Every month, a portion of an employee’s salary is taken out for SSS. Many people feel the deduction, but don’t really know what it’s for. So today, we’ll look at the benefits of SSS and how we can avail of them.

Every month, a portion of an employee’s salary is taken out for SSS. Many people feel the deduction, but don’t really know what it’s for. So today, we’ll look at the benefits of SSS and how we can avail of them.

I am a doctor, and being a medical doctor, I am trained to analyze. Applying my skills in studying in the financial world made me wonder so many things that matters to a common Filipino. About SSS, Pag-ibig, Philhealth, Taxation and a lot others that Filipinos pay every month but don’t even know what it is for. So, allow me to start this series of dissecting the basics in our Filipino finance and I hope many Filipinos will learn along with me. Let me start with what we call, SSS or Social Security System.

Who is covered exactly by the SSS? And is there a minimum or maximum contribution?

SSS covers basically the private sector workers. GSIS covers those who work in the government/public. The minimum contribution is P110.00 per month and the maximum is P1,760.00 per month. That’s equivalent to a monthly salary of P1,000 which is the minimum and the maximum salary credit ceiling at this point is P16,000.

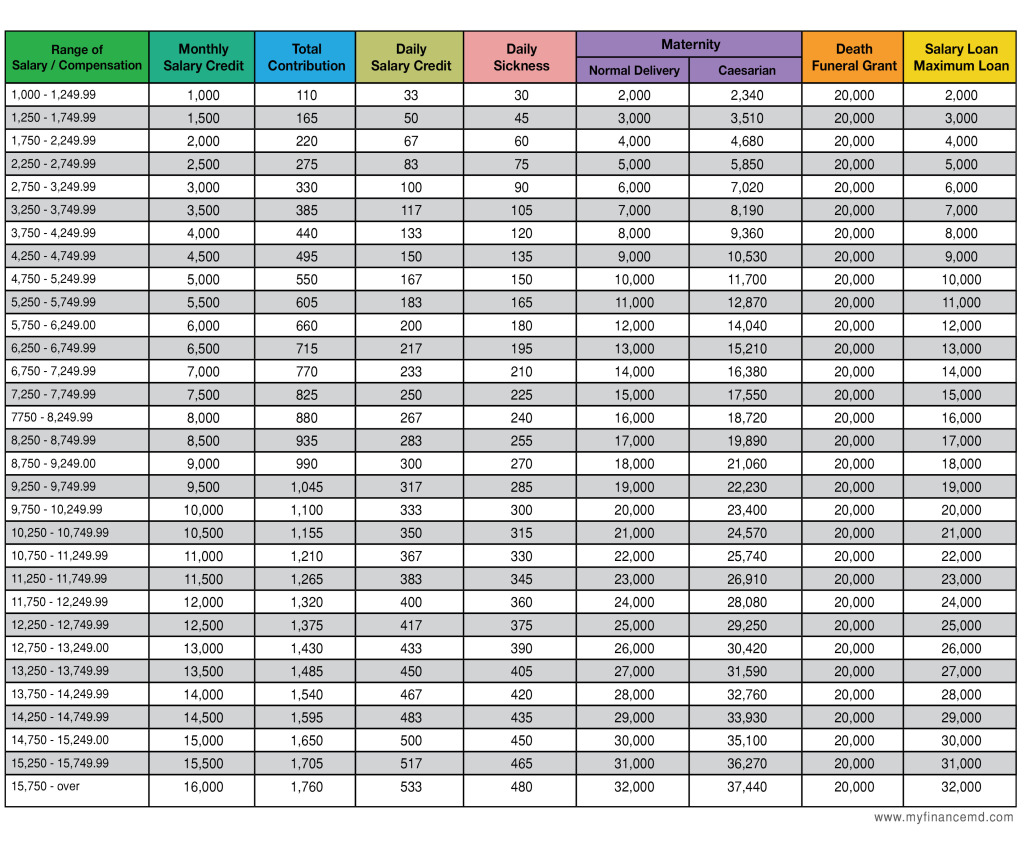

Look at this present schedule of contribution. Look at where do you belong in the Range of Compensation and its equal Monthly Salary Credit:

If your salary is more than 16,000 per month, then you still stay in the maximum contribution column.

Is there a minimum age for a person or as long as they’re employed they’re already qualified for?

The qualification is they should not be more than 60 years old and they should be earning at least P1,000 per month.

