This is the 2ND part in filing the Income tax return. Kindly see the 1ST part of this post. Filling the First Quarter ITR. Click here.

Before you can file your 2ND Quarter ITR, you will be needing the following:

- Your 1ST Quarter ITR

- Your gross income from April, May, and June 2018.

- Your form 2307 (for self-employed) – you can get this from institutions that pays you.

Let’s take for example this case:

Dr. Julie Yap is a General Surgeon who wants to file her own income tax return. These are her income from the first 2 quarters of the year:

Using Form 1701Q (SECOND QUARTER), this is how you fill this up, note that the DEADLINE for filing this is on: August 15

A. For those availing the Graduated Rates:

You need to fill up the Schedule I and III of the 1701Q form. For this example, we will be using the OSD or the Optional Standard Deduction. For itemized deduction, kindly refer to your receipts.

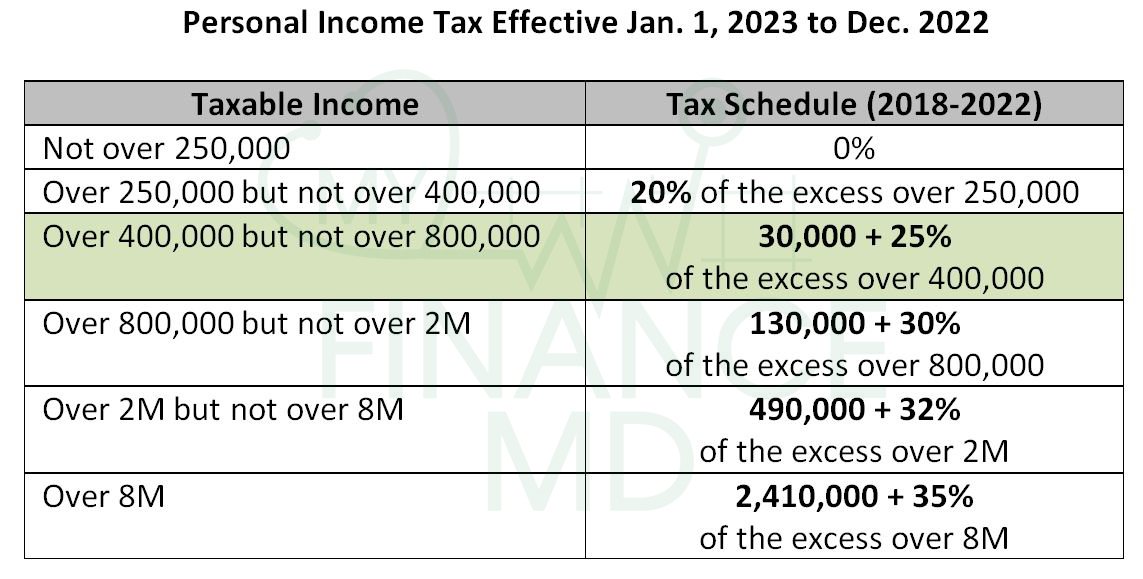

Use this table for #46: Compute for 630,000:

#63: Tax Payable: P35,000, this will be your due for this 2nd Quarter Income Tax Return. This is the amount you still need to pay using the Graduated IT Rate.

B. For those availing the 8% Optional Income Tax Rate

You need to fill up the Schedule II and III of the 1701Q form.

#63: Tax Payable: P11,500, this will be your due for this 2nd Quarter Income Tax Return. This is the amount you still need to pay using the 8% IT Rate.

So, how do you fill up the actual 1701Q Form? Click to Enlarge

For Graduated IT Rate:

For 8% IT Rate:

That’s it. Really simple. Now that you know, you can now input it in your Offline e-BIR forms, then pay in the accredited payment facilities or in your Electronic Filing and Payment System (EFPS), if you are using one.

Simple. Now, you may even think, why don’t I file it myself. It’s up to you.

Remember, the deadline for filing will be:

- First Quarter: May 15

- Second Quarter: August 15

- Third Quarter: November 15.

- For the 4thquarter, this will be included in the Annual filing of the ITR, which is due for next year.

I hope this post was able to help you. Don’t forget to like my Facebook Page to keep yourself updated.

Did you like this article? This was discussed intensively in my latest book:

Don’t forget to grab your copy! To order CLICK HERE. Limited copies available.

For your Financial Health,

READ MORE:

- How To File The First Quarterly Income Tax Return (TRAIN Edition)

- Financial Health 101 Talks for Medical Societies

- 8% OPTIONAL FLAT RATE vs. GRADUATED TAX RATES, Which is better for Self-Employed Doctors?

- The Essential Guide to Estate tax under TRAIN law

- 8 Facts Doctors Need To Know About the TRAIN and How It Will Impact Your Income Tax

Do you want to know how to file your taxes online without going out?

