Critical Illness, are you ready for this?

Critical Illness, are you ready for this?

1 out of 13 Filipino women will have breast cancer.

One out of four who are diagnosed with breast cancer die within the first 5 years, and no less than 40% die within 10 years.

Prostate Cancer Kills 1 Filipino per hour.

5 out of 10 deaths in the country or 50% of Filipino die due to cardiovascular causes (Heart Attack and Stroke).

In the world of medicine, “Holistic Health Care” means, to be able to look at a patient and treat him as a whole. Meaning to say, an EYE DOCTOR, even though “eyes” are his specialty, he should be able to examine the patient from head to toe and everything in between, correlate everything before giving diagnosis and treatment, this is called – Holistic Care. This goes as well with every type of doctor you will meet.

The same holds true with today’s society. Now, there is such a hype on “how to save, how to be financially literate, how to invest in the stock market, how to be financially ready, life insurance, stocks trading.” But nobody is talking about “Holistic Financial Planning.”

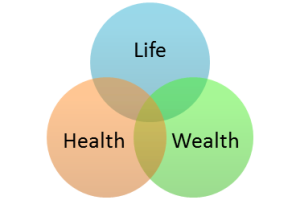

So, what is that? For me, holistic financial planning consisted of 3 circles.

The LIFE CIRCLE is planning for the unpredictability of life. It is money for your family if you die early or money for yourself, if you live a long life. Life insurance and Retirement plans will provide a solution for this circle.

The WEALTH CIRCLE is all about your money working for you. It is all about investing your money in different types of investment instruments to fulfill your life long dreams (education for your kids, your dream house, dream car, and even also retirement planning).

The most neglected circle of all is the HEALTH CIRCLE. Most people I know have a lot of life insurance, investments and even businesses, but when I ask them, do you have a CRITICAL ILLNESS PLAN? They usually say — they don’t. (Health cards/HMO are different!)

Dalai Lama once said, “Man sacrifices his health in order to make money. Then he sacrifices money to recuperate his health.”

Are you guilty of this? NO? Are you sure?

How many times did you NOT eat your breakfast before going to work?

Did you get enough sleep last night? Or you run late and went up early for work?

Did you in anyway sacrificed your health just for work?

Any Yes, here means you’re GUILTY.

Let me tell you a true story (names were altered):

Dr. A.Z. is a successful obstetrician, a friend of mine “Jane” is her financial adviser. They have a good time together. They planned for life insurance, retirement, education for her kids and even investments. But when Jane has begun advising her plan on critical illness, she said, she doesn’t need it. Her reason was, “I am a doctor, I have stocks in 3 different hospitals, they will take care of me and my family in case of sickness.” So, she in short, she did not comply. 5 years later, she was diagnosed with stage 4 breast cancer. As a doctor, yes, she had discounts in the hospital, and free professional fees from fellow doctors. But still, in few months span, all their savings were used-up, all were used on her chemotherapy drugs, radiotherapy and surgery. She then realized, having stocks in hospitals, does not give you “all-free treatment.” Even, some of her plans from Jane needed to be liquidated. She has begun surrendering first, the educational plans her investments intended for retirement. She even said, “all of my entire life savings were used-up in only 6 months.” Today, she is in remission, and she eagerly asked Jane, of the Critical Illness Plan she was giving her a year earlier. Unfortunately, Jane said, she might not be approved because of what happened.

What is a CRITICAL HEALTH PLAN?

Critical Illness health plan is something that could be taken along with your life insurance or a variable investment product as a rider. It is just an extra premium along with your regular plans. It pays a lump-sum money in case of a diagnosis of any Critical Illness stated in the policy. Some examples of diseases covered are: Cancer, Stroke, Heart Attack, Renal Failure, and 30+ more dread diseases you don’t want to have.

So how does it completes a financial plan?

Imagine this:

When you get sick, (critically ill?) What happens to your life insurance/retirement plans? Can you still afford the premium?

What happens also to your wealth circle? Can you still continue to invest? Or you now need to liquidate all your investments to help you with your treatment?

The bottom line here is. If you think the above story will NOT happen to you and you will live a long, healthy life? Think again. According to statistics, 90% of Filipinos (that is 9 out of 10) have 1 or more risk factor for the number 1 Disease of Filipino: (Cardiovascular Disease):

- Smoking

- Drinking Alcohol

- Have High Cholesterol

- Inactivity (No exercise)

- Have High blood pressure

- Have Diabetes

Do you have 1 or more risk factor from above? If yes, then better check if your plans have a critical illness rider attached to it? If there is, is the amount would be enough if in case you will be diagnosed with any dread disease in the future?

“A Single hospital bill can wipe out years of saving.”

If you haven’t plan any planning, do it now before it’s too late!

If you want to know more, contact me here.

Take a look at your 3 circles, is your financial plan holistic?

Read More:

- 7 Life Insurance Riders You Need to Know that could save your Life

- The Cost of Dying in the Philippines

- 10 Things You Really Should Know about your Life Insurance Policy

- 3 Genius Reasons Behind VUL (Variable Unit Linked) Insurance

Subscribe here and get to know how much will you get from SSS when you retire:

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023