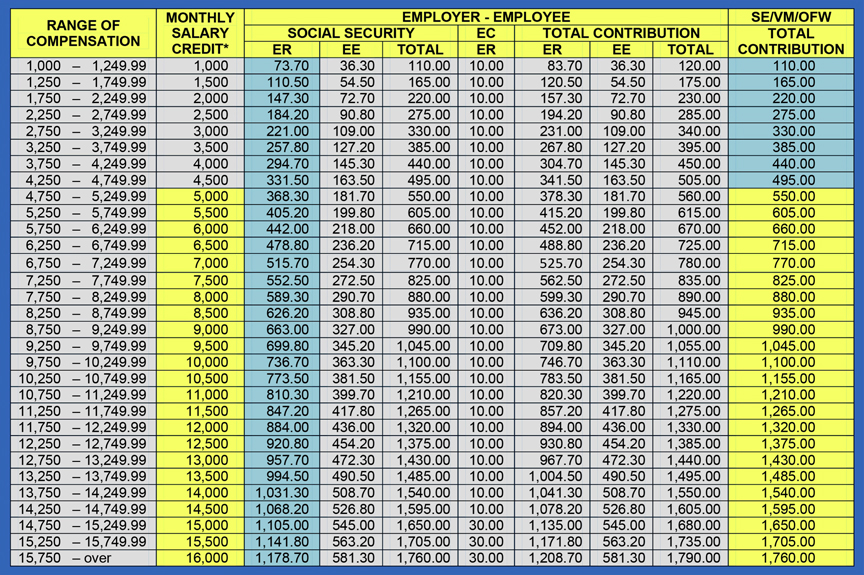

Is there a difference in the contribution and the structure of those Employed and Self-Employed?

The monthly contributions are based on the compensation of the members. The current SSS contribution rate is 11% of the monthly salary credit not exceeding 16,000. And this is being shared by the employer (7.37%) and employee (3.63%).

Self-employed and voluntary members pay whole 11% of the monthly salary credit.

How to Register?

Just go to any of our branches, and bring your birth certificate. A birth certificate is critical because that establishes basically the Birthdate. It would also be the basis for retirement, which is at the age of 60 on an optional basis and 65 at mandatory.

SSS Summary of Benefits

Retirement Benefit

Three basic formulas in computing the pension benefit. The first one is the minimum pension. Which for whatever reason, in terms of contribution the minimum pension is P1,200 if they contributed between 10-20 years. If they’ve reached 20 years or more, then they’d get a minimum P2,400. The second formula is 40% of their monthly salary credit and for the third formula, it is P300 plus 2% of every year the contribution that they make. So there are 3 basic formulas, in whichever is the highest of the formula is the pension benefit given to the individual.

Please see this post for the sample computation and more detailed discussion on Retirement. But basically you must have contributed at least 120 months of contribution, to be able to get the pension benefit.

Disability Benefit

The disability benefit, once you’ve reached 36 months of contribution, you can get a partial or total disability pension if something happens to you. For computation, please see: www.sss.gov.ph

Death Benefit

There are 2 types of Death Benefit. One is Cash benefit, either monthly pension or a lump sum amount to beneficiaries and the 2nd type is the Funeral Benefit.

- Cash Benefit – granted as a monthly pension or a lump sum amount to the beneficiaries of the deceased.

- Monthly Death Pension – is granted to primary beneficiary if the member should have paid at least 36 months contributions prior to death.

- Lump sum amount – is granted to primary beneficiary if the deceased member has less than 36 months contribution.

- Funeral Grant benefit – lump sum of

P20,000P40,000 to whoever paid for the burial expenses of the deceased member. This is granted even if there is only 1 month contribution paid.

Sickness Benefit

To be able to avail of sickness benefit, you need to have at least contributed 3 months contribution. Daily cash allowance for the number of days a member is unable to work due to sickness or injury. You get 90% of the Daily Cash Credit, maximum of 120 days of being sick. You must have exhausted first the sickness leave/benefit your company gives you.

Sample computation: First, you need to compute how much is your DAILY SALARY CREDIT

For example, your contribution is 1,760 pesos/month (maximum contribution). Your Monthly salary credit is 16,000. To get the Daily Sickness Credit, your Monthly Salary Credit is 16,000 divided by 30 (days in a month), then get the 90%.

16,000/30 = 533.33 (Daily Salary Credit)

533 (90%) = 480 (Daily Sickness Benefit)

Application

Juan was diagnosed of Community acquired pneumonia, and has been ill for 2 workweeks. He has already exhausted the sick leave given by the company. He heard of daily sickness allowance from SSS. He still needs to be confined for 7 days. How much is his total sickness benefit if he is contributing maximum contribution in his SSS.

