Existing Subscribers, Doctors and Financial Advisors that are already subscribers of this Blog. You don’t need to Subscribe again, I will be sending you this FREE SSS Retirement Pension Calculator to your emails to enjoy. Just tell me if you want a copy. Say “Yes, I want copy too!” Here.

Disclaimer: Calculation above is not absolute, changes may takes place if the Monthly Salary Credit is updated, and other rules that shall be implemented that may affect the present rules. The computation above is the closest estimate. For exact computation, kindly visit the SSS branch nearest to you.

Source: SSS website

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Wow, thank you for the Calculator. It is really useful. I just need to input my details then i get my estimated retirement pension. No need to compute it myself. Thank you Doc Pinky. You are really a blessing for us!

Thank you Maya. Don’t forget to share! 🙂

Hi, I already subscribed but it seems i can’t download the Calculator. Thank you for creating this useful website. More power!

Please email me, so that i can manually send you: docpinky@myfinancemd.com

Hi. What if my last 5 years of contribution has different AMSC?

That will be that one that will be used for computation

Hello if fx my contribution is 600 monthly in 20 yrs, how much will be my monthly pension when i retired?

Thank u

Please download the excel file of my post so you can try to see how it is.

That is what they are going to use. The last average of of that. 🙂

Hello Doc Pinky. With the three presented pension calculations above it clearly shows that paying for 10 years contributions (say 1760/month) is just enough to get the maximum pension of 6,400. So it is not advisable to pay over 10 years, am I right? Please clarify because i’m paying the maximum contribution for 9 years now and i planned to stop it when it reaches 10. Thank you.

Hi, if you download the free SSS pension calculator here, you can experiment how much your pension is going to be depending on number of years you contributed. But definitely, more years you contributed, more pension you are going to get. thankyou

Hi Doc,

Really appreciate this article of yours. However, I still need clarifications as I have multiple AMSC for the past 10 years. I also subscribed to your SSS calculator already and will be waiting for your assistance. I really appreciate it .

Thanks!

AC

Are you retiring na ba? Can you give me a little more information about yourself?

Good Day Doc,

Wow, ang bilis po ng Feedback! 😀

I’m a Registered Nurse, working as an OFW here in Saudi Arabia , 28yrs old.

Way back 2007-2008, July – January ( 6mos ) I worked as a Bagger in SM Supermarket and I assume I have the maximum contribution during that time ( dko lang po alam kng magkano kasi down ang SSS website as of this time )

I graduated nursing 2010 then went on trainings till 2012.

May 2012 i was hired as a Call Center representative in Ortigas , then resumed my SSS contribution

I worked May 2012 up to January 2016 with a maximum contribution of 1700 because I think I will fall under the 15,000php MSC.

I then created an SSS online account to monitor how many months I had contributed already, and SSS online showed me a stunning 49 months contribution already ( i was happy :p ) .

The SSS contribution history said above was all shared by Me and my Employer. ( un po ung sa palagay ko )

January 2016 po ang naging last na hulog ko for SSS, then I resumed this January 2017 and starts with a maximum contribution for an OFW for 1760php. Questions are as follows.

1. Is it advisable if I will start and continue contributing the allowed maximum contribution for 1760 for OFW until I finish 120months? or, Can I contribute at least 500pesos only then when I reach 55yrs old, thats the time I will do the maximum again?

2. I have multiple AMSC as I started 2007 pa, and I have this mindset that if I continue the maximum contribution for more than 10yrs, will it compensate the lower AMSC? since the 3rd formula has the highest possible outcome.

3. If I stop after completing the 120months, I assume I will just get the 6400php pension as shown on your table. Is there a possibility or is there a way how can I get more than 6400?

4. Since I got 50mos contribution already, 70months left, ( I assume when I reach 35yrs old, Im done with the 120months already ) what will happen if I will just continue contributing till I reach retirement age. ( so that’s age 35 to 60yrs old ) will it increase the monthly pension on may retirement age?

5. In question number 4, do you have an estimated value in mind how much will I get?

6. SSS website has an estimated calculator as well, then it says once I’m done with 120mos only, I will receive 11605php. Is it true? 😀

7. I have a good friend who’s working for 15years already I think, and still contributing as it is mandatory contribution from his Company ( calll center ) . Year 2000-present time. Do you also have an Idea how much will he get assuming that he has the maximum contribution as well.

I really appreciate your time Doc, and will be more than happy if you were able to answer this basic questions as I want to start securing my future today. I’m glad we have this website of yours.

Thanks!

ACSalinas

Sorry for the late reply:

1. Is it advisable if I will start and continue contributing the allowed maximum contribution for 1760 for OFW until I finish 120months? or, Can I contribute at least 500pesos only then when I reach 55yrs old, thats the time I will do the maximum again?

