How do you envision your retirement years? Have you thought about it yet?

If you ask me, how much do you have to save to have a healthy retirement ahead?

Financial analysts, suggest a minimum of 20% of your salary from DAY 1 you started working.

But what if, you tell me, “I cannot afford to save the 20% of my salary. You know, I have bills to pay, mortgages to settle and things I want to buy.”

Well, it all depends on you really. How much are you willing to put aside?

Before deciding how much to save for retirement, consider this first.

If you are going to save only:

10% – you can be able to provide for the BASICS of retirement; this may include food, shelter and clothing. Maybe you can’t afford to get sick, nor travel nor even a gift for your grand daughter’s birthday.

15%– you can have COMFORT in your retirement; aside from the basics, maybe you can travel once a year, just out of town. Perhaps you can even afford to finance your maintenance medicine or give your grandson a simple gift on his graduation.

20%– this is the ESCAPE. You can provide the basics (food, clothing, shelter), with the addition of some luxuries you are already enjoying now that you still have a job. This is just the level you are in right now. An upgrade of lifestyle would entail >20% budget.

Well, all of these are all subjective to your present standing right now and your comfort level. The decision on how much to save really depends on you. It depends on your financial maturity, patience, and being responsible to yourself.

Nadia Comaneci, first female gymnast to be awarded a perfect score of 10 in an Olympic gymnastic event. When interviewed on, how she was able to do the perfect score of 10?

She said, there are 3 kinds of people in the world.

One is, when to coach tells him, “give me 10,” he makes 7.

Another is, when the coach tells him, “give me 10,” makes 10.

And the last kind of person, when the coach tells him, “give me 10,” makes 15. These kind of people not only achieve greatness, but the ones that become champion and legend.

Same thing with retirement, when financial analysts tell you to save 20, do you save 10? 20? Or 25?

Do you like to keep having the things you have now?

Or you need to downgrade your lifestyle just to survive retirement?

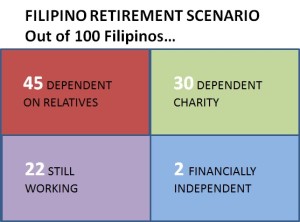

If you don’t take control your finances and start saving for your future self. You will end up in one of these boxes. Remember, only 2 out of 100 becomes financially independent.

If you need a more personal approach in helping you be financially ready. Contact me here.

Take action towards your future! I don’t think you deserve a downgraded lifestyle, do you?

Further Readings: The Filipino Retirement Scenario, Find out where do you think will you Belong in the Future?

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

I came across with your site been keen to interact concerning my short future plans. I am 56 yrs old, ofw and worried that I have not set aside yet for my retirement say reaching age 60 or 61. Will you advise what could I start now? Thanks.

Hi Rey, please PM me your concern, so that we can talk privately about your concerns. email me at: docpinky@myfinancemd.com thanks