Sickness Benefit = 480 (Daily Sickness Benefit) x 7 days = 3,360.

He can avail his sickness benefit from SSS amounting to 3,360.

Maternity Benefits

To be able to avail of this benefit, you have to have at least contributed 3 months to SSS. The computation is, Daily Salary Credit times (60) for normal delivery or miscarriage or abortion or times (78 days) for Caesarian Section.

Loans

Salary Loan

The maximum salary loan has now been P32,000 if you are contributing the maximum contribution each month. So a member may get a net of P31,700. Equivalent to 2 months salary. Minus P300.00 as a service charge. The interest is minimal at 10% per annum at an initial balance with diminishing interest.

“Meaning, pag habang nagbabayad ang member, patagal ng patagal, bumababa yung amortization.”

But in order to qualify for a salary loan, you need to have at least 36 months contribution for 1-month-salary-loan and 72 months contribution to get the 2-months-salary-loan.

For a quicker reference and easier understanding I made this table of Benefits and Maximum Salary Loan:

*Update: Under SSS Circular No. 2015-009 issued recently, the state-agency will increase funeral benefits from “a fixed amount of P20,000 to a variable amount ranging from a minimum of P20,000 to a maximum of P40,000,” depending on the member’s number of contributions and average monthly salary credit (AMSC).

*Update: Under SSS Circular No. 2015-009 issued recently, the state-agency will increase funeral benefits from “a fixed amount of P20,000 to a variable amount ranging from a minimum of P20,000 to a maximum of P40,000,” depending on the member’s number of contributions and average monthly salary credit (AMSC).

For Sickness Benefit, just multiply the Daily sickness by number of days sick. Maximum of 120 days in a calendar year

For Maternity Benefits, no need to multiply anything. It is the actual amount of benefits is stated depending on the contribution.

Educational Assistance Loan

This loan is actually the event to those belong in the lower or middle income group or those who are receiving lower than P50,000/year. The proceeds of the loan are directed to the school where the student of the member is enrolled. You can ask more about this in your nearest SSS branch.

Housing Loans

Housing construction –

Members can avail up to P2M as the maximum loan for construction of house and SSS normally lend via the accredited banks. It means they don’t normally lend direct except for OFW and junior members. This is the only set of members that SSS go directly to. They can combine it with the bank’s loan or they can combine it with PAG-IBIG, for example.

The loan can go as long as 25 years with 15 years fixing at 8-11% interest per annum at diminishing interest.

Housing Repair – The housing repair maximum loan you can apply for is P1M.

“Take note that both housing construction and housing repair loans are availed once in a life.”

Business Loans

The maximum loan you can avail for a business loan is up to 400M pesos. The rates right now would range from 8% to 11 % per annum. And they can fix the rates up to 15 years.

Below are some of the common Q & A that I believed are important in understanding SSS. I transcribed this in an interview with Mr. Emilio de Quiros, President and CEO of SSS by the show “ANC – On the Money.” I have changed some of the figures to update the present figures applicable today.

Common Questions and Answers:

If you have a loan with the SSS and you lose your job or you become disabled or you died, what happens to the loan?

Emilio de Quiros: The way SSS protects their fund is that when we grant the salary loan and there is no payment on the loan, there’s a penalty 1% month and what we do is we collect from the benefit of the member. So when they retire for example, then we collect it from the pension benefit. And that’s what we have been telling our members why don’t you religiously pay your loan because in the end, what happens is that the pension cannot be received by them or their spouse or beneficiary and sometimes if take even years before they even get their pension.

Theoretically, is it possible for the person does not pay such a long period of time that this whole pension and more is now due because he hasn’t paid. What would happen then?

Emilio de Quiros: We’ve constructed the formula that we will be able to collect where you will have at least 36 months contribution requirement.

I’m interested in getting a 2-month salary loan to pay for my family holiday in March. How big of a loan can I get and is it possible to combine it with a Pag-IBIG loan?

Emilio de Quiros: Okay. For a 2 months loan, you are required for 72 months contribution and the maximum that you can get is P32,000.00 right now with 10% interest per year and could be combined with Pag-ibig loan or any loans. Our requirement is basically the amount of contributions paid.

If in that case where the employer has a say and the person leaves even before they fully pay up their loan, what’s the recourse now of the SSS of the individual employee?

Emilio de Quiros: Well, the problem in the past was that, a lot of employees move from one company to another. And it’s difficult to track it. It’s really the responsibility of the employer to collect from the member. So if the employee normally signs the conformity of the salary loan so it’s the responsibility of the employer to ensure that the amount of the loan.