Well, some do that. But if you are going to do that better shift to max earlier, which is age 54, since at age 55, they won’t allow you to shift drastically. Plus, rules and regulations may change thru the years, so you have to be vigilant.

2. I have multiple AMSC as I started 2007 pa, and I have this mindset that if I continue the maximum contribution for more than 10yrs, will it compensate the lower AMSC? since the 3rd formula has the highest possible outcome.

– Usually, they only use the last 5 years in their computation. (but rules might change in the future)

3. If I stop after completing the 120months, I assume I will just get the 6400php pension as shown on your table. Is there a possibility or is there a way how can I get more than 6400?

– yes, try doing it in the excel for 20 years or 30 years, the pension will go up.

4. Since I got 50mos contribution already, 70months left, ( I assume when I reach 35yrs old, Im done with the 120months already ) what will happen if I will just continue contributing till I reach retirement age. ( so that’s age 35 to 60yrs old ) will it increase the monthly pension on may retirement age?

Yes, kindly download the SSS calculator in this site. Try to experiment for yourself.

5. In question number 4, do you have an estimated value in mind how much will I get? – Yes, kindly download the SSS calculator in this site. Try to experiment for yourself.

6. SSS website has an estimated calculator as well, then it says once I’m done with 120mos only, I will receive 11605php. Is it true? 😀 – Depends on how much you contribute.

7. I have a good friend who’s working for 15years already I think, and still contributing as it is mandatory contribution from his Company ( calll center ) . Year 2000-present time. Do you also have an Idea how much will he get assuming that he has the maximum contribution as well. — kindly download the SSS calculator in this site. Try to experiment for yourself.

Download the sss calculator by subscribing in my website. You will be given an excel calculator you can use to experiment on. 🙂

I really appreciate your time. More power and God Bless.

paano po kng 20yers nagcontribute magkano po ang pension na m atatanggap @ 1760php per month contribution of ofw?

Hi, please download the SSS pension calculator in the post. So, you can try it yourself

paano po kng 20yers nagcontribute magkano po ang pension na m atatanggap @ 1760php per month contribution of ofw?

Please subscribe in the lower part of the post. After subscribing, you will be sent with sss calculator. Thanks.

Hello po!

Ako po 57 years old na going to 58 sa sep. 2017 . nakapag hulog napo ako ng 129 months ang huling hulog ko po as employee ay noong pang 1999 pero ltunuloy ko ang pag huhulog sa sss simula noong january 2017 until now na nasa halagang 1320.00 pesos gusto ko lang pong malaman kung hangang kailan ako mag huhulog sa sss at mag kano ang magiging pension ko kapag akoy umabot na sa edad na 60 yrs old salamat po! At sana po ay masagot nyo ang aking katanungan. Gamit ko lang po ang fb account ng misis ko.

Hi po.

How many years should I pay 1,760 monthly in order to have benefits afterwards? Thank you.

ofw here po.

120 months to qualify the retirement pension.

Hi!

If my dad is receiving currently his monthly pension and is a benificiary of my SSS, is he still eligible for my benefits if I am going to die early? Will my mom and dad both receive pension?? Thank you

One of the benefits which a member of the Social Security System (SSS) could enjoy is that provided under Section 13 of Republic Act (R.A.) No. 8282 of the SSS Law governing Death Benefits. Death Benefits of an SSS member shall be given to his/her primary beneficiaries and, in the absence thereof, to his/her secondary beneficiaries (Section 13, R.A. 8282). The primary beneficiaries under the SSS Law are the dependent spouse until he or she remarries and dependent legitimate, legitimated or legally adopted, and illegitimate children, while secondary beneficiaries include the dependant parents and in the absence of the foregoing, any other person designated by the member as his/her secondary beneficiary (Section 8 [k], R.A. 8282).

Hi Doc,

How the lapses affect the retirement pension. I was member since 1987 and 12 years of that have contributions but not as the whole year? Currently tag as voluntary and has 94 Premiums?

Hi, not so much naman, they will just count your number of contributions. You need to have contributed 120 months to be eligible to get retirement pensions.

assuming u started contributing to sss at age 20 an ofw and opted to 550 per month for 34 years and then before you reach 55 yrs of age you increase your monthly contribution to maximum 1760 montly until you reach 60 yrs of age. SSS allows changing of monthly salary bracket if d person is below 55 yrs old. Total contribution will be 330,000. How much will be d monthly pension using d 3rd formula.??

Hi Doc,

I am interested to download your excel file.

What if po don sa last five years iba iba rin ang contribution sa self-employed po?

They will compute it for you.