“Hi doc Pinky, this is Jonathan, I would like to stop paying my life insurance.”

“Hi doc Pinky, this is Jonathan, I would like to stop paying my life insurance.”

May I know why? I said.

“I recently bought a car and I can’t pay for both.” (Jonathan)

“I also have a car and I know that the life insurance you got from me is only 10% of what you are paying your car and its insurance. It’s very small.” I said.

“But I have decided to stop my life insurance”(Jonathan)

Well this conversation happened two months ago from a young client (Jonathan) not his real name, 33 year old young doctor.

It is sad that many have a distorted view on life insurance. I thought he understood its importance when he bought his life insurance from me.

Don’t get me wrong of thinking I am against insuring car. I am not. I just find it funny, that car has insurance but the one who owns and drives the car doesn’t have.

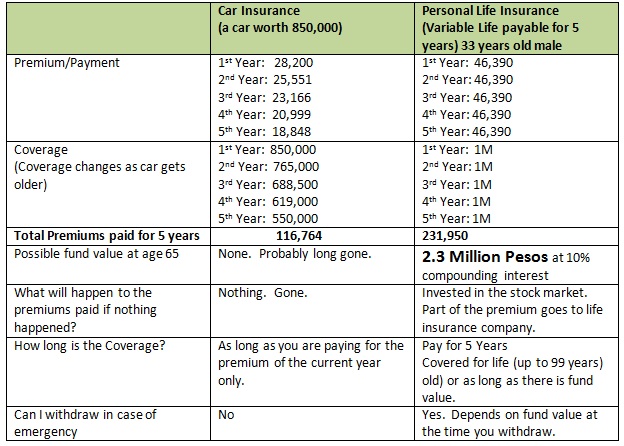

I know Car and Person are not comparable, but for the sake of looking who is more important to insure, allow me to compare at least their insurance coverage.

*Disclaimer: Sample proposals can differ depends on differences in circumstances and insurance companies both from car and life insurance. Fund values are not guaranteed.

*Disclaimer: Sample proposals can differ depends on differences in circumstances and insurance companies both from car and life insurance. Fund values are not guaranteed.

According to my non-life insurance agent friend, she has many clients that insure their cars and even pays up to 100,000+/annum car insurance, but with no life insurance? I really can’t imagine that. Is it lack of knowledge? or just plain ignorance?

I am reminded of the story, the Golden Goose that lays a golden egg. Jonathan is the goose, the car is the golden egg.

Who would you rather want to be replaced in case? The goose that lays the golden egg? Or the golden egg?

Many people always insure the egg instead of the goose. If you are wise, you will insure the goose because, although the egg is important, and it is the one that can be sold. It is the goose that is more important. The goose is the real money machine, not the golden egg.

Just like a person, it is not the car. Even if you use your car for business and it generates income, it is not the real money machine, it is you. If the car gets damaged or get lost, you can be able to replace it. But the person who buys and drives the car can never be replaced if gone. The real money machine for the family will be gone forever. Indeed, life insurance cannot replace the person but it can help the family rebuild and continue living their lives.

Thankfully, nothing bad has happened yet to Jonathan since he stopped paying for his life insurance. But, death, sickness, disability, and accident risks are things he has to face on his own without protection. They are all possibilities that can happen anytime.

Much like, the danger of damages, vehicular accident, lost, being car napped, or car getting flooded are also the risks his car has to take in case. But he chose to protect his car more than his life. I cannot do anything about it since it’s his decision and I am only here to educate.

That is what I am doing for you now, if ever you are also faced with this kind situation that you have to choose between you and your car, ask yourself,

Yung kotse mo insured? Eh ikaw?

I recommend you choose both. If lack of money is the issue, then don’t buy the car in the first place. It only means, you are not ready yet to buy your car.

Reminding you to love yourself first,

To those who want to get life insurance but does not know how? Ask me here!

Read more:

- Should I invest Before Election?

- Credit Card: The Bad, the Ugly and the Good

- Buy Term Invest The Difference (BTID), is that for me? Myth vs Reality

- Life Insurance, How much is Enough?

Source:

Sample computation of car insurance premiums came from Standard Insurance Co. Inc. and Life insurance from Manulife Affluence Builder 5 pay. (Thank you Ms. Sheila Marie Baylon for the data from car insurance).

To all Financial Advisers out there or those who wanted to be one:

I invite you to level up your financial advisory career! Get this Ebook for FREE! Click Here.

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023