I’m planning on availing of a housing loan from Pag-IBIG of P2M but I know that SSS also offers housing loans. How do they compare and is it possible for me to get have a loan from each so I can increase my budget for buying a place?

Emilio de Quiros: Okay in terms of housing loan, we normally work through our accredited banks and the maximum is P2M for house construction, now it can be combined with Pag-IBIG depending on the accredited bank. Because they need to look at the collateral. Because we can only lend on the 90% of the appraised value, so it depends on how big that property the house is. If it qualifies, and the bank is willing to pick-up the loan from Pag-IBIG as well as SSS then that’s no problem with that.

I have been wanting to start a business and decided that a franchise is best for me. There is a franchise I am interested in, which will cost me P1M. Can I avail of a loan from the SSS for this and what are the requirements and terms? How does this compare to a loan that I could get from a bank?

Emilio de Quiros: Well, they need to go through any of our accredited banks for any business loan. And we go as high as P400M in terms of business loans so as long as they can justify their capacity to pay, and we can analyze that the business is liable then we should be able to lend them.

When it comes to terms, we can go as far as 25 years or so with 15 years fixed interest. Interest should range 8-11%, depending on the market.

I know that I can avail of PhilHealth but I also know that SSS is supposed to provide coverage for sickness. Can I avail of both if I am getting medical treatment that’s already covered by PhilHealth?

Emilio de Quiros: Yes. Technically, you need to qualify for the sickness allowance with the SSS. For employed people, it’s normally the employer that pays for sickness, the hospitalization of the employee and then we do the reimbursement.

Maximum sickness allowance is 90 percent of their daily salary credit and you can avail up to 120 days in a calendar year.

Right now SSS have about more than 28 million members. The mandate of SSS is to provide the social protection to all private workers and both employed and self-employed workers. It is our responsibility as a member to know our rights and benefits if not…

”What you do not know with money, will definitely hurt you!”

Thank you for reading. For those who want to know more how to be financially free and how to grow your money, contact me here.

Helping you know your rights,

More good reads:

- SSS Retirement Benefits, Updated 2014 Is it enough for your Retirement Needs? Find Out now!

- What is Estate Tax and How it can hurt you even After Death? Part 1 of Estate Planning 101

- Filipino Worker Benefits, What is Available to You?

- The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review

Disclaimer:

I am not associated with SSS, I am not an employee of SSS. This is from an outsider point of view and from the formulas the SSS has given to public. So if you have more complex questions you can ask in any SSS branches near you.

Some of the figures may be not so exact because there may be processing fee I may not have included, but I did my best to give you the close to exact figures as much as I can give you.

Sources:

ANC On the Money

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

You are one of my idol, to financial literacy! Keep it up po. God bless!

Thank you Charina. Keep reading. And don’t forget to share.

Good day! Thank you for this article, the language used makes it easier for me to understand the content. I recently left my previous employer and I want to continue my SSS contribution while searching for my next job. My question how much should I contribute now that I am unemployed? Here are things to clarify my case:

1. I have 1 month lapse in contribution because when I left my first job, I wasn’t aware of how things like these work

2. I already have 22 months of contribution, all of which were at maximum

Also, I would like to know the impact of variable contribution (having the minimum contribution for some time during my unemployment and then going back to paying the maximum once I get employed again) to my benefits specially the computation of pension in the future. Thank you and more power to your blog!

Hi, sorry for the late reply. I did not saw it immediately.

Your question was how much you need to contribute. Well you can choose how much you will contribute since now it would be now voluntary.

Ok lang kahit my 1 month lapse ka sa contribution. You just have to be aware that, the last 5 years contribution will be the one that will be used in your pension computation in the future. Even though variable now, i suggest you make it at the maximum as soon as you can. there are other benefits that you can use. I hope that helps you.

Good day! I would like to seek from your point of view po since I’m confused on how will I pay my SSS loan because I’m employed now in a public sector wherein GSIS sila.

Correct me if I’m wrong po kung mag se self-employed ako, I will pay 1,760 (assuming maximum salary) + monthly loan amortization? (masyado kasi malaki po pala)

Thank you for your response 🙂

Hi Gerald,

You can visit any SSS branch and have a loan reconstructuring para it won’t be heavy on your part. And the 1760 contribution is the maximum contribution, you can contribute less than that if you like.

Is sss sickness benefit taxable ? Is it right that my employer credits the amount as earnings instead as a benefit?