These courses will teach you how to file and pay your Income Tax returns at the comfort of your home.

Start to end, step by step, no going out. From encoding, filing and payment. (All done online)

Enroll in our online course:

For Physicians/Doctors/Dentists/Vets:

https://pro.myfinancemd.com/taxcination/

For Financial Advisors:

https://pro.myfinancemd.com/taxcination-for-financial-advisors/

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Hi, pag walang babayaran at nag file online, need pa ba ipasa sa RDO mismo or ok na yun online submission? Thanks.

Online submission is ok as long as they send you an email.

Hello! So no need to go sa RDO para patatakan ng received stamp if no payment and submitted online? Ung bookkeeper ko kse sabi sakin punta pa ko sa RDO. Eh sabi ko,why the need since i passed it online naman na.Just want po to double confirm. Thanks!

To be sure, call. Your RDO, generally kasi no need na basta may email confirmation. But just be sure, minsan kasi may RDO na may ibang regulation.

I remember po kse last time, ung 1604E. No payment din kase un,i submitted online din. My bookkeeper told me to go to my RDO to have them stamped received.When i went to my RDO they told me no need to go to them since online na nga daw.So maybe it’s the same case din.Thanks!

Ah if that’s the case, pwede nga siguro sa RDO mo na mo need na.

I called my RDO, no need na daw patatakan basta may confirmation email. Thanks.

Good. 🙂

How long before you receive the confirmation email? I just submitted the form, it said submission was successful, but no email received. It’s only been a few minutes though. Thank you.

Hello! did you receive your email confirmation? Kse ako walang email.Sabi sa RDO namin,andaming cases ngayon na ganyan.Since ung form updated pero sa kanila ndi.So advised nila is pag naquestion ako i-contest na lang.I emailed BIR,1week na wala pa din reply.

I called the RDO and they said it could take up to 3 days. But as long as the online process ended with a note that the transaction was successful, ok na daw yun. I did get the email later that night.

Good pm. Clarify ko lang po. Di po ba yung sa first quarter supposedly nacompute na yun and naibigay na last May 15? Bakit po kasama pa sya sa pagcompute ulit para sa second quarter? Di po ba madodoble yun? Pasensya na po for clarification po sana. Salamat.

Cumulative po kasi yung hinihingi sa form.

Hi Doc, Your blog on the 2nd Quarter Computation guide is every easy to understand compared to other blogs.

Thank you for this. And I hope you could also publish a blog for the 3rd Quarter computation.

Thank you Michelle. 🙂 Appreciate your comment very much.

big help.. DOc how about po third quarter 🙂

thanks God bless you more and more

You can search the blog. I made a video for that.

Hi Doc. What if under BMBE un company? How can I reflect that it is exempted from Income Tax. Thanks

Hi Dr. Pinky, your blogs are heaven sent for newbie tax fillers like me. May I ask po, late filling na po kasi kami for 2018 ITR. We assumed the BIR 2307 given to him monthly from August 28, 2018 up to present was his tax credit. We recently found out under his consultancy agreement that he needs to file the quarterly/annual ITR personally. Is it best to file it manually muna at his RDO? I am confused po sa filling because of the penalties. Thank you so much po.

Yes pwede po Para they can assist you on that. Para mas accurate din pag nag file kayo.

Hi Doc Pinky..sorry po another question😊 Nakalimutan ko po i-Less ang SSS/Pag-IBIG/Philhealth sa 1st and 2nd Quarter ITR online filing. Pwede ko pa po ba eto i-Less on the 3rd Quarter ITR or sa Annual ITR filing na? Thanks so much po for the inputs😊

I USE efps . I USE THE FORM 1701Q IN FILLING UP FOR THE INCOME SECOND QUARTER. . USING 8%. . I CAN’T ENTER THE INCOME FOR THE PREVIOS QUARTER. IT IS STILL A ZERO. WHAT WILL I DO.

I’m not seeing the problem with your form mam. You might want to get an accountant that can see your problem right now?

Question po, bakit wala po nilagay dun sa Item 56: Tax Payments for the Previous Quarter? Supposedly po diba ilagay dyan yung naging Total Amount Payable nung 1st Quarter na nabayaran?

If you have previous payment from previous quarter, you can put it there.

Hi Doc Pinky..sorry po another question😊 Nakalimutan ko po i-Less ang SSS/Pag-IBIG/Philhealth sa 1st and 2nd Quarter ITR online filing. Pwede ko pa po ba eto i-Less on the 3rd Quarter ITR or sa Annual ITR filing na? Thanks so much po for the inputs😊

Graduated po ba filing nyo?

Walang deduction if 8%. Less 250K,, that’s it.

8% IT Rate po doc Pinky. I can’t wait for the 3rd quarter ITR filing kasi I am now an avid follower😊 I ammended my husband’s 2Q ITR that was incorrectly filled up by someone upon reading your blog.