Hi Sir Manny, I don’t have the exact answer for your inquiry because i do not know all the variables. It would be more appropriate if you ask directly the SSS. NCR 920-6446 – 55, Provincial hotline 1-800-10-2255777, they are open monday- friday /24 hours. If you like to get your call through, call them at night or or wee hours of the morning. Not everyone knows this, kaya your call will be accomodated

I’m 47 years old Non working housewife. I never had the chance even apply for membership. Can I still start paying the premium membership? and how much monthly pension will I receive when I become 60 y/o?

Yes, you still can voluntarily contribute. The pension will depend on how much you will contribute and number of years you will contribute. Note that you need to contribute at least 120months or 10 years.

Good day.I’ve been paying my social security contribution for almost 5 years now.I always make sure to pay it quarterly and never miss paying it.I am paying P 1,650 each month which is P4,950 quarterly.My question is,Is it okay if I continously paying after 10 years?Can I pay for 20 years?I am only 35 years old and I really want to make sure to have a retirement money when I get old.Thank you very much.God Bless You.Diane from KY USA..

Yes, very much OK. The pension will increase the more you pay.

Hi Ms Pinky,

Regarding my SSS contribution, I was employed for 5years in the Phil and now I am OFW still paying my SSS.

I guess I do have now total of 14 years of paying SSS contribution.

As i read your article you mentioned minimum years to avail monthly pension is 10 yrs or 120 months.

May i ask how many maximum months to avail the highest monthly pension?

Thanks

There is no max, as long as you can pay it the greater would be the amount of your pension. The longer you pay, the better.

i have been an sss member since 1978 with my employment at Mercury Drug Corporation.i was illegally suspended on June,1992 where after 30 days,i should get back to work,but they refused to reinstate me and issued a termination letter.i then consulted a legal advise and later filed a labor case at the NLRC.The Court Decision was released in December,2006 but i was not notified either by my counsel or by the NLRC but rather asked to appear there in December,2010.to cut it short,my counsel advised that we enter into a compromise agreement.Naturally,not all my demands were granted and i was asked to sign a quit claim.i was paid my backwages only until 2006 purposely because they did’nt want to grant me my retirement benefits.30 yrs in service grants an employee a monthly pension of half of his basic salary.In 2015,i wrte a letter to the Large Accounts Div. of SSS thru Mr.Allan Delo asking for assistance to demand from Mercury Drug to pay my SSS premiums they did not remit to SSS from March,1996 to December,2006,the date of the finality of the court’s decision,since i was paid my backwages until that period.Mr Delo has been communicating with me thru emails the latest of which was on Dec.12,2016.In SSS’ letter to Mercury Drug,it served a final demand letter where it contained the amount of contribution they should remit to SSS and the corresponding penalties to SSS.i have started receiving my retirement pension since Nov.,2016.Am very hopeful that my appeal with the Large Accounts Div.Legal Dept. be finally considered so that i may receive the retirement pension that i deserve.kindly advise me what to do next.thank you.

i

Hi Ms Araceli, I think I am not the right person to comment on this since it is a pending case right now. Let us just hope and pray you will get the retirement pension you deserve. When they already have a decision, let us know so that’s the time we can think of your next step. We can probably ask lawyer experts on that. For now, let us wait and hope.

Ms De Leon, I am now 60 years old and living in the United Stes since 1996. But I have contributed to the Philippine sss for 16 years. Also I availed of the housing loan in 1986 and sold the house when I left for the US. The people that purchased the house assumed the balance had arrears of P78000 in 2012. Will this loan balance affect my pension?

Also, I list my social security card, forgot my sss I’d number? How do I get get this information?

Hi, did the people who assumed the payment of your loan finished paying the loan? You can contact SSS so that you can retrieve your SSS number.

assuming u started contributing to sss at age 20 as an ofw and opted to contribute 550 per month for 34 years and then before you reach 55 yrs of age you increase your monthly contribution to maximum 1760 montly until you reach 60 yrs of age. SSS allows changing of monthly salary bracket if d person is below 55 yrs old. Total contribution will be 330,000. How much will be d monthly pension using d 1st formula.??

hi, kindly download the SSS calculator in this site. you can experiment there, use your contribution from your last 5 years of contributing. then add 1,000 across the board increase that was implemented last year.

Ask poh I pay my sss as self employed for 10 years. Do I need to continue it? or what benefits I can get??? Salamat

you can continue it if you want so the the pension will increase. The more years you pay, the better is your pension rates.

Hi, Aside from injury are there specific type of illness covered in the SSS Sickness benefit? How about mental sickness like depression, anxiety etc?

as long as the Sick leave in the company was already used, and you satisfy the conditions, you can use it in a mental sickness, provided he/she is confined.